Nvidia Beats Earnings and So the Stock Goes... Down?

August 28, 3:43 pm

Nvidia (NVDA) has once again outperformed expectations, reporting earnings that surpass Wall Street’s predictions and providing robust guidance for the upcoming quarter. Yet, in a surprising turn, Nvidia’s stock dropped by 8% in extended trading. So why did the stock take a hit despite such impressive results?

Breaking Down the Numbers

Let’s start with the basics. Nvidia reported adjusted earnings per share of 68 cents, beating the expected 64 cents. Revenue came in at $30.04 billion, exceeding the anticipated $28.7 billion. For the current quarter, Nvidia has guided revenue to approximately $32.5 billion, slightly higher than the $31.7 billion forecasted by analysts. This would represent an 80% increase from the same period last year.

The company’s revenue continues to surge, climbing 122% year-over-year, driven largely by its dominance in the artificial intelligence (AI) sector. Net income more than doubled to $16.6 billion, showcasing Nvidia’s ability to capitalize on the AI boom.

The Bigger Picture: AI and Beyond

Nvidia remains the primary beneficiary of the AI boom, with its data center business, which includes AI processors, growing by 154% year-over-year to $26.3 billion. This accounts for a staggering 88% of total sales. While some of these sales are from AI chips, a significant portion - $3.7 billion - comes from networking products.

The company’s AI chips, like the H100 and H200, are powering the majority of generative AI applications, including OpenAI’s ChatGPT. Nvidia is also preparing to launch its next-generation AI chip, Blackwell, which is expected to further strengthen its market position.

So Why the Drop?

While these numbers are impressive, the stock market often reacts not just to performance, but to expectations—and in Nvidia’s case, those expectations are sky-high. The slight increase in forward guidance (32.5 billion vs. 31.7 billion) wasn’t enough to thrill investors, especially when compared to the significant upward revisions Nvidia has provided in recent quarters. When a company is priced to perfection, any sign that growth might be slowing - even slightly - can trigger a sell-off.

This 7-8% drop might seem significant, but it’s relatively modest for Nvidia, a stock known for its volatility. The market’s reaction suggests that investors are becoming more cautious, possibly signaling a belief that Nvidia’s explosive growth may begin to normalize.

Alternative Data Signals Growth

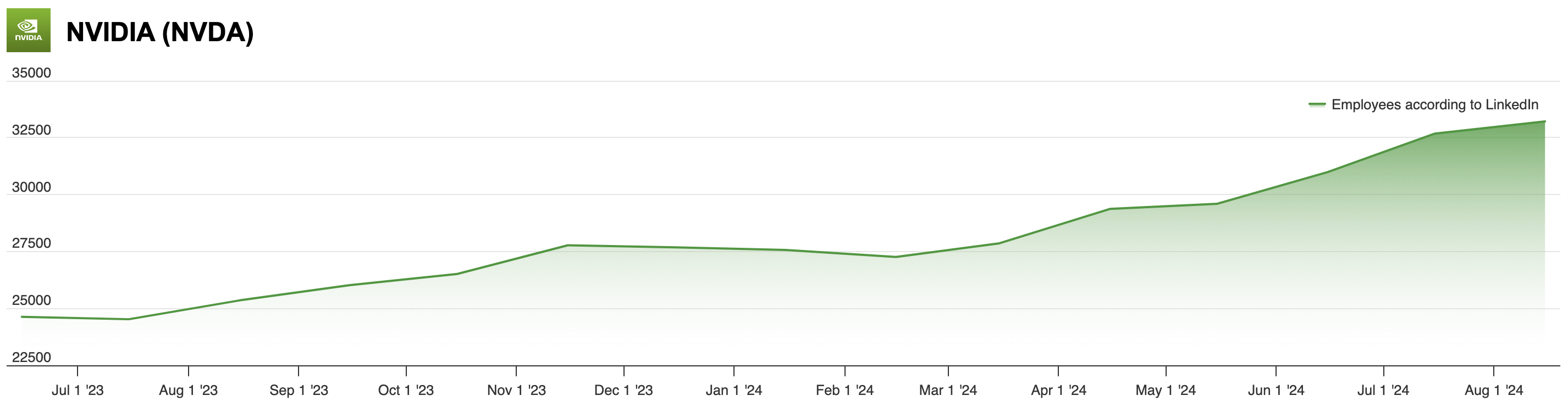

Despite the stock’s recent dip, alternative data points to a company that continues to grow and thrive. The number of employees at Nvidia (according to LinkedIn) has increased by 31% in the last year, and the company has a strong pipeline of job openings. Employee sentiment is overwhelmingly positive, with over 91% reporting a favorable business outlook.

Read more about how companies with a favorable business outlook tends to outperform companies with a less favourable business out

Nvidia Employees according to LinkedIn

Nvidia’s social media presence also reflects its growth. The company has seen significant increases in followers across various platforms, including a 73% rise on Threads and a 38% increase on YouTube.

What Does This Mean for Investors?

Given Nvidia’s strong fundamentals and its leadership in a market that shows no signs of slowing down, AltIndex’s AI score of 62 - a buy signal - seems justified. While the market may be reacting to concerns over future growth, the company’s position at the forefront of the AI revolution and its impressive performance metrics suggest that Nvidia remains a solid investment.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.