Data gathered: November 21

Alternative Data for Sonos

About Sonos

Sonos is an American developer and manufacturer of audio products best known for its multi-room audio products. The company was founded in 2002 by John MacFarlane, Craig Shelburne, Tom Cullen, and Trung Mai. It is currently run by Patrick Spence.

| Price | $13.50 |

| Target Price | Sign up |

| Volume | 1,420,000 |

| Market Cap | $1.57B |

| Year Range | $11.09 - $19.51 |

| Dividend Yield | 0% |

| PE Ratio | 101.4 |

| Analyst Rating | 50% buy |

| Industry | Wearable Tech |

In the news

|

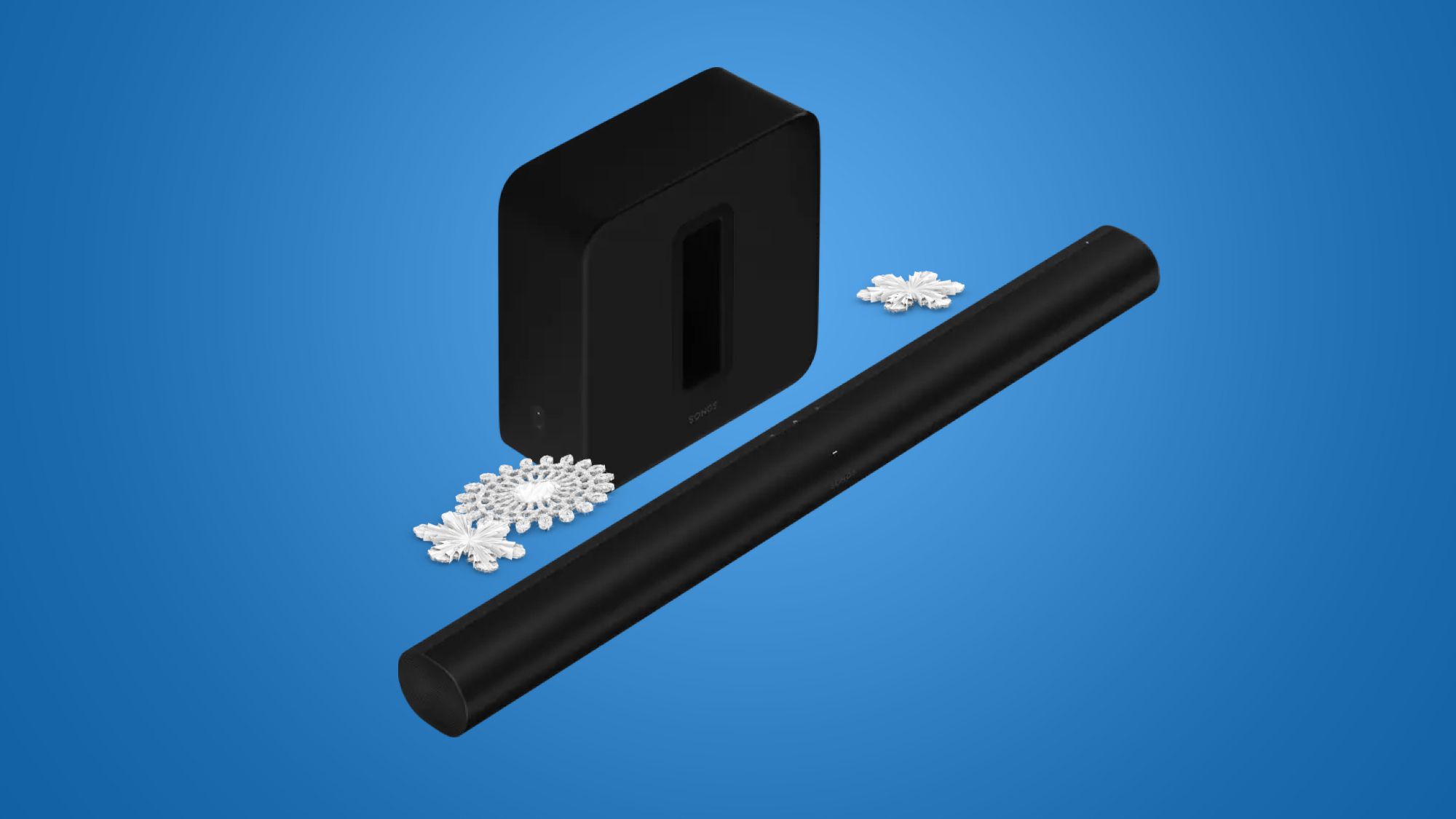

Hear the sweet sound of Sonos Black Friday bargainsNovember 21 - Cult of Mac |

|

Upgrade your Sonos home theater at up to $200 off this Black Friday with Arc Soundbar, subs, more from $169November 21 - 9to5Toys |

/cdn.vox-cdn.com/uploads/chorus_asset/file/24530056/DSCF0433.jpg) |

Sonos speakers and soundbars are up to $200 off ahead of Black FridayNovember 21 - The Verge |

Sonos Black Friday deals: Save up to $200 on speakers and soundbars - EngadgetNovember 21 - Slashdot.org |

|

|

Sonos Black Friday Sale Has Year's Best Prices on Ace Headphones, Arc Soundbar, and MoreNovember 21 - MacRumors |

|

Grab Sonos speakers for their cheapest prices this year During Amazon’s early Black Friday saleNovember 21 - Popular Science |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q3 '24 | 256M | 257M | 103M | -53M | -68M | -0.180 |

| Q2 '24 | 397M | 311M | 192M | 3.7M | 13M | 0.030 |

| Q1 '24 | 253M | 244M | 112M | -70M | -69M | -0.560 |

| Q4 '23 | 620M | 455M | 283M | 81M | 94M | 0.640 |

| Q3 '23 | 305M | 269M | 128M | -31M | -31M | -0.250 |

Insider Transactions View All

| Braman Shamayne filed to sell 26,588 shares at $11.6. August 19 '24 |

| Mason Christopher Scott filed to sell 122,009 shares at $14.5. July 19 '24 |

| Coles Joanna filed to sell 20,949 shares at $15. July 12 '24 |

| Millington Nicholas filed to sell 371,614 shares at $14.7. July 2 '24 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

GarminGRMN |

$209.04 1.7% | 43 |

|

Vuzix CorporationVUZI |

$1.3 16.1% | 36 |

|

GoProGPRO |

$1.21 7.1% | 23 |

|

Turtle BeachHEAR |

$15.11 1.8% | 56 |

|

KossKOSS |

$7.35 5.3% | 47 |

Read more about Sonos (SONO) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, youtube subscribers, news mentions, customer reviews, business outlook & linkedin employees.

What is the Market Cap of Sonos?

The Market Cap of Sonos is $1.57B.

What is Sonos' PE Ratio?

As of today, Sonos' PE (Price to Earnings) ratio is 101.4.

What is the current stock price of Sonos?

Currently, the price of one share of Sonos stock is $13.50.

How can I analyze the SONO stock price chart for investment decisions?

The SONO stock price chart above provides a comprehensive visual representation of Sonos' stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Sonos shares. Our platform offers an up-to-date SONO stock price chart, along with technical data analysis and alternative data insights.

Does SONO offer dividends to its shareholders?

As of our latest update, Sonos (SONO) does not offer dividends to its shareholders. Investors interested in Sonos should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of Sonos?

Some of the similar stocks of Sonos are Garmin, Vuzix Corporation, GoPro, Turtle Beach, and Koss.

.