Data gathered: July 10

AI Stock Analysis - Hasbro (HAS)

Analysis generated November 30, 2024. Powered by Chat GPT.

Hasbro, Inc. is a global play and entertainment company known for its iconic brands, including Transformers, My Little Pony, and Monopoly. The company operates in three primary segments: U.S. and Canada, International, and Entertainment, Licensing and Digital. Hasbro’s product portfolio spans a range of categories, such as toys, games, television programming, movies, and digital gaming. In recent years, Hasbro has focused on expanding its entertainment and digital offerings, recognizing the growing significance of these sectors in the evolving market landscape.

Stock Alerts - Hasbro (HAS)

|

Hasbro | July 10 Over the past few months, there has been an downward trend in Web Traffic. |

|

Hasbro | July 1 Employee Rating is up by 3.1% over the last month. |

|

Hasbro | July 1 Business Outlook among employees is down by 4% over the last month. |

|

Hasbro | June 19 News Alert: Sorry to say but Hasbro lays off 150 people due to tariffs. That's Life, I guess [Asinine] |

Download our app to get future alerts delivered in real-time.

Alternative Data for Hasbro

About Hasbro

Hasbro Inc provides children and family leisure time and entertainment products and services which includes manufacturing and marketing of games and toys. It reaches customers by leveraging its well-known brands such as Transformers, Monopoly, and Nerf.

| Price | $77.10 |

| Target Price | Sign up |

| Volume | 1,830,000 |

| Market Cap | $10.7B |

| Year Range | $50.18 - $78.22 |

| Dividend Yield | 3.79% |

| PE Ratio | 25.25 |

| Analyst Rating | 100% buy |

| Earnings Date | July 23 '25 |

| Industry | Toy Manufacturer |

In the news

|

Hasbro G.I. Joe Classified Mad Marauders Sgt. Slaughter Figure Marked Down On Amazon For Prime DayJuly 10 - Toynewsi.com |

|

DA Davidson Issues Pessimistic Forecast for Hasbro EarningsJuly 9 - ETF Daily News |

|

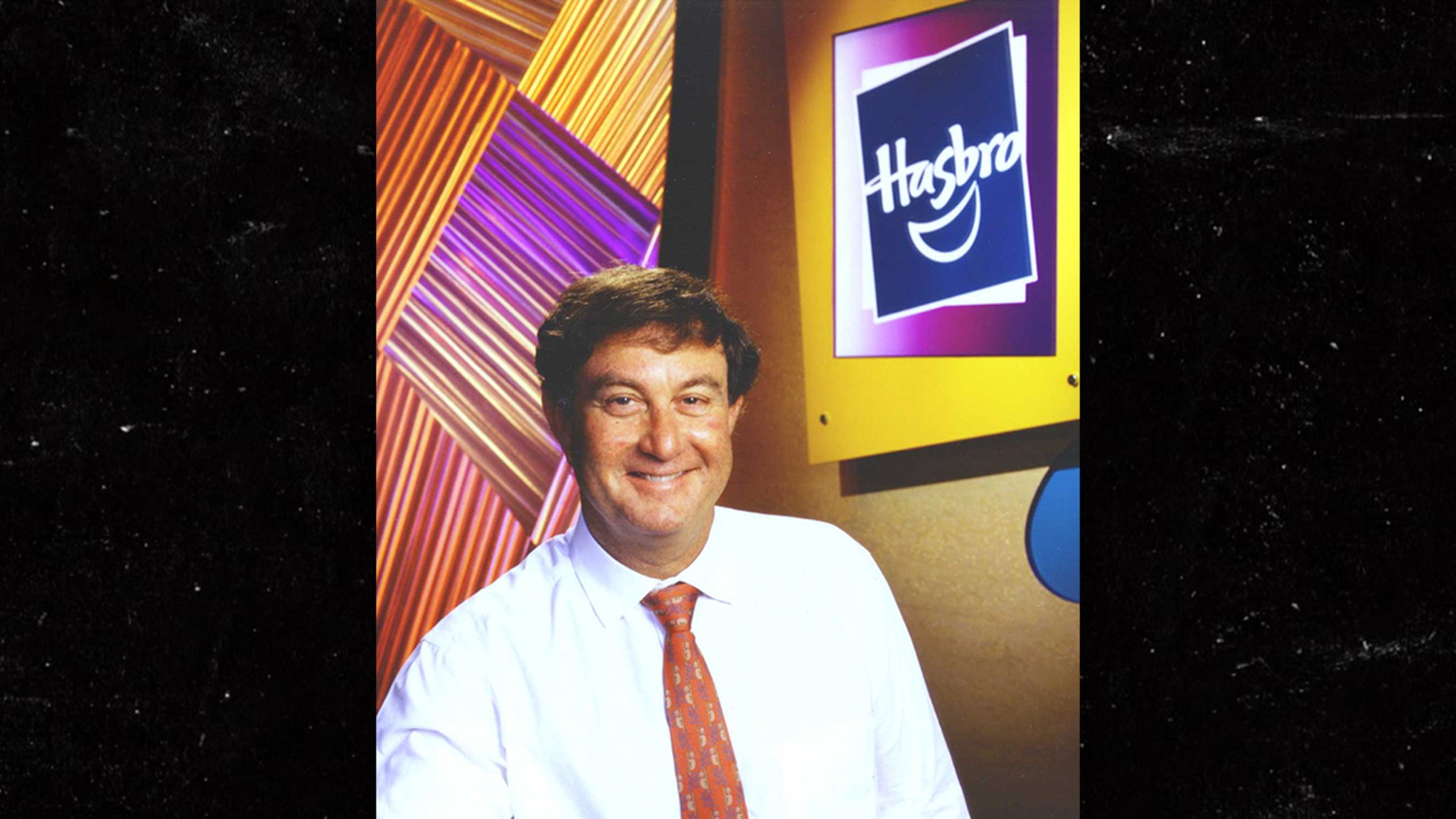

Former Hasbro CEO Alan Hassenfeld Dead at 76, Family Founded Toy MakerJuly 9 - TMZ |

|

Allen G. Hassenfeld, former CEO of Hasbro and whose family founded the iconic toy maker, dies at 76 - ABC NewsJuly 9 - Biztoc.com |

|

Former Hasbro CEO Alan Hassenfeld, whose family founded iconic toy maker, dead at 76July 9 - New York Post |

|

Former CEO and philanthropist Alan Hassenfeld, whose family founded toy giant Hasbro, dies at 76July 9 - Biztoc.com |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q1 '25 | 887M | 229M | 658M | 99M | 220M | 1.040 |

| Q4 '24 | 1.1B | 439M | 663M | -34M | 49M | 0.460 |

| Q3 '24 | 1.28B | 477M | 804M | 223M | 386M | 1.730 |

| Q2 '24 | 995M | 293M | 702M | 139M | 280M | 1.220 |

| Q1 '24 | 757M | 255M | 502M | 58M | 166M | 0.610 |

Insider Transactions View All

| Austin Matthew Edward filed to sell 36,828 shares at $65.1. December 2 '24 |

| Sibley Tarrant L. filed to sell 53,003 shares at $60.3. May 31 '24 |

| BURNS MICHAEL RAYMOND filed to buy 16,398 shares at $87.7. April 25 '22 |

| Cocks Christian P filed to buy 57,145 shares at $88.8. April 22 '22 |

| Cocks Christian P filed to buy 65,945 shares at $89.7. April 22 '22 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

JAKKS PacificJAKK |

$20.52 1.3% | 47 |

|

MattelMAT |

$20.22 0.4% | 42 |

|

Build-A-Bear WorkshopBBW |

$51.4 1.8% | 44 |

|

FunkoFNKO |

$4.57 3.6% | 38 |

|

JAKKS PacificJAKK |

$20.52 1.3% | 47 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Julie Johnson |

May 15, 25 | Sell | $1K - $15K |

| Julie Johnson |

Feb 13, 25 | Buy | $1K - $15K |

| Rohit Khanna Democrat |

Jun 5, 24 | Buy | $1K - $15K |

Read more about Hasbro (HAS) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, threads followers, twitter followers, twitter mentions, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of Hasbro?

The Market Cap of Hasbro is $10.7B.

What is Hasbro's PE Ratio?

As of today, Hasbro's PE (Price to Earnings) ratio is 25.25.

When does Hasbro report earnings?

Hasbro will report its next earnings on July 23 '25.

What is the current stock price of Hasbro?

Currently, the price of one share of Hasbro stock is $77.10.

How can I analyze the HAS stock price chart for investment decisions?

The HAS stock price chart above provides a comprehensive visual representation of Hasbro's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Hasbro shares. Our platform offers an up-to-date HAS stock price chart, along with technical data analysis and alternative data insights.

Does HAS offer dividends to its shareholders?

Yes, Hasbro (HAS) offers dividends to its shareholders, with a dividend yield of 3.79%. This dividend yield represents Hasbro's commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering Hasbro in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

What are some of the similar stocks of Hasbro?

Some of the similar stocks of Hasbro are JAKKS Pacific, Mattel, Build-A-Bear Workshop, Funko, and JAKKS Pacific.

.