McDonald’s Store Traffic Slips as Alternative Data Signals Fading Popularity - What Investors Should Know

May 1, 3:53 pm

McDonald’s (MCD) reported weaker-than-expected store traffic in its latest earnings report, raising fresh concerns about the fast-food giant’s momentum in a challenging consumer environment. According to the company, same-store sales in the U.S. fell 3.6% in the first quarter — its steepest domestic drop since 2020 — as lower- and middle-income consumers pulled back on fast food spending amid inflation and economic uncertainty.

CEO Chris Kempczinski acknowledged that only high-income consumers have maintained steady visits, while McDonald’s core customer base has been cutting back. Globally, same-store sales fell 1%, and without the extra leap year day, they were flat — missing Wall Street’s expectation for nearly 2% growth.

AltIndex Data Highlights Fading Consumer Interest

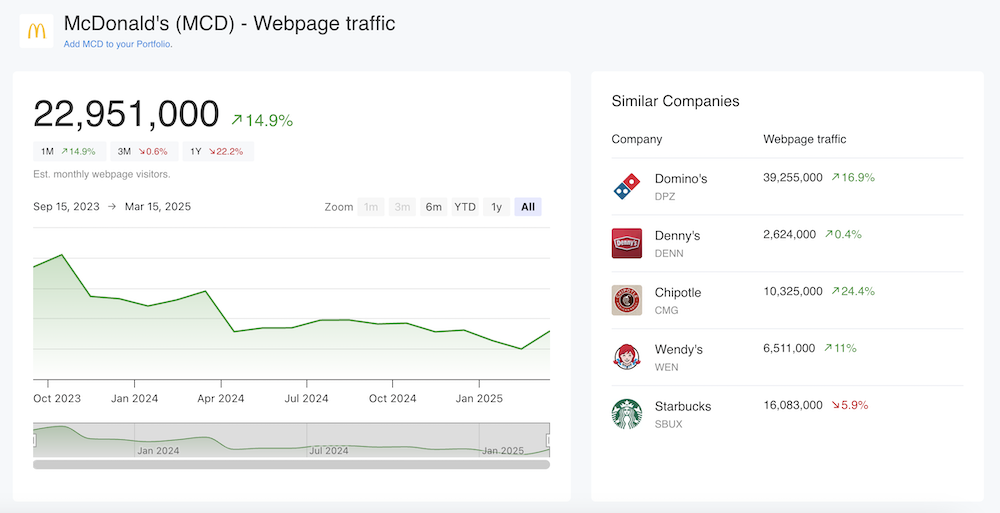

The alternative data that we track at AltIndex underscores these worrying trends. Web traffic to mcdonalds.com has dropped sharply, with an estimated 23 million monthly visitors — up slightly in the last month but down 22% year over year. This decline in online interest mirrors trends seen across the broader fast-food industry, with Wendy’s and Domino’s also experiencing web traffic slowdowns. This could point to a broader shift in consumer preferences, perhaps away from traditional fast food.

McDonalds Web Traffic

Another telling signal comes from mobile app downloads. McDonald’s U.S. apps are seeing around 25,000 downloads per day, but that’s 10% lower than a year ago. App activity often correlates with customer engagement and transaction volume, so this decline suggests fewer new customers and possibly lower repeat visits.

Social media provides a mixed picture. McDonald’s Instagram following has grown 7% year over year, reaching 5.4 million followers. While that’s solid, it lags competitors like Chipotle, which saw a 16% increase, and Wendy’s, up 12% over the same period — a sign that McDonald’s is not capturing cultural attention at the same pace.

New Menus and Deals Aim to Win Back Customers

To counter these headwinds, McDonald’s has rolled out new promotions, including a $5 Meal Deal that’s proven popular and a McValue menu that has yet to deliver the expected lift in sales. Looking ahead, the company is pinning its hopes on new product launches, like chicken strips and the much-anticipated return of the snack wrap in the U.S. Kempczinski also noted the strong consumer response to the limited-time Minecraft Movie meal, which sold out its collectible figures in under two weeks.

Despite the soft quarter, McDonald’s reaffirmed its full-year financial targets and remains confident in its ability to weather industry volatility. Revenue fell 3% to $5.95 billion, missing estimates, but adjusted earnings of $2.67 per share narrowly beat expectations. Shares slipped 1.8% after the earnings report but remain up 14% over the past year.

What Investors Should Take Away

The alternative data signals — falling web traffic, softer app downloads, and relatively modest social media growth — line up with the official earnings report and suggest that McDonald’s is facing real challenges in maintaining consumer engagement. While promotions and product innovations could help, investors should watch closely whether these efforts translate into sustained traffic and sales improvements, especially among price-sensitive customers.

For now, McDonald’s strong brand and international footprint provide a cushion, but the declining popularity reflected in both traditional and alternative data suggests that the company will need to work harder to hold its ground in a shifting market.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.