Apple Is Missing The AI Wave - What's Next For The Stock?

July 14, 4:55 am

Apple has long been one of the most trusted and admired names in tech. But as the AI revolution accelerates, the company once known for changing the game now finds itself struggling to keep up. In 2025, Apple is no longer seen as a leader - and that shift in perception is starting to show up in the stock price.

Apple’s AI Problem

Apple stock is down 15% year-to-date, trailing far behind the rest of Big Tech. Nvidia, Microsoft, Meta, and even Amazon are hitting new all-time highs. The difference? AI.

Wall Street analysts, tech investors, and even Apple’s most loyal shareholders are expressing doubts about the company’s ability to compete in the AI arms race. While rivals are integrating advanced generative AI into nearly every corner of their platforms - from search and productivity to cloud services and advertising - Apple’s approach has been slower, more cautious, and far less visible.

“Apple needs the AI story because that's what's being rewarded in the market,” said Dave Mazza, CEO of Roundhill Investments, in an interview with Axios. “Until that changes, they're going to be looked at… as a loser.”

That may sound harsh, but it's a sentiment echoed by some of the most bullish tech voices on Wall Street.

“Apple is at a highway rest stop on a bench watching this 4th Industrial Revolution race go by at 100 miles an hour,” said Dan Ives of Wedbush Securities.

At the recent Worldwide Developers Conference (WWDC), investors were hoping for a bold AI reveal. Instead, Apple’s much-hyped “Apple Intelligence” announcement fell flat — lacking both product depth and a clear vision.

What’s Holding Apple Back?

Apple has always taken its time when adopting new technology - and often, it pays off. The company didn’t invent the smartphone, the tablet, or the wireless earbuds, but it perfected and scaled each of them. This time, however, the risk is that Apple is moving too slow in a market that’s evolving at lightning speed.

Some key issues include:

- Unclear AI product vision: So far, Apple hasn’t delivered compelling consumer-facing AI products.

- Lack of a foundational model: Unlike Google (Gemini), OpenAI (ChatGPT), or Meta (LLaMA), Apple does not have its own large language model powering its ecosystem.

- Leadership concerns: Recent executive departures and a drop in employee confidence have raised concerns about the company’s direction.

And perhaps most importantly, Apple has yet to make a major acquisition to turbocharge its AI capabilities.

Dan Ives believes Apple needs to act now.

“Apple needs to acquire Perplexity to significantly boost its AI platform. If Apple has to pay ~$30 billion, it’s a drop in the bucket relative to the monetization opportunity,” he wrote in a client note.

Alternative Data Backs Up the Bear Case

At AltIndex, we track not just financials, but also alternative data - online signals like web traffic, employee sentiment, social media discussions, and insider trading. And when it comes to Apple, the story is concerning.

Here’s what we’re seeing:

1. Declining Employee Outlook

Apple employees are growing less optimistic. Internal business outlook scores have steadily dropped over the last two years, according to online employee reviews, falling to 72 out of 100. That’s not terrible, but it shows a weakening confidence in the company’s trajectory. Even more telling: CEO Tim Cook’s approval rating has fallen from 94% in 2020 to 86% today.

2. Bearish Retail Sentiment

Our sentiment analysis on popular stock forums shows that retail investor sentiment toward Apple has been trending down for over a year. AI discussions dominate forums like Reddit and Stocktwits — and Apple is frequently left out of the excitement. When it is mentioned, the tone is often skeptical or critical.

3. Dropping Web Traffic

Web traffic to Apple.com is down 6% year-over-year. While that may seem minor, it’s important: Apple generates significant sales through its own website. A drop in traffic can indicate slowing demand for its products, especially as it faces increasing global competition.

4. Insider Selling

It’s not unusual for executives to sell stock, but recent filings show that Apple’s COO, CFO, and even CEO Tim Cook have all sold shares this year. While not a smoking gun, this broad pattern of selling does raise eyebrows - especially when paired with weak stock performance.

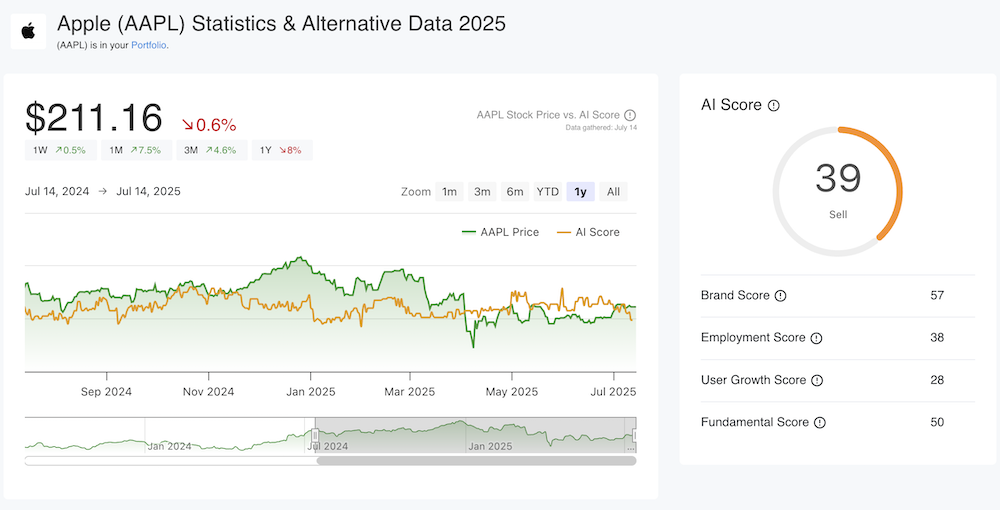

Based on this data, AltIndex currently gives Apple an AI Score of just 39 - a sell signal.

Our model predicts that Apple’s stock could continue to fall in the next couple of months if no positive AI catalyst emerges.

But Apple Isn’t Out Yet

Despite the warning signs, Apple still has several key strengths:

- Massive cash reserves: Apple has over $80 billion in cash, giving it ample firepower for acquisitions, R&D, or aggressive marketing.

- Growing services business: Nearly a quarter of Apple’s revenue now comes from services - a high-margin segment that’s less dependent on hardware cycles.

- Global footprint: With 60% of revenue generated outside the U.S., a weaker dollar actually boosts Apple’s earnings.

In other words, this isn’t a company in crisis - but it is facing headwinds.

“With the cash they have on hand and the loyalty they have… there would have to be something disruptive in the marketplace that would draw away customers. It’s not there yet,” said Brian Mulberry, client portfolio manager at Zacks Investment.

What’s Next for Investors?

Apple has about 12–24 months to show real progress in AI before investor patience runs out. If it fails to do so, it risks becoming the next AOL - a once-dominant brand that lost its edge by missing a major technological shift.

For long-term investors, this means asking a hard question: Is Apple still a growth story, or just a cash-flow machine?

Until we see:

- a bold AI acquisition,

- meaningful product innovation,

- or stronger sentiment data,

- a jump in revenue,

the bearish case will likely continue to build.

Bottom Line

Apple is no longer the market’s darling - and its silence on AI is costing it dearly. While it still has immense strengths, it needs to act quickly to regain investor confidence.

At AltIndex, we’ll continue tracking every signal - from insider selling to social media buzz - to help investors stay ahead of the curve.

Want to get real-time alerts on Apple’s sentiment, AI signals, and more? Sign up and add Apple to your portfolio.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.