Top 5 Growth Stocks in April 2024

April 10, 9:06 pm

At AltIndex, our approach to identifying growth opportunities diverges from the norm. We extend our analysis beyond traditional financial statements to include alternative data insights, which we believe are forward-looking indicators of a company's performance. This month, we’ve evaluated companies based on metrics such as revenue growth, web traffic, social media followers, and mobile app downloads.

Let's take a look at what growth stocks make the list.

Coinbase

Coinbase stands out in the cryptocurrency boom with impressive metrics across the board. Web traffic has surged by 55% year-over-year, indicating increased user interest and platform engagement. The 125% jump in app downloads over the last quarter suggests a growing user base, potentially leading to higher transaction volumes and revenue. Furthermore, a nearly 7% increase in Instagram followers reflects stronger brand recognition and community engagement. These factors, combined with a 41% revenue increase quarter-over-quarter in Q4 and a significant rise in job postings, paint a picture of a company scaling rapidly in anticipation of sustained demand.

Robinhood

Robinhood has captured attention with its remarkable performance in key growth areas, similar to Coinbase. The nearly 60% increase in web traffic and 88% rise in app downloads over the past three months highlight a surge in user activity and interest, likely fueled by the expanding crypto market. Despite a decline in social media followers, the robust growth in user engagement metrics suggests that Robinhood continues to be a favorite platform for retail investors, mirroring its over 100% stock price increase in the last quarter.

Estimated webtraffic - robinhood.com

Skechers

Skechers showcases surprising strength in digital engagement, with a 68% increase in mobile app downloads over the past year, indicating a successful digital marketing strategy and growing consumer interest. An 11% rise in web traffic year-over-year further demonstrates the brand's expanding online presence. The 50% growth in Instagram followers over the past year not only enhances brand visibility but also suggests increasing consumer loyalty and interest, which could translate into higher sales and revenue.

Wingstop

Wingstop's alternative data insights reveal a company that’s appealing to more consumers and effectively expanding its digital footprint. The 15% increase in web traffic and 22% rise in app downloads over the last three months suggest effective marketing (further shown in the 18% increase in Instagram followers) that could lead to growing brand engagement and popularity. Additionally, the improvement in business outlook across employee reviews by 22% in the last three months might indicate a positive internal culture, which can contribute to better service and growth.

Shopify

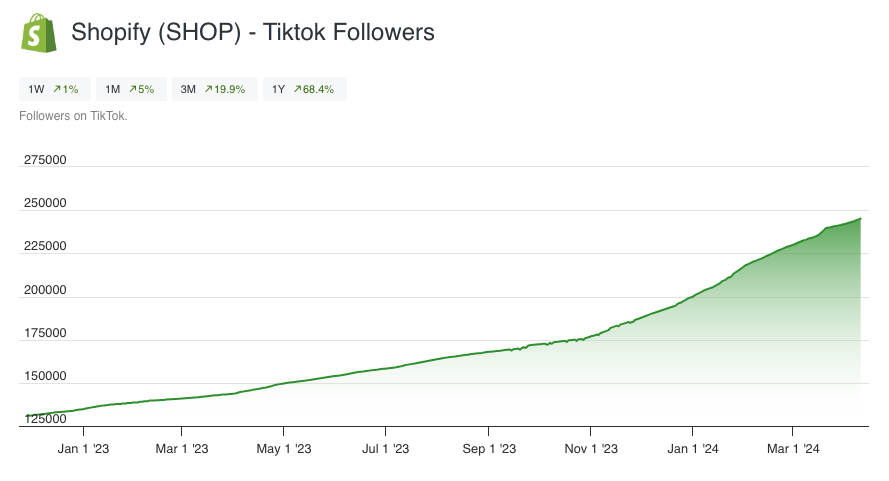

Shopify’s nearly double stock price over the last year, with recent corrections, is supported by strong alternative data insights. The 36% increase in web traffic year-over-year and a 24% rise in app downloads in the last quarter underscore a growing base of merchants and shoppers using the platform. A nearly 20% increase in TikTok followers in the same period suggests Shopify is effectively engaging with younger audiences and entrepreneurs, expanding its market reach. These metrics, alongside a 25% revenue increase in its latest earnings report, confirm Shopify's solid position in e-commerce.

Shopify Tiktok Followers

Growth stocks conclusion

Our journey through the top 5 growth stocks for April 2024 underscores a pivotal shift in investment strategy - embracing the power of alternative data insights. In an era where traditional financial metrics continue to serve as the backbone of investment analysis, the integration of unconventional data points, such as web traffic, social media engagement, mobile app downloads, and even employee reviews, offers a complementary lens through which growth potential can be discerned.

These alternative metrics act as early indicators of a company’s growth trajectory, long before conventional financial results catch up. For instance, a surge in app downloads or web traffic can signal increasing consumer interest or market share, potentially leading to revenue growth in subsequent quarters. Similarly, an uptick in social media engagement might reflect strengthening brand loyalty and awareness, contributing to long-term value creation.

In essence, alternative data insights equip investors with a more holistic view of a company's potential, enabling the identification of growth opportunities with a higher degree of precision. As the financial landscape continues to evolve, integrating these insights into investment strategies will be crucial for staying ahead in the rapidly changing market.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.