Cloudflare: How Alternative Data Helped Predict a 200% Stock Surge

June 11, 1:11 pm

At AltIndex, we pride ourselves on identifying promising investment opportunities before the mainstream catches on - using alternative data as our edge. One of the clearest success stories is Cloudflare (NET).

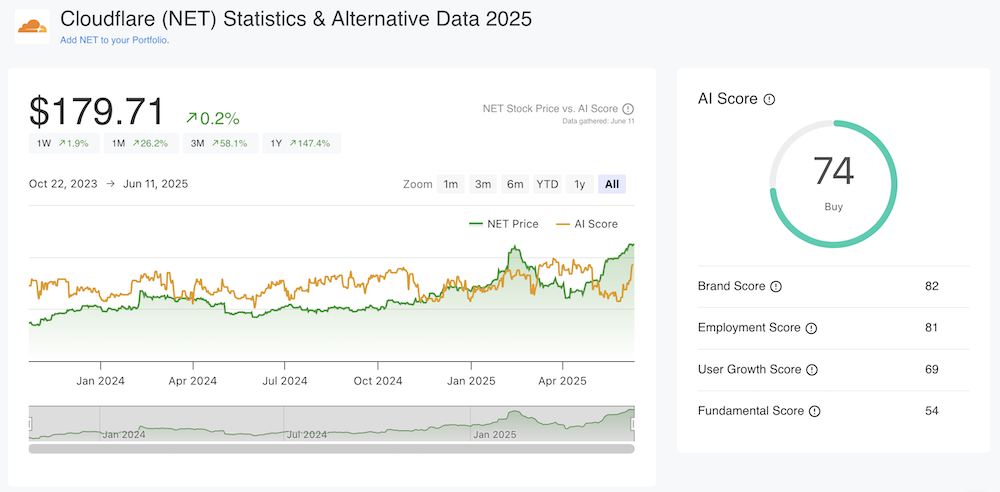

Two years ago, in 2023, when Cloudflare stock was hovering around $60 per share, we published an article titled “Alternative Data Signals That Cloudflare Is a Buy”. At the time, Cloudflare was still flying under the radar for many investors, but our AI-powered model saw something different. Today, the stock is trading around $180, up 200% since our initial call. And much of that foresight came not just from financial metrics - but from alternative data signals that mainstream analysts tend to miss.

What We Saw in 2023

Back in 2023, Cloudflare’s financials were already solid - strong revenue growth, a growing client base, and expanding margins. But what really stood out were the alternative data trends:

- Web Traffic: Cloudflare.com was seeing consistent growth in web visits, indicating rising customer interest and product usage.

- Google Trends: Searches for "Cloudflare" were steadily increasing, another signal of brand awareness and demand.

- Social Media Growth: Social Media followers on platforms such as Twitter and Instagram were growing at a rapid pace, signaling broader interest from both developers and tech-savvy users.

- Employee Sentiment: Glassdoor reviews and employee outlook ratings showed a highly motivated workforce with a bullish internal outlook.

These indicators collectively fed into a high AI Score - a metric we derive from analyzing not only financial data but also web traffic, social media trends, job postings, employee sentiment, and more. Based on that, our AI model issued a long-term buy signal on Cloudflare.

Fast Forward to Today

Now, with Cloudflare up 200% since our call, it’s worth asking: are the signals still bullish?

Yes - but with nuance.

- Employee Outlook: While there was a slight dip in sentiment earlier this year, it has rebounded. Employee business outlook is up 5.3% year over year.

- Investor Sentiment: On social platforms and forums, 86% of retail investors discussing Cloudflare remain bullish.

- Social Media Growth:

- Instagram followers are up 41.9% year over year

- The Cloudflare subreddit on Reddit has grown by over 70% year over year

- Financial Growth: Revenue continues to rise, up 26% year over year.

However, web traffic has declined slightly in recent months, a potential warning sign that growth momentum could be slowing. It’s a key metric we’ll continue to monitor closely.

Wall Street Is Taking Notice

We’re not the only ones bullish on Cloudflare. Investment banks have also started to echo our optimism.

On June 5, Oppenheimer raised its price target on Cloudflare from $165 to $200 and reiterated its Outperform rating. After engaging with Phil Winslow, the company’s VP of Strategic Finance & Investor Relations, the firm became even more optimistic about Cloudflare’s long-term trajectory.

Highlights from Oppenheimer’s note include:

- Strong momentum in SASE security, aided by increased adoption of Magic WAN

- Enhanced capabilities in CASB and data loss prevention

- Growing developer traction for the Worker platform, tied to its shift-left architecture

- New AI-focused edge computing technologies, including MCP, A2A, and a container service for AI workloads

Oppenheimer believes Cloudflare could surpass 30% revenue growth and hit $5 billion in ARR by the end of 2028.

The Power of Alternative Data

While traditional analysts are just now catching up, our alternative data models have been highlighting Cloudflare’s growth trajectory for over two years. This is a textbook example of why alternative data matters. By tracking signals like:

- Webpage Traffic

- Search Trends

- Employee satisfaction

- Social momentum

- Investor sentiment

…we're able to spot long-term winners early.

Cloudflare still maintains a high AI Score on our platform. Despite some softening in web traffic, most other indicators remain positive. With continuous innovation, growing adoption in AI edge infrastructure, and strong support from the developer community, Cloudflare remains on our radar as a long-term growth story.

Final Thoughts

Cloudflare’s 200% stock rally since our 2023 buy signal isn’t luck - it’s data-driven investing in action.

If you're not already tracking alternative data, you’re missing out on the early signals that often precede massive moves in the stock market. At AltIndex, we analyze thousands of companies using alternative indicators that go beyond the traditional financials. And Cloudflare is just one of many success stories.

👉 See Cloudflare’s stock dashboard here

👉 Sign up and get real-time alerts for trending stocks

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.