Are Reddit Investors Fleeing to GameStop and Gold?

April 18, 1:11 pm

Each day, AltIndex tracks Reddit mentions and sentiment for thousands of stocks, helping investors spot shifts in market sentiment before they hit the headlines. This week’s data (see full list at the end of the article) paints a fascinating picture: while most of the market is flashing red in terms of sentiment, two assets are clearly standing out - GameStop and Gold.

Reddit Stocks Heatmap

S&P 500 Dominates Mentions, But Sentiment Turns Bearish

The SPDR S&P 500 ETF (SPY) was the most mentioned asset across Reddit’s investment forums last week. Given the recent spike in volatility - largely triggered by Trump's “Liberation Day” tariff announcements - this level of attention is no surprise. What is surprising, however, is just how bearish the sentiment is. Investors are clearly nervous, with posts showing a high level of concern about further macroeconomic instability.

Despite being up 0.5% in the last week, the S&P is still down 6% over the past month, reflecting broader unease and uncertainty in the market.

GameStop is Back - And Reddit Is Bullish

Right behind the S&P in terms of mentions is a familiar name: GameStop. Long a favorite among Reddit traders, GameStop (GME) is once again making headlines in subreddits - not just for nostalgia or memes, but for genuine investor interest. What sets it apart this time is sentiment: unlike the rest of the market, Reddit is bullish on GameStop.

GameStop's stock is currently trading at $26.78, up 5% over the last week and 15% over the past month. That kind of price movement, combined with top-tier sentiment and mentions, makes it a standout in this week's data. Whether this is the start of another retail-led surge or just a brief rally remains to be seen - but Reddit clearly hasn’t given up on GME.

Gold Glimmers in Uncertainty

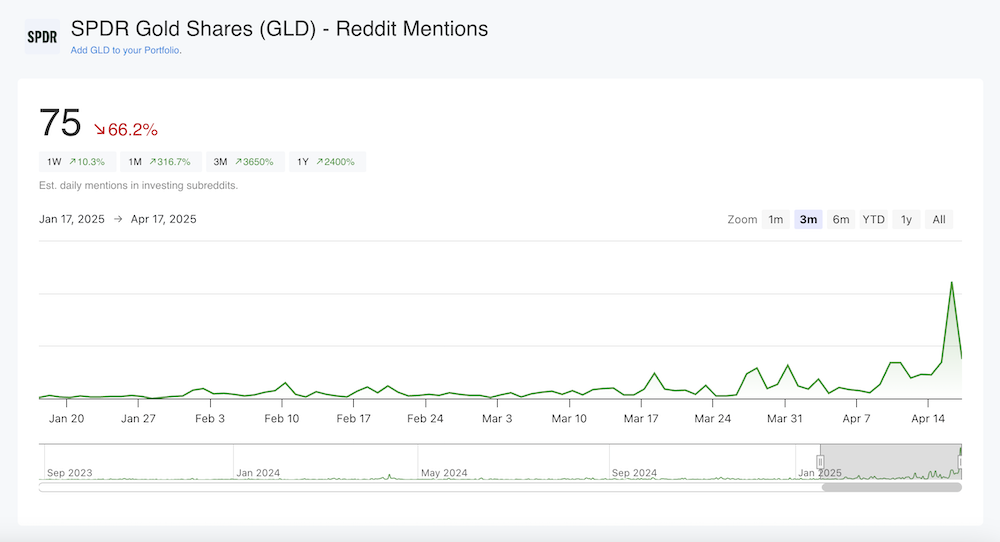

Another interesting standout is SPDR Gold Shares (GLD). Amid stock market uncertainty, many Reddit users are turning to gold as a traditional safe haven. GLD made it into the top 20 most mentioned assets, and it ranks as the second most bullish in terms of sentiment - trailing only GameStop.

GLD is currently trading at $306, up 5% over the last week and 10% over the past month. With momentum building and retail attention growing, gold is proving once again that in times of uncertainty, it shines brightest.

Reddit Mentions for GLD have been increasing in the last week

Tech Giants in the Red

Even reliable tech favorites aren’t immune to the current wave of bearishness. Tesla, Apple, and Google are all among the most discussed stocks on Reddit - but unlike past weeks, the tone has shifted. All three are showing bearish sentiment, which is especially unusual given their historical popularity and strong fundamentals.

This could indicate a broader risk-off sentiment, where even growth darlings aren’t being spared.

Conclusion

This week’s Reddit sentiment shows a clear divide: while the broader market - particularly the S&P 500 and mega-cap tech - is viewed with caution, retail investors are hyping GameStop and Gold. Whether it’s a tactical pivot or a deeper signal of changing retail sentiment, these trends offer valuable insights for anyone watching the markets closely.

At AltIndex, we’ll continue tracking these shifts in real-time, so you can make smarter, data-backed investment decisions. Sign up to get real-time Reddit Alerts, AI stock picks, and more alternative stock insights.

Reddit's Most Talked About Stocks

| Company | Mentions | Sentiment | Price | AI Score | |

|---|---|---|---|---|---|

|

SPDR S&P 500 ETFSPY |

3,952 39.8% |

$526.41 1.4% |

45 |

|

|

GameStopGME |

3,146 50.6% |

$26.78 1.4% |

42 |

|

|

TeslaTSLA |

2,890 39.6% |

$241.37 4.3% |

43 |

|

|

NVIDIANVDA |

2,813 31.1% |

$101.49 8.5% |

53 |

|

|

AppleAAPL |

1,991 15.5% |

$196.98 0.6% |

42 |

|

|

849 15.5% |

$153.36 0.6% |

56 |

||

|

RobinhoodHOOD |

763 22.6% |

$41.18 5.7% |

55 |

|

|

NetflixNFLX |

697 190.4% |

$973.03 6% |

52 |

|

|

BlockXYZ |

661 22% |

$53.90 0.1% |

38 |

|

|

653 65.4% |

$151.16 3.8% |

46 |

||

|

Fox NewsFOX |

643 50.8% |

$44.57 2.4% |

55 |

|

|

Invesco QQQQQQ |

639 35.8% |

$444.10 2.3% |

44 |

|

|

MetaMETA |

617 32.9% |

$501.48 7.7% |

39 |

|

|

AmazonAMZN |

568 57.2% |

$172.61 6.6% |

38 |

|

|

NasdaqNDAQ |

563 37.6% |

$72.18 0.9% |

56 |

|

|

SpotifySPOT |

516 35.9% |

$574.25 5.6% |

65 |

|

|

SPDR Gold SharesGLD |

496 140.8% |

$306.12 2.7% |

51 |

|

|

GapGAP |

495 30% |

$19.13 2.8% |

46 |

|

|

Vanguard S&P 500 ETFVOO |

468 46% |

$483.90 1.4% |

47 |

|

|

TSMCTSM |

461 0.4% |

$151.74 3.4% |

63 |

|

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.