Stock of the Week: Sleep Number

September 11, 9:44 am

At AltIndex, we’re always looking for stocks that might surprise investors, and this week, Sleep Number (SNBR) has caught our attention. Trading at $14.30 per share, Sleep Number is a company whose future is intricately tied to a growing trend: longevity. With the increased emphasis on health and wellness, people are more focused on optimizing their sleep, which is exactly where Sleep Number excels.

The Longevity Trend and Sleep Number's Growth Potential

Sleep is no longer just about rest - it’s a pillar of longevity, one of the critical components of a long, healthy life. As more people prioritize health and wellness, the demand for high-quality sleep products will likely increase.

Sleep Number is perfectly positioned to ride this wave. Their Sleep Number 360 smartbeds, now in their next generation, are not just beds but AI-powered sleep ecosystems. With 19 million hours of accumulated sleep data, the company has been able to refine its product offerings, and these advancements align well with the health and wellness trends driving consumer behavior.

The longevity trend makes Sleep Number a company to watch, as consumers increasingly understand that better sleep contributes to longer, healthier lives. And while the company's stock performance has been rocky, we believe these broader trends can help support future growth.

Earnings Report: A Mixed Bag

Let’s not sugarcoat it - the Q2 CY2024 earnings report for Sleep Number was a bit disappointing. The company posted revenue of $408.4 million, an 11% decline year over year, and missed Wall Street estimates by 1.9%. The reported GAAP loss of $0.22 per share contrasts sharply with the $0.03 profit per share from the same quarter last year. This reflects the company’s struggle to boost revenue, and with an annualized growth rate of only 2.1% over the past five years, it’s clear that Sleep Number’s physical retail footprint hasn’t been a game-changer.

However, there are reasons to believe that the recent stock rebound (up 16.9% in the past month) may signal a potential turnaround. Despite the earnings miss, alternative data points hint at growing momentum behind the scenes.

Alternative Data Insights: A Ray of Hope

While traditional financial metrics paint a less-than-rosy picture, the alternative data provides a different, more optimistic story.

First, there’s insider sentiment. Stephen E. Macadam, a member of Sleep Number’s Board of Directors, recently bought 43,000 shares of the company. This is a strong signal that those inside the company see better days ahead. Insider buying is often a leading indicator of future performance, as it shows internal confidence in the company’s direction.

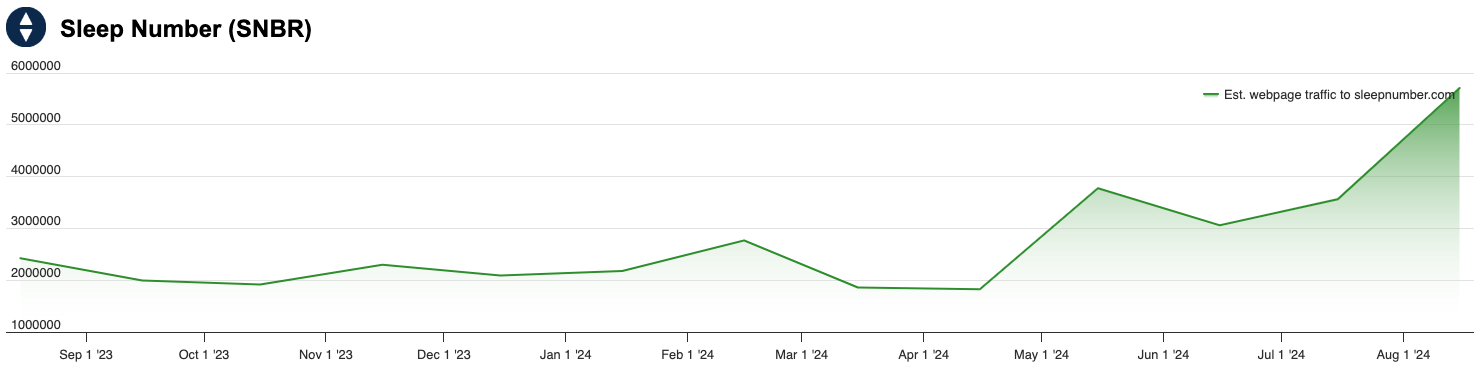

Second, web traffic data shows a significant upward trend. Sleepnumber.com has experienced a 50% increase in traffic over the past couple of months, which could signal rising consumer interest. An uptick in web traffic often correlates with potential sales growth, particularly for e-commerce-focused businesses. This trend is further supported by the increase in app downloads, though it's too early to determine if this growth will persist.

Sleep Number est. Webpage Traffic

Social media metrics also offer mixed signals. The company has grown its Instagram following by 15% over the last year, indicating strong engagement with a younger, more health-conscious audience. However, Sleep Number has seen slight declines in its Facebook and Twitter followers, which may reflect a shift in audience demographics or engagement strategies.

AltIndex’s AI Score: Hold for Now, But Signs of Growth

Currently, our AI Score for Sleep Number signals a "Hold," reflecting the company's uncertain short-term prospects but acknowledging the potential for longer-term growth. The earnings miss and weak five-year growth rate are concerns, but the positive alternative data points—insider buying, web traffic increases, and social media engagement - suggest that Sleep Number might be turning a corner.

In conclusion, while Sleep Number has faced its share of challenges, the company is positioning itself to benefit from the rising tide of health-conscious consumers focused on longevity. Combined with improving alternative data insights, Sleep Number might just be a sleeper hit for investors willing to bet on the long game.

Final Verdict: Keep an eye on this stock. The future of sleep - and longevity - may be brighter than its recent earnings suggest.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.