Top Growth Stocks That Might Pop Soon

January 14, 3:33 am

If you’re looking to invest in the stock market and want to explore growth stocks, you’re in the right place. Growth stocks are companies expected to increase their revenue, profits, or market share at a faster rate than the overall market. They’re exciting but come with higher risks, so knowing what to look for is essential. Let’s break down a few stocks that could be on the brink of significant growth based on key metrics and alternative data insights.

What Makes a Stock a Growth Stock?

Growth stocks often have the following characteristics:

High Revenue Growth: Consistent increases in sales and earnings.

Strong Consumer Interest: Growing web traffic, app downloads, and social media engagement often indicate popularity and potential future growth.

Market Trends: Companies in sectors with high future potential, like tech or healthcare, often exhibit growth stock traits.

1. Coinbase (COIN)

Stock Price: Up 28% in the last 3 months, down 19% in the last month.

Revenue: Down 17% quarter-over-quarter (QoQ) but up 81% year-over-year (YoY).

Web Traffic: Up 65% in the last 12 months.

App Downloads: Up 300% in the last 12 months.

Instagram Followers: Up 15% in the last 12 months.

Why COIN Could Grow:

Coinbase has seen an impressive rise in user engagement, as evidenced by skyrocketing app downloads and web traffic. Despite recent volatility, the company’s year-over-year revenue surge highlights its potential to capitalize on growing interest in cryptocurrencies. Its stock price dip over the last month could present a buying opportunity for investors betting on the long-term growth of digital assets.

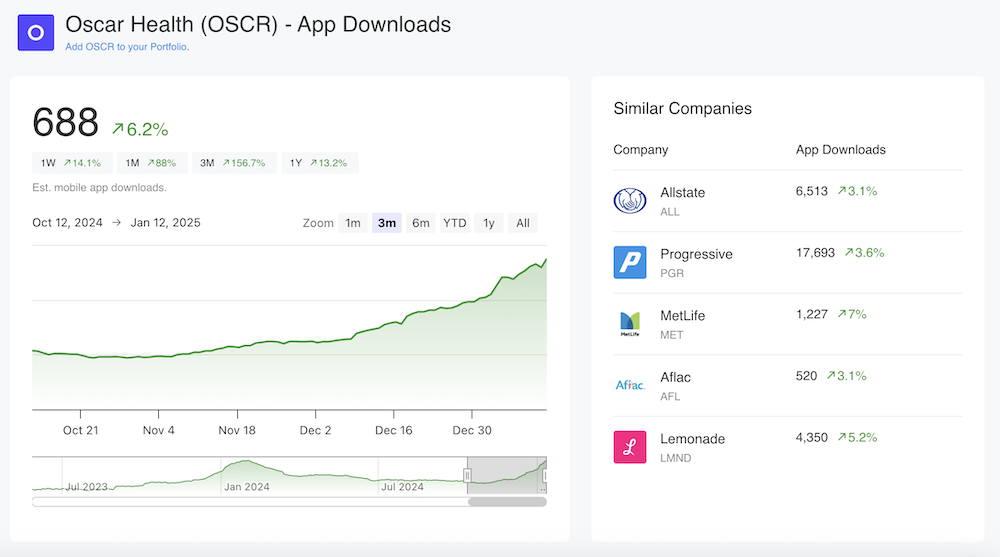

2. Oscar Health (OSCR)

Stock Price: Up 81% in the last 12 months but down 18% in the last 3 months.

Revenue: Up 9% QoQ and 68% YoY.

Web Traffic: Up 46% in the last 12 months.

App Downloads: Up 100% in the last 12 months.

Instagram Followers: Up 7% in the last 12 months.

Why OSCR Could Grow:

Oscar Health is a digital-first health insurance company showing significant revenue growth and increasing consumer interest. Its doubling of app downloads reflects the growing adoption of its user-friendly platform. While its recent stock price decline might be concerning, long-term investors could view this as a moment to buy into a company modernizing the health insurance space.

3. Roku (ROKU)

Stock Price: Down 11% in the YoY.

Revenue: Up 10% QoQ and 16% YoY.

Web Traffic: Up 4% in the last 12 months.

App Downloads: Up 48% in the last 12 months.

Instagram Followers: Up 8% in the last 12 months.

Why ROKU Could Grow:

Roku’s consistent revenue growth and increased app downloads demonstrate that its platform remains a popular choice for streaming entertainment. However, the decline in employee sentiment (-24% YoY) could indicate internal challenges. While not the strongest contender on this list, Roku remains a steady performer in the tech sector with room for growth.

4. iRobot (IRBT)

Stock Price: Down 73% in the last 12 months, with extreme volatility.

Revenue: Up 16% QoQ (4% YoY).

Web Traffic: Up 8% in the last 12 months.

App Downloads: Up 10% in the last 12 months.

Instagram Followers: Up 8% in the last 12 months.

Why IRBT is Risky but Intriguing:

iRobot has experienced significant volatility, with a recent 50% surge followed by a sharp decline. Despite a low market cap of $249.97 million, the company generated $193.44 million in Q3 revenue. Preliminary Q4 results show expected losses, but iRobot’s strong revenue figures and cash management could attract speculative investors who believe in the robotics sector's potential.

Investor Note: This stock is highly speculative, and caution is advised.

Key Takeaways for New Investors

Do Your Research: Beyond stock price, consider revenue growth, consumer interest, and market trends.

Think Long Term: Growth stocks can be volatile, but they often reward patience.

Diversify: Spread your investments across sectors to mitigate risks.

With tools like AltIndex, you can analyze alternative data such as app downloads, web traffic, and employee sentiment to make informed investment decisions. Sign up to get access to all of our insights today.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.