TikTok Trends to Stock Gains: The Chili’s Story and Why Investors Should Care

January 31, 4:44 pm

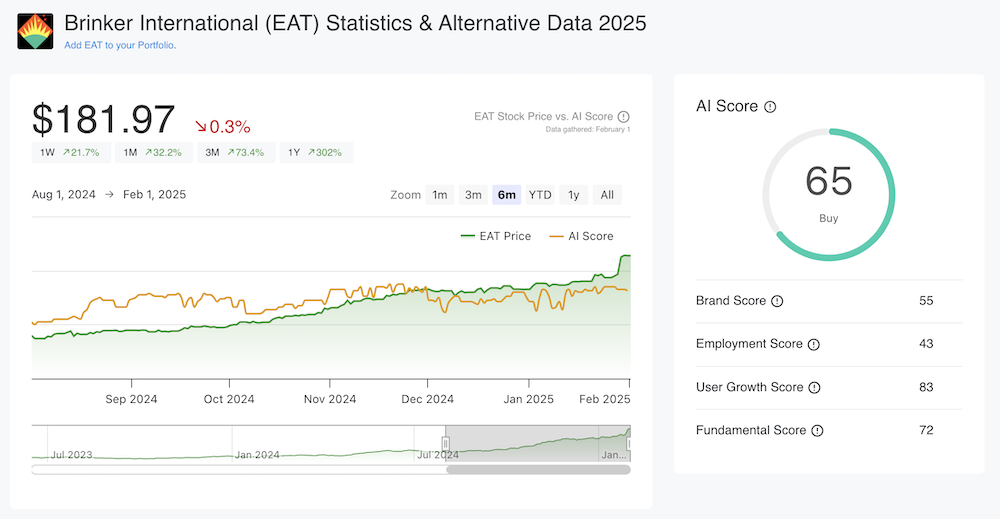

While tech companies like Nvidia and Meta often capture headlines, Brinker International (EAT), the parent company of Chili's, has seen an unexpected and dramatic rise in its stock price. Over the past year, the stock has surged by 325%, with a current trading price of $181.97. This impressive growth has been fueled by a clever use of social media to revamp the brand's image and menu.

A Success Story Reimagined

During recent earnings discussions, analysts praised Chili’s for what they called an unmatched turnaround in the restaurant industry. Under CEO Kevin Hochman's leadership, the brand has refreshed its menu with better French fries and chicken tenders, alongside appealing deals that mimic fast-food pricing.

However, it was Chili’s strategic use of TikTok that really turned heads. Their "Triple Dipper" platter, which includes choices like mozzarella sticks and chicken wings for under $20, has been around for years but gained new life through social media promotion. Videos featuring the platter, especially those with gooey mozzarella sticks, have gone viral, gathering millions of views.

@ireneykim I FEAR CHILI’S ATE WHEN THEY MADE THE TRIPLE DIPPER @Chili’s Grill & Bar #chilis #chilisbarandgrill #chilistripledipper #tripledipper #chickentenders #mozzarellasticks #chilisreview #chilisrestaurant #mukbang #foodreview #creatorsearchinsights ♬ original sound - irene kim 🧸

One of many viral Tiktok videos highlighting Chili's menu items

Going Viral and Winning New Fans

This viral marketing strategy has effectively attracted a younger audience, many of whom had never considered dining at Chili's before. The popularity of these TikTok videos has not only made the meal option famous but has also significantly boosted sales. The Triple Dipper sales soared by 70%, making up 11% of the chain’s total business, and contributing to a 14.1% rise in same-store sales for the most recent quarter.

Why Social Media Followers Matter to Investors

For investors, Chili's success story highlights the growing importance of keeping an eye on a company's social media metrics. Chili’s has dramatically increased its TikTok followers to over 145,000, a significant jump that has correlated with its rising stock price. The brand has also seen growth on Instagram, which continues to attract more customers.

At AltIndex, we’ve closely monitored Brinker International and Chili’s social media influence. We issued our first buy signal six months ago on August 22, when the stock was at $68 per share, largely based on the company's growing social media presence. Currently, the stock still holds a buy signal with an AI score of 65. Our target price of $198.83 is based on several promising factors: robust financial fundamentals, a year-over-year increase in revenue, a recent spike in employee optimism, increased mobile app downloads, and continued growth in Instagram and TikTok followers.

The Take-away

Monitoring social media trends offers investors a way to spot potential gains early. Similar increases in social media followings and corresponding stock price rises have been observed in other companies like The RealReal (REAL), TripAdvisor (TRIP), and Victoria’s Secret (VSCO). This trend underscores the value of social media engagement in today's investment strategies.

The resurgence of Brinker International through Chili’s innovative use of social media is a powerful lesson for investors. In today’s market, tracking a company's online engagement is crucial, not just for understanding brand popularity but for finding potential stocks to buy. As Chili's continues to draw in crowds and drive sales, it's clear that smart social media strategies can lead to real-world profits - and strong gains for investors keeping an eye on social media trends.

For more ideas, use our Stock Screener to find stocks with a growing social media audience.

Disclaimer: The information provided is for educational and informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and you should conduct your own research or consult a qualified professional before making any investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.