Data gathered: November 17

AI Stock Analysis - Berkshire Hathaway (BRK.B)

Analysis generated October 10, 2024. Powered by Chat GPT.

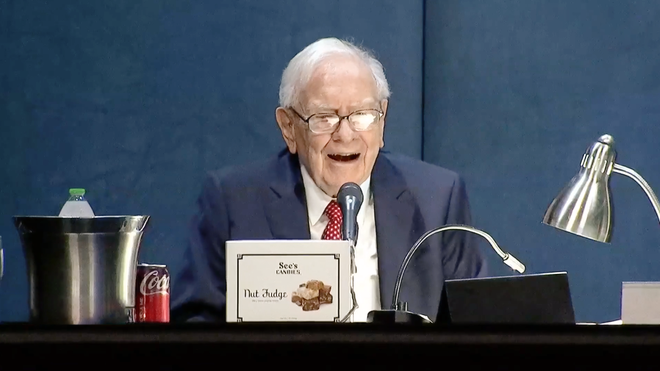

Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska. The company is known for its control and leadership under Warren Buffet, who has grown the company into one of the largest in the world by market capitalization. Berkshire Hathaway’s diversified portfolio includes wholly owned subsidiaries in insurance, railroads, utilities, manufacturing, services, and retail. Warren Buffet’s investing philosophy focuses on acquiring companies with strong fundamentals and long-term potential, a strategy that has made Berkshire Hathaway a stalwart in the investment world.

Stock Alerts - Berkshire Hathaway (BRK.B)

|

Berkshire Hathaway | November 6 Price is up by 5% in the last 24h. |

|

Berkshire Hathaway | November 3 Reddit mentions are up by 392% in the last 24h. |

|

Berkshire Hathaway | October 22 Marjorie Taylor Mrs Greene (member of U.S. congress) is buying shares |

|

Berkshire Hathaway | October 19 News Alert: Sirius XM Holdings Inc. (NASDAQ:SIRI) Major Shareholder Berkshire Hathaway Inc Acquires 175,569 Shares |

Alternative Data for Berkshire Hathaway

| Alternative Data | Value | 3m Change | Trend | Benchmark |

|---|---|---|---|---|

| Job Posts | 98 | Sign up | Sign up | Sign up |

| Sentiment | 72 | Sign up | Sign up | Sign up |

| Webpage traffic | 324,000 | Sign up | Sign up | Sign up |

| Employee Rating | 84 | Sign up | Sign up | Sign up |

| Google Trends | 9 | Sign up | Sign up | Sign up |

| Patents | 841 | Sign up | Sign up | Sign up |

| 4chan Mentions | N/A | Sign up | Sign up | Sign up |

| Reddit Mentions | 73 | Sign up | Sign up | Sign up |

| Stocktwits Mentions | 16 | Sign up | Sign up | Sign up |

| Stocktwits Subscribers | 40,735 | Sign up | Sign up | Sign up |

| Twitter Mentions | 30 | Sign up | Sign up | Sign up |

| News Mentions | 2 | Sign up | Sign up | Sign up |

| Customer reviews | 66 | Sign up | Sign up | Sign up |

| Lobbying Cost | $490,000 | Sign up | Sign up | Sign up |

| Business Outlook | 74 | Sign up | Sign up | Sign up |

| Linkedin Employees | 7,026 | Sign up | Sign up | Sign up |

About Berkshire Hathaway

Berkshire Hathaway Inc., through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

| Price | $470.28 |

| Target Price | Sign up |

| Volume | 5,760,000 |

| Year Range | $396.73 - $478.57 |

| Analyst Rating | 50% buy |

| Industry | Investment Management |

In the news

|

Warren Buffett's Berkshire Hathaway reveals new bets on Domino's Pizza and Pool CorpNovember 16 - Biztoc.com |

|

Warren Buffett’s Berkshire Hathaway sells $23 billion in Apple shares in Q3November 15 - Macdailynews.com |

|

Warren Buffett's Berkshire Hathaway Slashes Apple, BofA Holdings, Adds Domino's Pizza In Q3November 15 - Biztoc.com |

|

Berkshire Hathaway sells 100 mln Apple sharesNovember 14 - Investing.com |

Warren Buffett's Berkshire Hathaway reveals new bets on Domino's Pizza and Pool Corp.November 14 - Business Insider |

|

|

Warren Buffett’s Berkshire Hathaway Takes a Small Stake in Domino’s PizzaNovember 14 - Yahoo |

Insider Transactions View All

No recorded Insider transactions.

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

BNY MellonBK |

$78.29 0% | 45 |

|

Morgan StanleyMS |

$134.06 0% | 48 |

|

BlackrockBLK |

$1047.37 0% | 70 |

|

HSBCHSBC |

$45.74 0% | 62 |

|

Goldman SachsGS |

$593.54 0% | 54 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Marjorie Taylor Mrs Greene |

Oct 22, 24 | Buy | $1K - $15K |

| Marjorie Taylor Mrs Greene |

Sep 23, 24 | Buy | $1K - $15K |

| Josh Gottheimer |

Sep 11, 24 | Buy | $1K - $15K |

Read more about Berkshire Hathaway (BRK.B) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter mentions, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the current stock price of Berkshire Hathaway?

Currently, the price of one share of Berkshire Hathaway stock is $470.28.

How can I analyze the BRK.B stock price chart for investment decisions?

The BRK.B stock price chart above provides a comprehensive visual representation of Berkshire Hathaway's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Berkshire Hathaway shares. Our platform offers an up-to-date BRK.B stock price chart, along with technical data analysis and alternative data insights.

Does BRK.B offer dividends to its shareholders?

As of our latest update, Berkshire Hathaway (BRK.B) does not offer dividends to its shareholders. Investors interested in Berkshire Hathaway should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of Berkshire Hathaway?

Some of the similar stocks of Berkshire Hathaway are BNY Mellon, Morgan Stanley, Blackrock, HSBC, and Goldman Sachs.

.