5 Alternative Data Insights That Every Investor Should Monitor

May 7, 6:06 am

In the world of investing, relying solely on traditional metrics like financial reports often leaves us with an incomplete picture. While these numbers offer valuable insights, they can also be limited in scope and prone to biases. As retail investors, navigating this landscape can feel like searching for a needle in a haystack.

But what if there was a way to peer beyond the confines of balance sheets and income statements? What if we could harness the power of unconventional data sources to gain a deeper understanding of market dynamics and company performance? Enter alternative data – the game-changer that is revolutionizing the way we approach investment analysis.

Alternative data opens doors to a wealth of information previously overlooked by traditional methods. By tapping into sources like job postings, social media audience metrics, web traffic, and more, investors gain access to a treasure trove of insights that can inform smarter investment decisions.

In this article, we'll explore five key alternative data insights that every investor should monitor. It's time to think outside the box and embrace the future of financial analysis. Let's dive in!

Job postings

In the realm of alternative data, few metrics offer as profound insights into a company's future performance as job postings. At AltIndex, we recognize the pivotal role that job postings play in deciphering corporate strategies and market dynamics. By monitoring job postings from thousands of public companies, we unveil a wealth of information that transcends traditional financial metrics.

Each job posting serves as a forward-looking indicator, providing invaluable foresight into companies' growth plans. By tracking the volume, location, and department of postings, investors gain unique insight into how companies are positioning themselves for expansion or contraction.

Our analysis reveals a compelling correlation between job growth and stock performance over the last 12 months. A staggering 76% of companies experiencing a 25% or more increase in job postings have witnessed a corresponding surge in their stock prices. On average, these companies have seen a remarkable 37% jump in stock value, showcasing the predictive power of job postings as a leading indicator of corporate growth.

Amazon has more than doubled their job postings over the last 12 months. In the same time period, the stock is up by 78%.

Conversely, companies witnessing a decline in job postings paint a contrasting picture. Those with a 25% or more decrease in postings have experienced a mere 3% uptick in stock prices on average. This stark dichotomy underscores the pivotal role that job postings play in forecasting company performance and potential stock price movements.

Web traffic

Web traffic data is an invaluable indicator of a company's digital health and public interest. For investors, changes in web traffic can serve as a bellwether for potential shifts in market demand and financial performance. An increase in traffic typically suggests heightened consumer interest, which could translate to higher sales and revenue growth. Conversely, declining traffic may indicate waning interest, possibly foretelling lower earnings ahead.

At AltIndex, we strategically utilize webpage traffic data to enhance our investment strategies. By collaborating with multiple web traffic providers, we gain comprehensive insights into which companies are attracting more visitors. We regard these visitors as potential proxies for customers and future revenue. The logic is straightforward: more web traffic potentially means more customers, which should lead to increased revenue and, consequently, attract more investors.

This approach is validated by our empirical analysis. Our findings reveal a significant correlation between web traffic increases and stock price movements. Specifically, over 76% of the companies we monitored, which registered at least a 25% increase in web traffic over the past year, also saw a notable rise in their stock prices. The average stock price increase for these companies was an impressive 60%. This robust correlation underscores the effectiveness of web traffic analysis as a tool for predicting stock performance and guiding investment decisions.

Mobile app downloads

Tracking mobile app downloads is becoming increasingly crucial for investors seeking to gauge a company's market traction and potential revenue streams. Mobile app downloads can serve as a leading indicator of a company's growth and consumer engagement. Essentially, a surge in downloads often suggests an expanding user base, which, for companies reliant on digital platforms, can directly correlate with increased customer acquisition and revenue.

At AltIndex, we meticulously track mobile app downloads for thousands of public companies. This data helps us identify which companies are not only maintaining user engagement but are also successful in attracting new users. By analyzing these trends, we can forecast potential revenue increases, particularly for companies where mobile apps play a central role in their business model.

Our findings validate the predictive power of mobile app downloads. We have observed that companies experiencing a 25% or more increase in app downloads over the last year have seen their stock prices rise by an average of 40%. This substantial correlation highlights the importance of mobile app metrics as a component of our investment analysis.

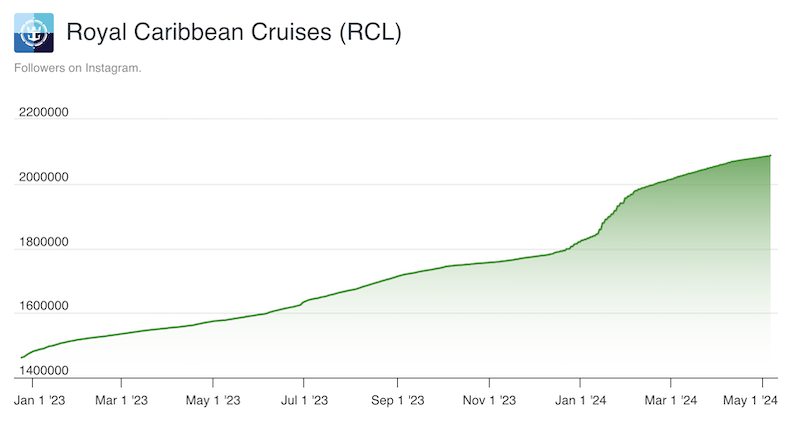

Social media followers

Tracking social media followers is increasingly recognized as an essential metric for investors analyzing the health and potential growth of companies. Social media presence can indicate brand strength and customer engagement, elements critical to a company's ability to attract and retain consumers. A robust social media following often signifies a company's successful marketing and engagement strategies, which can translate into enhanced brand loyalty and potentially increased revenues.

At AltIndex, we conduct comprehensive tracking of social media followers across multiple platforms including Facebook, Instagram, Twitter, TikTok, Pinterest, YouTube, and Reddit. This broad spectrum approach enables us to ascertain which companies are effectively attracting new interest and expanding their customer base, as well as those that may be losing touch with their followers.

Our analysis underscores a clear correlation between an increase in social media followers and stock price performance. For instance, over the last year, more than 70% of companies that experienced a 25% increase in Instagram followers also saw their stock prices rise. On average, these companies enjoyed a 31% increase in their stock valuation. Similar trends are observed with TikTok, where companies that achieved a 25% rise in followers typically saw a 32% increase in their stock price. Conversely, companies experiencing a decline in TikTok followers generally faced a downturn in their stock prices.

The number of Instagram Followers of Royal Caribbean Cruises have increased by 32% in the last year. In the same time period, the stock is up by 89%.

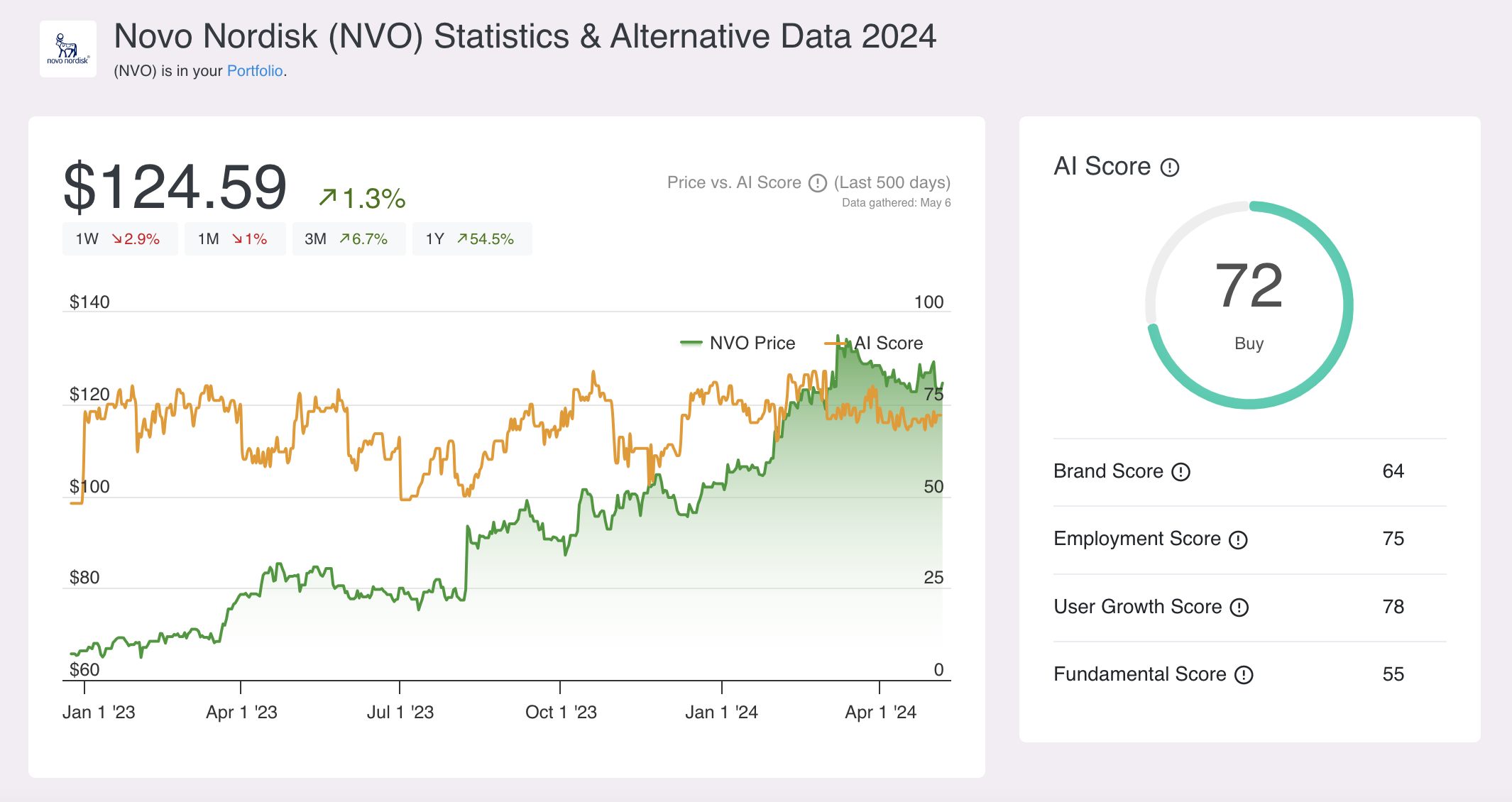

AltIndex AI Score

At AltIndex, we rigorously monitor the digital footprint of thousands of public companies every day. Our analysis includes various data points such as job postings, web traffic, social media engagement, media mentions, app downloads, and employee reviews and ratings. This wealth of alternative data is integrated with detailed analysis of financial statements to formulate our AI score, which ranges from 0 to 100. This holistic score provides an assessment of a company's overall health, performance, and potential for growth.

The AI score has proven to be a decent predictor of stock performance. Historically, stocks with a higher AI score have outperformed those with lower scores. Over the past year, for instance, stocks with an AI score above 60 have seen an average increase of 15.5% in their stock price. Additionally, more than 65% of stocks with an AI score over 60 have experienced a rise in their price.

Over the past 12 months, Novo Nordisk has maintained a high AI score. During the same period, its stock price has increased by 54%.

Conversely, stocks with an AI score below 30 have typically underperformed, with an average stock price decrease of 9.7% over the last year and only 37% of these stocks showing an increase in stock price. This pattern not only highlights the predictive power of our AI score but also presents an opportunity for investors to consider shorting stocks that receive low scores.

By combining traditional financial analysis with cutting-edge alternative data, AltIndex delivers nuanced insights that empower investors to make informed and strategic decisions, effectively navigating the complexities of the stock market.

Data is power

The power of data in today's investment landscape cannot be overstated. According to a recent survey, 98% of investment professionals agree or strongly agree with the view that the use of alternative data is becoming increasingly important to identify innovative ideas to boost alpha. It is the cornerstone of making informed and strategic decisions that can significantly enhance investment outcomes.

At AltIndex, we empower our members by providing comprehensive access to a wide range of alternative data insights on thousands of public companies.

Sign up today for free to get access to alternative data insights and receive timely alerts on key data points.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.