Carvana’s Stock Is Skyrocketing - Here’s What the Data Predicts Next

August 14, 9:44 am

Carvana (CVNA), once written off during the post-pandemic correction in used car sales, is back with a vengeance. The online used car retailer has staged one of the most impressive turnarounds in recent memory - both operationally and in the market. Trading at $344 per share, Carvana’s stock is up a staggering 142% over the past 12 months, bolstered by strong earnings, strategic service expansion, and accelerating alternative data signals that suggest the momentum may just be getting started.

A Quick Recap: What’s Driving Carvana’s Stock Rally?

Carvana’s recent resurgence came into sharper focus after its July earnings report blew past Wall Street expectations. The company reported:

- $4.84 billion in Q2 revenue, a 42% year-over-year increase

- Diluted earnings of $1.28 per share, compared to just 14 cents in the year-earlier quarter - representing more than 800% growth

- 143,280 retail units sold, up 41% YoY

- 72,770 wholesale units sold, a 44.5% jump

These numbers didn’t just impress analysts - they also generated a wave of price target upgrades. Oppenheimer, for instance, raised its target to $450, describing Carvana as a “digitally-driven disruptor” poised to reshape the fractured used car market.

Analyzing Alternative Data Insights - Will the Rally Continue

While headline financials grab the attention of Wall Street, alternative data tells a deeper story - one of growing demand, operational expansion, and increasing brand visibility. These are key indicators that support the idea that Carvana's rise isn't just sustainable but that it can continue.

1. Job Postings and Hiring Trends

Carvana’s hiring activity has surged. According to online job listing data, job postings have increased by 58% over the past year. This kind of aggressive recruitment suggests plans for capacity expansion and investment in both logistics and customer service.

LinkedIn data further confirms the trend - headcount has grown by 11% year-over-year. This indicates the company isn’t just posting jobs but that it's also filling them, signaling real growth rather than unexecuted ambition.

2. Web Traffic Surge

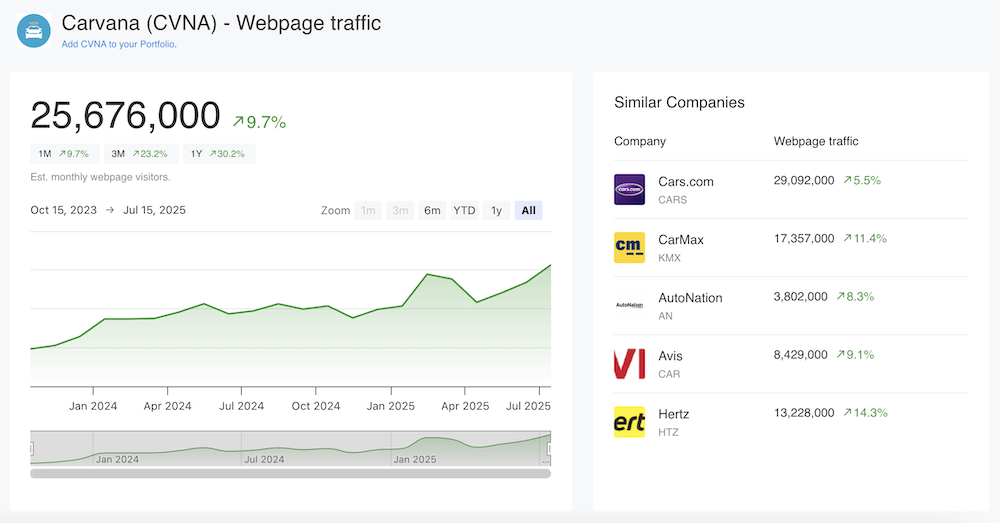

The company’s digital footprint has widened considerably. Carvana just recorded a record month with an estimated 25 million monthly website visitors, a 30% increase compared to the same period last year. This uptick reflects stronger consumer interest, better online conversion strategies, or both.

Increased web traffic is often a leading indicator of sales volume - especially for online-first platforms like Carvana that don’t rely on traditional showrooms.

3. Mobile App Downloads

The rise in mobile engagement is even more striking. Estimated mobile app downloads have jumped by an estimated 60% year-over-year. As more consumers shift to mobile-first shopping experiences - even for big-ticket items like cars - Carvana’s ability to meet them there gives it a strategic edge.

App engagement also allows for more personalized notifications, financing options, trade-in offers, and promotions, turning passive users into potential buyers.

4. Social Media Momentum

Brand visibility is growing in less conventional but equally important spaces too. Carvana's Instagram followers are up 13% over the past year, indicating rising consumer affinity and engagement. In a sector where trust and transparency can make or break a deal, social growth adds another layer of brand validation.

Risks to Watch

No company is without challenges. The used car market remains sensitive to macroeconomic forces, such as interest rates, supply chain pressures, and changing consumer behavior could all present hurdles. However, Carvana’s improving unit economics, cost control, and strong digital adoption suggest it is more resilient than in previous years.

Final Thoughts: Is Carvana Still a Buy?

Carvana's recent performance signals more than a temporary rebound. The company is scaling fast, growing both its business and its brand in a way that few competitors in the used car industry can match. Strong financials, including double-digit revenue growth and triple-digit EPS gains, have been matched by real operational progress.

The expansion of same-day delivery services, strong retail and wholesale volume, and a clear focus on logistics efficiency show that Carvana is building for long-term scale. And this growth is supported by alternative data trends that are difficult to ignore.

Job postings are up 58 percent, suggesting continued investment in new roles and markets. The 11 percent rise in headcount confirms that these roles are being filled. Web traffic just reached an all-time high with 25 million monthly visitors, while app downloads have increased by 60 percent year over year. Even social media signals are trending upward, with a 13 percent increase in Instagram followers.

These are clear indicators of rising demand, customer engagement, and operational expansion. If these trends continue, Carvana could be entering a new phase of growth where it captures even more market share and reshapes the online used car experience.

For investors and analysts alike, the data points to one conclusion. Carvana is not just growing. It is accelerating. And the signals suggest there is still more road ahead.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.