Chipotle: Is a Leadership Change and Falling Stock Price a Cause for Concern?

September 4, 8:05 am

Chipotle Mexican Grill (CMG) has long been a top performer in the restaurant industry. Over the past decade, its stock has risen by 300%, solidifying its place as a growth investment. However, the company is currently facing headwinds, with shares trading at $53, down 16% over the last three months. This decline comes amid significant news: the departure of CEO Brian Niccol, who has been lured away by Starbucks.

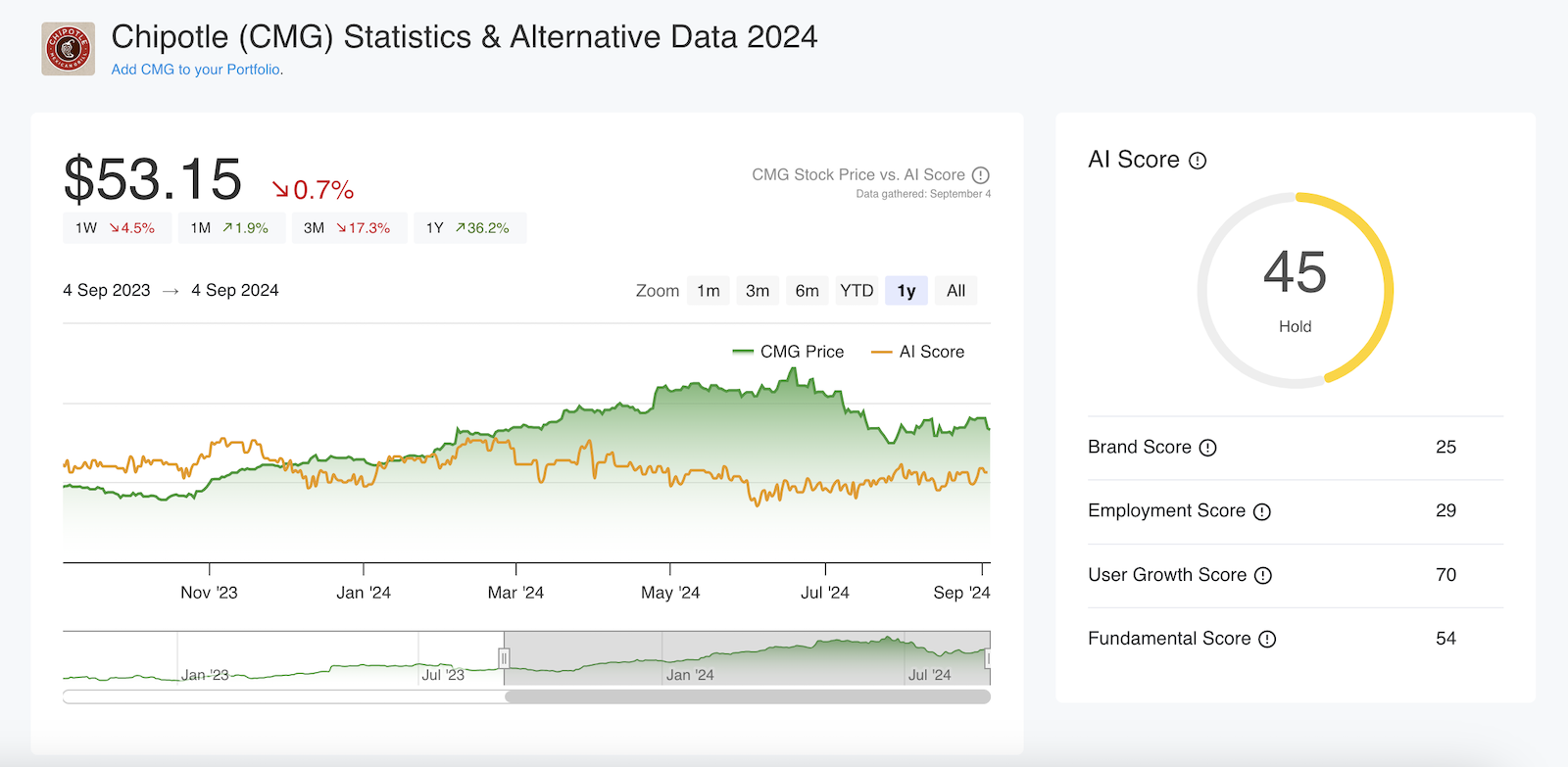

Chipotle Dashboard with Price and AI Score

This brings investors to a critical question: Is Chipotle's stock in trouble, or does this recent dip present a buying opportunity?

A Look at Chipotle’s Business Fundamentals

Despite the CEO transition, Chipotle’s underlying business remains strong. In its most recent earnings report for Q2 2024, the company posted revenue of $3 billion, an 18% increase compared to the same quarter last year. Same-store sales growth stood at an impressive 11%, with 9% of that growth coming from increased transactions rather than price hikes, highlighting strong customer demand. This is especially significant in an environment where many restaurants struggle to grow without raising prices.

While CEO departures often raise concerns, Chipotle’s leadership transition might not be as alarming as it seems. The interim CEO, Scott Boatwright, has been with the company since 2017 and has held the role of Chief Operating Officer, giving him an intimate knowledge of Chipotle's operations. The company’s strong leadership bench suggests that Niccol’s departure, while impactful, may not derail its future.

The Valuation Dilemma

One factor investors are likely weighing is Chipotle’s high valuation. Currently trading at 50 times its estimated future earnings, the stock’s premium has been a source of concern. With this in mind, the recent correction may have been inevitable, given that it was previously trading at such elevated levels.

What Alternative Data Tells Us

Digging deeper into alternative data, Chipotle's broader business outlook seems stable. The company currently has 7,000 open job postings, a figure that has increased by over 50% in the last year—evidence that Chipotle is still expanding its workforce, a positive sign for growth.

Another positive growth sign is Chipotle’s presence on social media. The company’s Instagram followers are up 12%, outpacing both McDonald’s and Starbucks. Chipotle has also been gaining followers on platforms like Threads, TikTok, and YouTube, though it has lost some ground on X (formerly Twitter) and Facebook. This growth on emerging platforms suggests that Chipotle is still resonating with its target audience, especially among younger consumers.

However, there are some cautionary signals. Web traffic to Chipotle’s site has declined by 15% in the last three months, and app downloads have also seen a slight drop. These declines in customer acquisition metrics are minor red flags, though they don’t suggest an immediate crisis.

Additionally, Chipotle has seen some skepticism from both insiders and political figures. Insider transactions show that company executives have sold $183 million in stock over the past two years, with Curt Garner, the Chief Customer and Technology Officer, selling $4 million worth of shares in just the last weeks. Similarly, U.S. politicians have been net sellers of Chipotle stock, with $750,000 worth of sell transactions from political figures over the last two years, surpassing both Starbucks and McDonald’s.

Competition on the Horizon

Another factor to consider is competition. Cava, a Mediterranean-inspired chain that appeals to younger, health-conscious consumers, has been making waves. Its stock has jumped 165% over the last year, compared to Chipotle’s 37% rise, suggesting that investors see potential in this niche. While Chipotle continues to perform well, the rise of competitors like Cava could create challenges in attracting and retaining customers in the long run.

Conclusion: A Buying Opportunity or Time to Wait?

Chipotle’s recent challenges—CEO departure, minor declines in customer acquisition metrics, and rising competition—are balanced by strong financial performance and promising growth indicators. While the stock's high valuation might deter some investors, the company’s fundamentals remain solid. As with any investment, it comes down to risk tolerance. For investors willing to navigate short-term volatility, Chipotle’s dip may present a buying opportunity, especially if the company continues on its growth trajectory under stable leadership.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.