Spotify Hits All-Time High in Web Traffic: What It Means for Investors

January 10, 3:33 pm

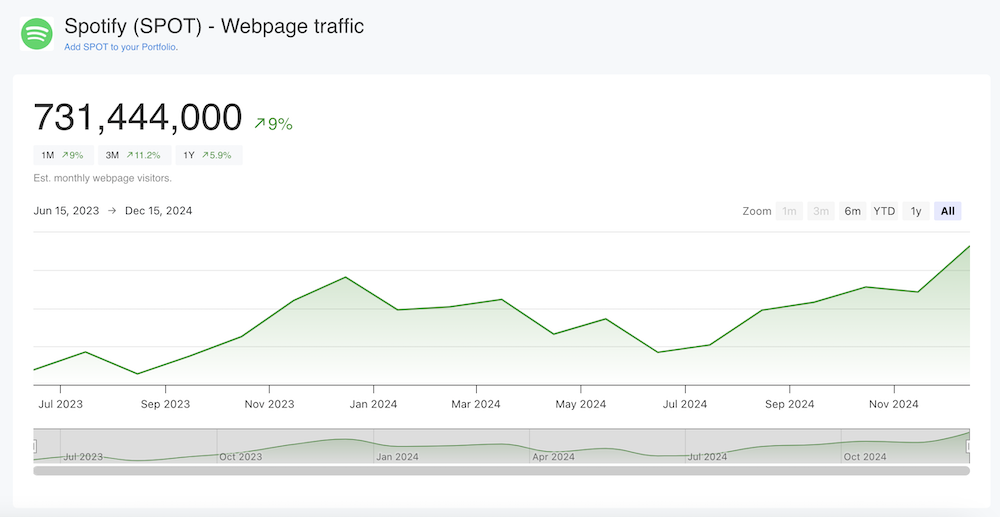

Spotify’s ($SPOT) growth story continues to impress. According to our estimates, the streaming giant’s website traffic hit an all-time high in December, with a staggering 731 million visitors. This milestone signals promising news for the company and its shareholders, as web traffic often serves as a proxy for growth.

December Controversy Didn’t Hurt Growth

December proved to be a strong month for Spotify, even as its year-in-review feature faced criticism for being bland and uninspired. Despite the backlash, the platform achieved a new milestone with an estimated 731 million visitors accessing spotify.com, the highest web traffic we've seen in the past five years of tracking and 6% more than December 2023, the previous all-time high.

Web traffic is an important metric for a company like Spotify. It reflects both user engagement and the influx of potential new subscribers, as many first-time users visit the website to sign up for premium plans. The surge in December’s traffic highlights Spotify’s ability to attract and retain users despite momentary controversies, signaling a strong growth trajectory.

AltIndex’s Long-Term Insights

At AltIndex, we have been monitoring Spotify’s web traffic for the past five years, and December’s numbers are unprecedented. This growth echoes previous trends we highlighted in 2022, where rising web traffic and app downloads indicated a positive growth trajectory. Since that article, the stock is up 440%.

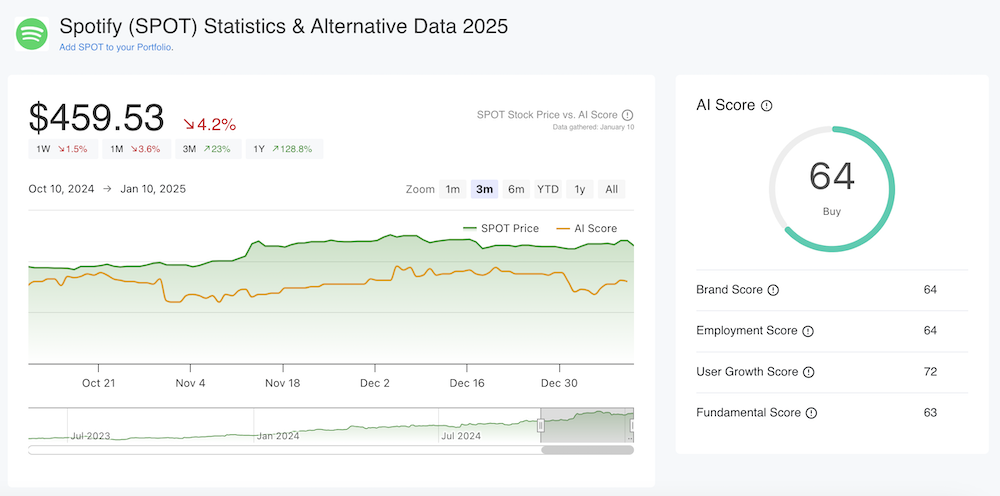

Currently, Spotify’s stock price stands at $459.53 - down 1.5% in the last week but up an impressive 128.8% over the past year. Goldman Sachs analyst Eric Sheridan recently reaffirmed his "Buy" rating on Spotify’s stock, raising the price target from $490 to $550. This endorsement, paired with the company’s rising metrics, underscores the confidence in Spotify’s future potential.

Spotify Stock Price & AI Score

At AltIndex, our insights also indicate a buy signal as the stock's AI score currently sits at 64. This score reflects several key growth drivers:

Revenue Growth: Spotify’s financials are improving steadily.

Web Traffic Surge: December’s record-breaking visitor numbers signal strong consumer interest.

Employee Sentiment: A more bullish outlook among employees highlights optimism about the company’s direction.

Social Media Presence: A recent jump in Instagram followers suggests rising brand engagement.

Why This Matters for Investors

Web traffic as a growth proxy signals that Spotify’s strategy is resonating with consumers. Combined with positive financial performance and optimistic analyst ratings, this milestone strengthens Spotify’s position as a growth stock. For investors, the latest metrics reaffirm the potential for continued gains, making Spotify a compelling choice for portfolios focused on growth.

As always, AltIndex remains committed to providing actionable insights based on alternative data and analytics. For those looking to capitalize on Spotify’s momentum, the time to act may be now.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.