Reddit: Undervalued Despite Massive Web Traffic?

March 30, 10:15 am

In an age where digital presence directly translates into revenue potential, website traffic has become an essential metric for investors. Companies attracting millions of daily visits often have significant monetization opportunities, making web traffic a key indicator of growth potential.

Reddit's High Traffic, Low Valuation

Reddit (RDDT), the self-proclaimed "front page of the internet," stands out as a fascinating example. Boasting an estimated 5 billion web visits in February, Reddit significantly surpasses many of its competitors in online engagement. Yet, despite its impressive digital footprint, the market values Reddit at approximately $19.5 billion - considerably lower than some competitors with far less web traffic.

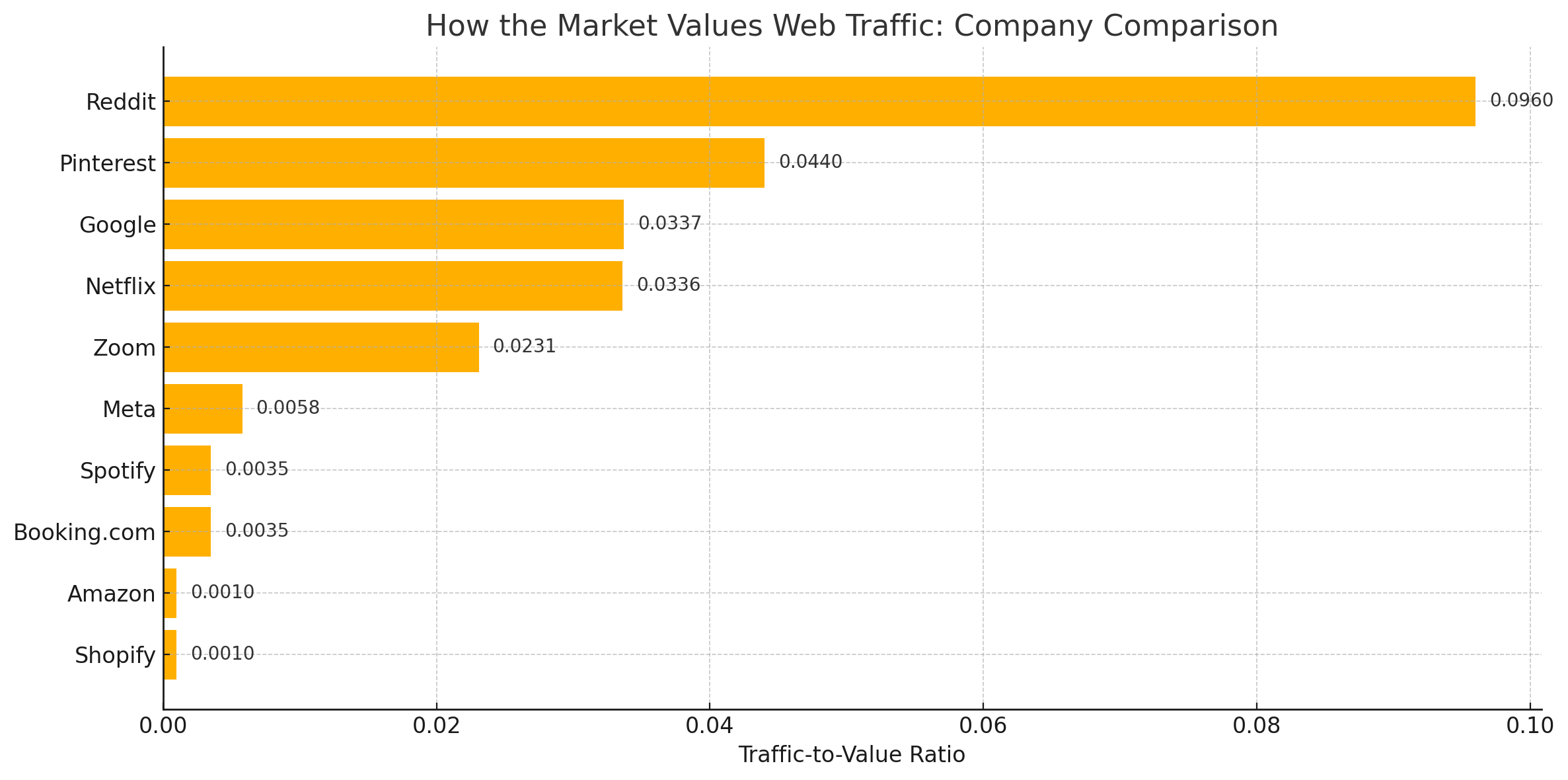

To illustrate, consider Pinterest, a direct competitor in the realm of user-generated content and digital communities. Pinterest, valued around $21 billion, has a higher valuation compared to Reddit, yet its webpage traffic is significantly lower at roughly 1.2 billion visits in February. However, when comparing their "Traffic-to-Value" - the ratio of web traffic to market capitalization - Reddit outshines Pinterest. Reddit’s web worth stands at 0.0960, more than double Pinterest's 0.0440, suggesting that Reddit’s market valuation has yet to fully reflect the true potential value derived from its massive online audience.

Here’s a list of prominent companies with massive web traffic, sorted by their Traffic-to-Value Ratio - which shows how the market values the traffic based on the company's valuation.

| Company | Domain | Traffic-to-Value Ratio | Price YTD |

| Reddit.com | 0.0960 | 35% | |

| Pinterest.com | 0.0440 | 3% | |

| Google.com | 0.0337 | 18% | |

| Netflix | Netflix.com | 0.0336 | 5% |

| Zoom | Zoom.us | 0.0231 | 8% |

| Meta | Facebook.com | 0.0058 | 4% |

| Spotify | Spotify.com | 0.0035 | 22% |

| Booking.com | Booking.com | 0.0035 | 6% |

| Amazon | Amazon.com | 0.0010 | 12% |

| Shopify | Shopify.com | 0.0010 | 10% |

If we plot the data on a chart, the difference is even more startling. Companies like Reddit and Pinterest rise clearly to the top, while giants like Amazon and Microsoft are far lower despite their massive valuations.

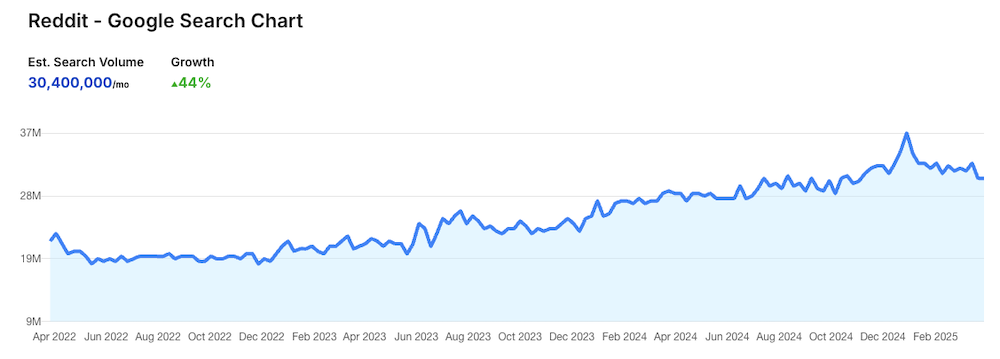

To add to the picture, interest in Reddit has been rising steadily over the past three years based on Google search trends.

Google Searches for Reddit according to Google Trends

Untapped Potential and Investment Opportunity

This discrepancy hints at Reddit's untapped potential. Currently trading at $107.71 per share, down 35% year to date, investors considering Reddit might see substantial upside, particularly if the platform continues to improve monetization strategies, leverage advertising opportunities, or explore new revenue-generating models such as premium subscriptions or digital marketplaces.

In comparison, social media giants like Meta and Google have much lower web worth ratios, highlighting that their enormous market valuations already price in extensive revenue generation from various streams beyond just traffic. Reddit, in contrast, is uniquely positioned, with vast web traffic yet a valuation that suggests substantial room for growth.

For investors, Reddit presents an intriguing opportunity - a company that might be undervalued based on its most basic asset: its ability to attract and engage billions of users online. As the market begins to further appreciate web traffic’s inherent value, Reddit could find itself significantly revalued.

At AltIndex, we’ll keep tracking alternative data like web traffic to uncover hidden market gems and deliver unique insights to help investors stay ahead. Visit our Top lists for more webpage traffic insights, our stock screener, or sign up and get stock alerts on webpage traffic and lots more for the companies in your portfolio.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.