Data gathered: November 22

AI Stock Analysis - 3D Systems (DDD)

Analysis generated October 31, 2024. Powered by Chat GPT.

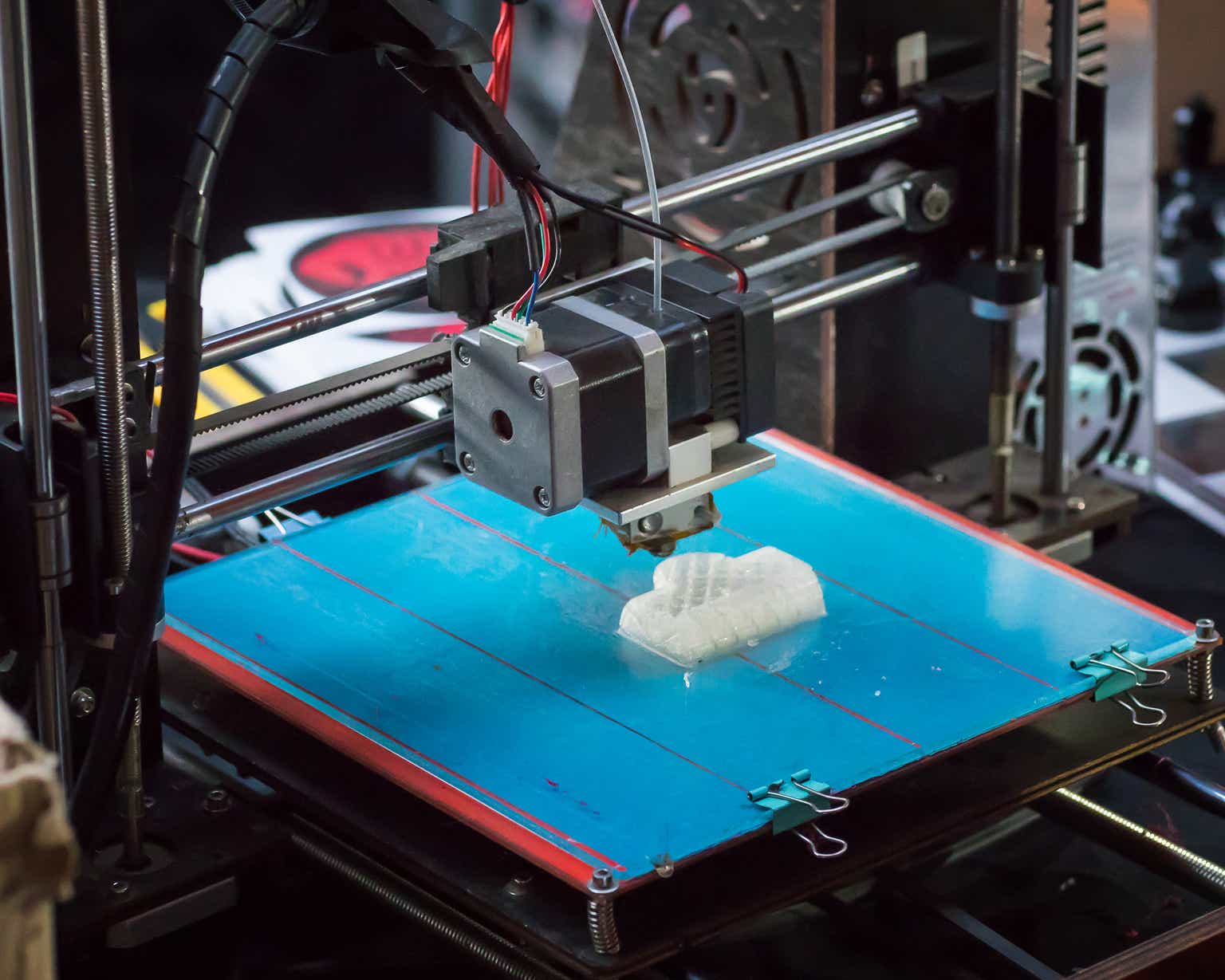

3D Systems Corporation (NYSE: DDD) is a leading global provider of 3D printing and digital manufacturing solutions. Established in the 1980s, the company pioneers in additive manufacturing, offering a comprehensive range of products and services, from advanced 3D printers and print materials to on-demand parts services. 3D Systems caters to diverse industries, including aerospace, automotive, healthcare, and dental, providing tailored solutions that drive innovation and efficiency.

Stock Alerts - 3D Systems (DDD)

|

3D Systems | November 21 Price is up by 5.5% in the last 24h. |

|

3D Systems | November 15 Price is up by 5.5% in the last 24h. |

|

3D Systems | November 14 Price is down by -17.2% in the last 24h. |

|

3D Systems | November 13 Price is up by 6.9% in the last 24h. |

Alternative Data for 3D Systems

About 3D Systems

3D Systems Corp is a developer of computer systems and components. Its suite of products includes 3-D printers, print materials, digital design software and on-demand manufacturing services.

| Price | $3.20 |

| Target Price | Sign up |

| Volume | 2,660,000 |

| Market Cap | $415M |

| Year Range | $1.88 - $4.61 |

| Dividend Yield | 0% |

| PE Ratio | 11.23 |

| Analyst Rating | 40% buy |

| Industry | Computer Hardware |

In the news

|

3D Systems Announces Date of Third Quarter 2024 Financial ResultsNovember 21 - Yahoo |

|

LMR Partners LLP Invests $189,000 in 3D Systems Co. (NYSE:DDD)November 21 - ETF Daily News |

|

3D Systems: Waiting For More Clarity On The Profitability PathNovember 17 - SeekingAlpha |

|

Why 3D Systems (DDD) Stock Is Falling TodayNovember 14 - Yahoo |

|

Why 3D Systems Stock Is Plummeting TodayNovember 14 - Yahoo |

Sauber Motorsports Drives Innovation with 3D Systems’ SolutionsNovember 13 - Finnhub |

|

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q2 '24 | 113M | 119M | 47M | -27M | -19M | -0.140 |

| Q1 '24 | 126M | 127M | 41M | -16M | -6.5M | -0.170 |

| Q4 '23 | 145M | 437M | 44M | -293M | -284M | -0.110 |

| Q3 '23 | 121M | 121M | 55M | -12M | -2.2M | 0.010 |

| Q2 '23 | 126M | 144M | 50M | -29M | -19M | -0.070 |

Insider Transactions View All

| ERICKSON THOMAS W filed to buy 257,294 shares at $5.3. November 29 '23 |

| ERICKSON THOMAS W filed to buy 207,294 shares at $4.6. November 22 '23 |

| Puthenveetil Reji filed to sell 206,982 shares at $8. May 31 '23 |

| Clinton Malissia filed to sell 62,785 shares at $8.6. May 18 '23 |

| Johnson Andrew Martin filed to sell 178,434 shares at $9.4. December 9 '22 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

AppleAAPL |

$229.87 0.6% | 51 |

|

HPHPQ |

$38.13 0.6% | 43 |

|

SonySONY |

$19.06 0.1% | 75 |

|

TeradataTDC |

$30.7 1.1% | 48 |

|

LogitechLOGI |

$79.58 0.2% | 63 |

Read more about 3D Systems (DDD) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, youtube subscribers, news mentions, customer reviews, business outlook & linkedin employees.

What is the Market Cap of 3D Systems?

The Market Cap of 3D Systems is $415M.

What is 3D Systems' PE Ratio?

As of today, 3D Systems' PE (Price to Earnings) ratio is 11.23.

What is the current stock price of 3D Systems?

Currently, the price of one share of 3D Systems stock is $3.20.

How can I analyze the DDD stock price chart for investment decisions?

The DDD stock price chart above provides a comprehensive visual representation of 3D Systems' stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling 3D Systems shares. Our platform offers an up-to-date DDD stock price chart, along with technical data analysis and alternative data insights.

Does DDD offer dividends to its shareholders?

As of our latest update, 3D Systems (DDD) does not offer dividends to its shareholders. Investors interested in 3D Systems should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of 3D Systems?

Some of the similar stocks of 3D Systems are Apple, HP, Sony, Teradata, and Logitech.

.