Prediction: Coinbase Looks Like a Strong Buy

December 11, 3:01 pm

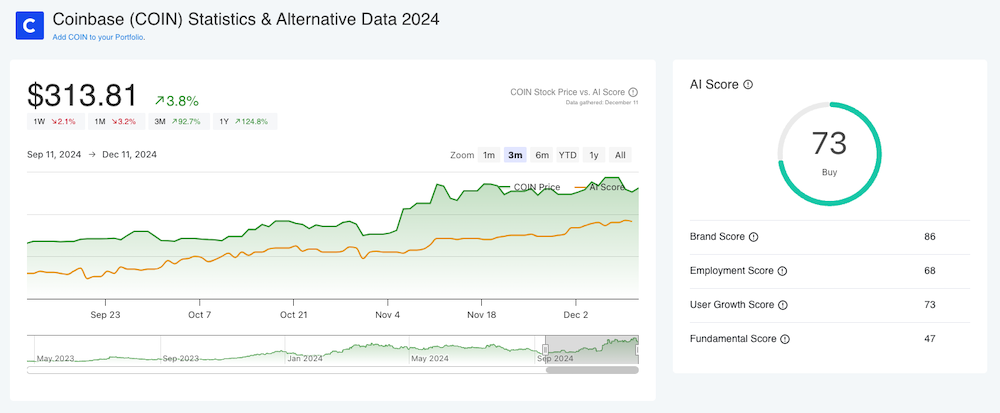

Coinbase (COIN), the top U.S.-based crypto exchange, is trading at roughly $313 per share and while it’s down 3.2% in the last month, it remains up an impressive 124% year-over-year. This strong performance coincides with Bitcoin’s surging price - now at $100,000 per coin, having climbed 24% over the last month. Since Coinbase’s shares often trend in line with Bitcoin, this upward momentum in the world’s largest cryptocurrency naturally captures investor attention. But to understand why Coinbase may be positioned for further gains, let’s step beyond headline prices and focus on a set of indicators that many investors overlook: alternative data.

Why Alternative Data Matters For COIN Investors

Traditional investors often rely on balance sheets, income statements, and press releases. While these are essential, they’re backward-looking. In fast-moving markets - especially crypto - real-time signals can be found in user engagement, search activity, and sentiment. For retail investors, these less conventional metrics can provide a more current, and deeper perspective. And with Coinbase, a range of promising alternative data suggests the company’s platform is attracting more interest, engagement, and trust:

Web Traffic: Up 68% over the last month. A spike in website visits indicates growing awareness and activity. More visitors often translate into more account openings, trades, and recurring platform use, all of which support revenue growth.

Mobile App Downloads: Surging over 400% in the past three months. When people download the Coinbase app, they’re not just browsing - they’re preparing to trade. This can lead to sustained user growth, higher transaction volumes, and more consistent cash flow. In a market where liquidity matters, more active traders mean greater reliability in fee-based revenue.

Google Searches: Searches for Coinbase is up 250% in the last three months. When search interest spikes, it shows that Coinbase’s brand recognition is expanding. More searches often reflect growing mainstream attention, signaling that the platform is capturing the public’s imagination. For a company that thrives on participation in crypto markets, wider recognition can be a precursor to long-term user growth.

Employee Business Outlook: Up over 30% in the last year. While internal sentiment is often overlooked by investors, a more optimistic workforce can lead to improved customer experience and product innovation. When employees feel positive about their company’s trajectory, they’re more likely to deliver better service and launch effective initiatives. This can boost the user experience, retention, and, ultimately, revenue.

Social Media Growth: Significant increases across multiple platforms - Instagram followers up 11% in the last year, Reddit subscribers up 42%, Threads followers have doubled, and YouTube subscribers have risen by 25%. Strong social media growth signals an expanding community of advocates, learners, and influencers. A larger, more engaged social audience can accelerate word-of-mouth referrals, converting casual onlookers into active traders.

Coinbase Stock Price & AI Score

Connecting These Signals to Growth

These data points aren’t just random metrics. They represent consumer trust, brand momentum, and market influence. When more people search for Coinbase, download its app, follow its social channels, or show up on its website, the platform gains a foothold in the everyday lives of retail participants. This dynamic can be especially powerful now, as Bitcoin’s ascent to $100,000 fuels excitement about crypto investing.

At their core, these alternative data trends suggest rising interest at exactly the time when Coinbase could capitalize on that interest. As more participants rush into the crypto space, Coinbase’s revenues from transaction fees and custodial services may grow. And with improved internal sentiment, the company may execute more effectively, roll out new products, and retain customers more successfully.

Other Catalysts and Fundamentals

Beyond these alternative data signals, the macro environment may turn even more supportive. President-elect Donald Trump’s evolving stance on crypto and the increasing popularity of crypto-based ETFs point to a more favorable regulatory and investment landscape. If Coinbase continues to attract new users as Bitcoin rallies and broader crypto adoption gains speed, it will be well-positioned to benefit financially.

Fundamentally, Coinbase also shows impressive metrics. Its earnings per share soared by 245% year-over-year last quarter, and its net income reached $75 million. Strong financials combined with rapidly expanding user interest form a compelling narrative.

Conclusion

Coinbase’s recent performance, combined with the surge in Bitcoin to $100,000, positions it as a stock worth serious consideration. While core financials remain strong, it’s the forward-looking metrics - web traffic, app downloads, search trends, employee sentiment, and social media engagement - that provide valuable insight into how the platform is gaining traction with users.

These indicators matter because they often reflect changing market dynamics faster than traditional measures. They can signal an expanding user base, improving brand perception, and potential revenue growth opportunities before the next quarterly report drops. At AltIndex, our AI-driven model currently assigns Coinbase a high score of 73, reinforcing the positive narrative these alternative data signals are suggesting.

For retail investors hoping to spot growth opportunities ahead of the crowd, factoring in alternative data can help guide more informed decisions. And right now, a lot of signs point to Coinbase as a potential buy.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.