Investing in a CEO? AMD’s Lisa Su Might Be Your Best Candidate

December 11, 5:33 am

For many investors, choosing where to put their money can be a daunting task. While company metrics, market share, and product pipelines all matter, it’s easy to overlook one vital element: leadership. This is where AMD and its CEO, Lisa Su, stand out as a compelling case study. Recently named “CEO of the Year” by Time, Su has transformed AMD from an underdog chipmaker into a leading player in the data center and AI chip markets, all while fostering a positive corporate culture.

The AMD Story: From Struggles to Success

A decade ago, AMD was teetering on the brink of irrelevance. Its share price languished at about $3, and the company’s role in the data-center chip market was so minimal that analysts simply rounded it down to zero. Traditional rivals, most notably Intel, were dominating the sector, raising real questions about AMD’s future. Could this once-promising semiconductor designer survive the onslaught of better-funded and more entrenched competitors?

Lisa Su’s arrival as CEO changed the narrative completely. Leveraging her engineering background and a keen sense of the industry’s direction, she initiated a comprehensive overhaul from the ground up. This involved rethinking AMD’s entire product strategy - from performance and energy efficiency to the way chips integrate with emerging technologies. By doing so, AMD started closing the gap in CPU and GPU performance, gradually regaining the trust of data-center clients and making inroads into cloud computing, AI, and other growth areas.

Crucially, Su also repaired fractured relationships with key customers and refocused the company’s culture around innovation and accountability. The shift paid off. AMD’s products improved dramatically, winning back market share and investor confidence. Its stock price soared, at one point surpassing historic rival Intel’s overall market value. What was once a $3 stock now trades above $100, and at times as high as $140. In short, AMD under Su’s leadership has achieved a nearly 50-fold appreciation - a testament to visionary, hands-on management.

Why a Respected CEO Matters

The AMD story underscores a powerful lesson: a well-regarded leader can be a significant asset, especially when navigating competitive, rapidly evolving industries like semiconductors. Internally, Su commands a remarkable 95% approval rating and 87% of employees say they would recommend AMD as a place to work - clear indicators of a positive work environment. Employee sentiment and culture often translate to better long-term performance, as a motivated workforce is more likely to develop cutting-edge products and maintain strong customer relationships.

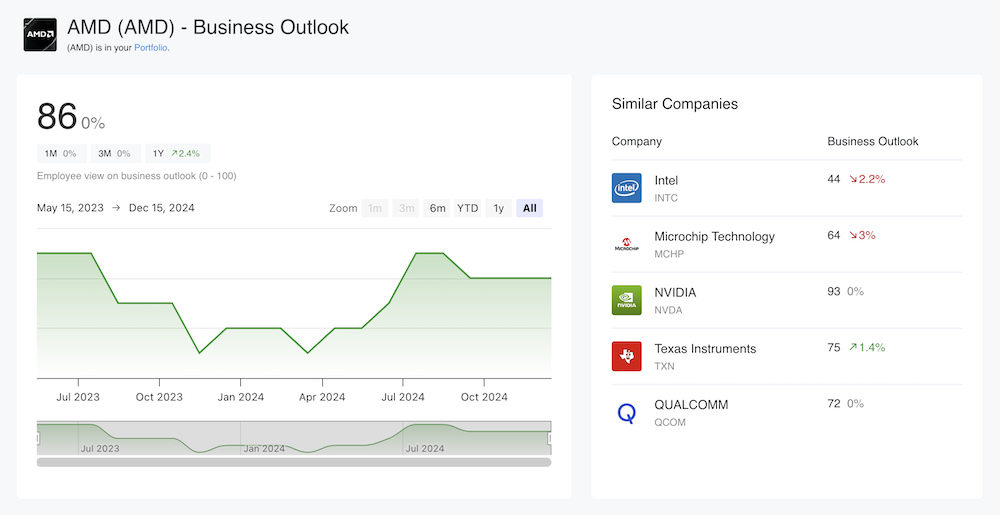

AMD Business Outlook amongst employees

Investors should note that this kind of leadership extends beyond operational improvements. Su’s forward-looking vision guided AMD to embrace the AI revolution. After the release of ChatGPT in 2022, AMD quickly developed a more powerful line of GPUs aimed at the data-center market - technology that now drives inference workloads for advanced AI systems. Projected revenue from specialized AI chip sales for AMD went from essentially zero to $5 billion in just a year. While Nvidia still dominates AI chips, AMD’s foothold in this lucrative market positions it well for future growth. Su is betting on a rapidly expanding sector that could be worth $500 billion by 2028.

Long-Term Outlook

At the time of writing, AMD shares hover around $127, down about 13% in the last month. While short-term dips can give some investors pause, long-term shareholders may see this as a buying opportunity. The semiconductor sector is cyclical and sensitive to market sentiment, but the underlying fundamentals at AMD - strong leadership, a track record of innovation, and a growing presence in high-demand areas like AI - remain robust.

It’s also worth noting that AMD’s main competitor, Nvidia (NVDA), is down about 7% in the same period. The short-term fluctuations may simply reflect broader market movements or investor rotations between tech stocks. Given AMD’s past resilience and Su’s long-term strategic thinking, it would be unwise to judge the company solely on a month’s performance.

Utilize AltIndex for Deeper Insights

For retail investors, the story of Lisa Su and AMD offers a valuable reminder: strong leadership can be a key driver of corporate success. With AMD’s upward trajectory and its CEO’s visionary approach, this is a company worth watching. But numbers and headlines alone don’t tell the whole story.

That’s where AltIndex comes in. Our platform taps into alternative data sources - like employee sentiment, job postings, and social media trends - to provide deeper insights into thousands of stocks and cryptocurrencies. Before you commit to an investment in AMD, or any other company, consider exploring what AltIndex can reveal about the company's performance, leadership, and sentiment to make more informed investments.

Use our stock screener to find more companies with a high business outlook among employees.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.