Data gathered: August 2

AI Stock Analysis - BlackBerry (BB)

Analysis generated December 2, 2024. Powered by Chat GPT.

BlackBerry Limited is a Canadian multinational company specializing in enterprise software and the Internet of things (IoT). Originally known for its mobile phones, BlackBerry has now pivoted to cybersecurity and software solutions, especially in automotive and governmental sectors.

Stock Alerts - BlackBerry (BB)

|

BlackBerry | July 24 Reddit mentions are up by 891% in the last 24h. |

|

BlackBerry | July 23 Trending on Reddit. |

|

BlackBerry | July 23 Reddit mentions are up by 500% in the last 24h. |

|

BlackBerry | July 22 Employee Rating is up by 2.9% over the last month. |

Download our app to get future alerts delivered in real-time.

Alternative Data for BlackBerry

About BlackBerry

BlackBerry Ltd is a Canada-based designer, manufacturer and marketer of wireless solutions for the mobile communications market. It also owns QNX, a leader in software used in automotive infotainment systems.

| Price | $3.61 |

| Target Price | Sign up |

| Volume | 8,680,000 |

| Market Cap | $2.15B |

| Year Range | $2.35 - $6.07 |

| Dividend Yield | 0% |

| PE Ratio | 180.5 |

| Analyst Rating | 25% buy |

| Industry | Communication Equipment |

In the news

|

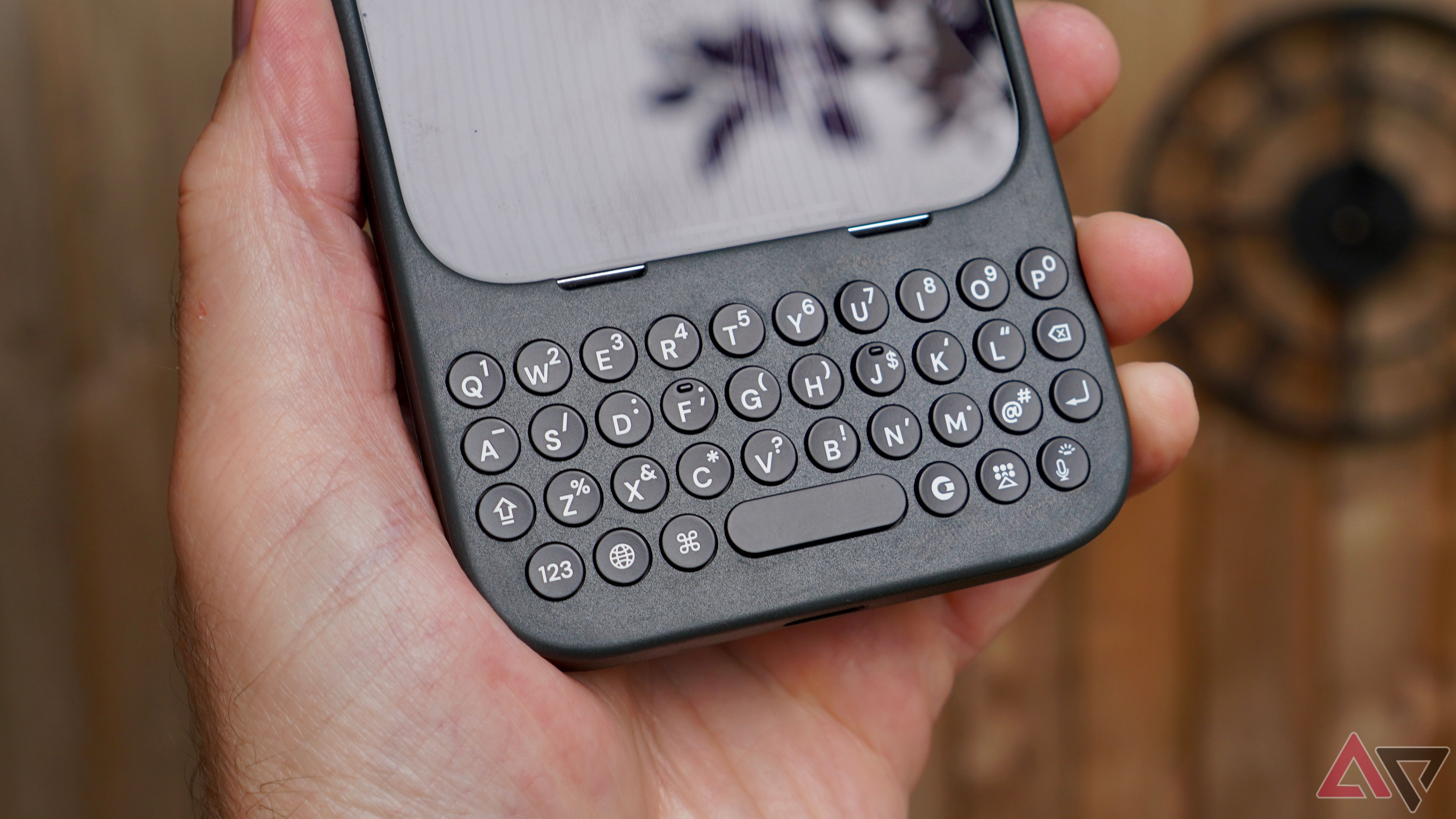

Unihertz Titan 2 Is A BlackBerry Throwback In 2025July 30 - Forbes |

|

BlackBerry Limited (NYSE:BB) Receives $4.60 Consensus Target Price from BrokeragesJuly 28 - ETF Daily News |

|

BlackBerry Target of Unusually High Options Trading (NYSE:BB)July 25 - ETF Daily News |

|

There's a plan to bring BlackBerry back from the dead. AgainJuly 24 - Android Police |

|

Lilbits: Qi2 25W wireless charging, more Pixel 10 series leaks, and an effort to bring back BlackBerryJuly 23 - Liliputing |

|

Unihertz Titan 2 Unboxing: A BlackBerry-Like Phone For An Android World videoJuly 23 - CNET |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q2 '25 | 122M | 31M | 90M | 1.9M | 0 | 0.020 |

| Q1 '25 | 144M | 38M | 106M | -7M | 9.2M | 0.030 |

| Q4 '24 | 143M | 31M | 112M | -11M | 33M | 0.020 |

| Q3 '24 | 145M | 51M | 94M | -19M | -8M | -0.032 |

| Q2 '24 | 144M | 60M | 84M | -42M | -19M | -0.030 |

Insider Transactions View All

| Kurtz Philip S. filed to sell 60,822 shares at $4.3. July 3 '25 |

| Foote Tim filed to sell 35,489 shares at $4.3. July 3 '25 |

| Armstrong-Owen Jennifer filed to sell 46,038 shares at $4.3. July 3 '25 |

| ERIKSSON MATTIAS filed to sell 284,963 shares at $4.3. July 3 '25 |

| GIAMATTEO JOHN JOSEPH filed to sell 530,135 shares at $4.3. July 3 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

Cisco SystemsCSCO |

$67.11 0% | 38 |

|

NetgearNTGR |

$22.5 0% | 45 |

|

EricssonERIC |

$7.25 0% | 40 |

|

Juniper NetworksJNPR |

$39.95 0% | 41 |

|

ADTRANADTN |

$8.76 0% | 32 |

Read more about BlackBerry (BB) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, reddit subscribers, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, youtube subscribers, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of BlackBerry?

The Market Cap of BlackBerry is $2.15B.

What is BlackBerry's PE Ratio?

As of today, BlackBerry's PE (Price to Earnings) ratio is 180.5.

What is the current stock price of BlackBerry?

Currently, the price of one share of BlackBerry stock is $3.61.

How can I analyze the BB stock price chart for investment decisions?

The BB stock price chart above provides a comprehensive visual representation of BlackBerry's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling BlackBerry shares. Our platform offers an up-to-date BB stock price chart, along with technical data analysis and alternative data insights.

Does BB offer dividends to its shareholders?

As of our latest update, BlackBerry (BB) does not offer dividends to its shareholders. Investors interested in BlackBerry should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of BlackBerry?

Some of the similar stocks of BlackBerry are Cisco Systems, Netgear, Ericsson, Juniper Networks, and ADTRAN.

.