Investing in TQQQ: A High-Powered Bet on Tech Stocks

October 19, 6:44 pm

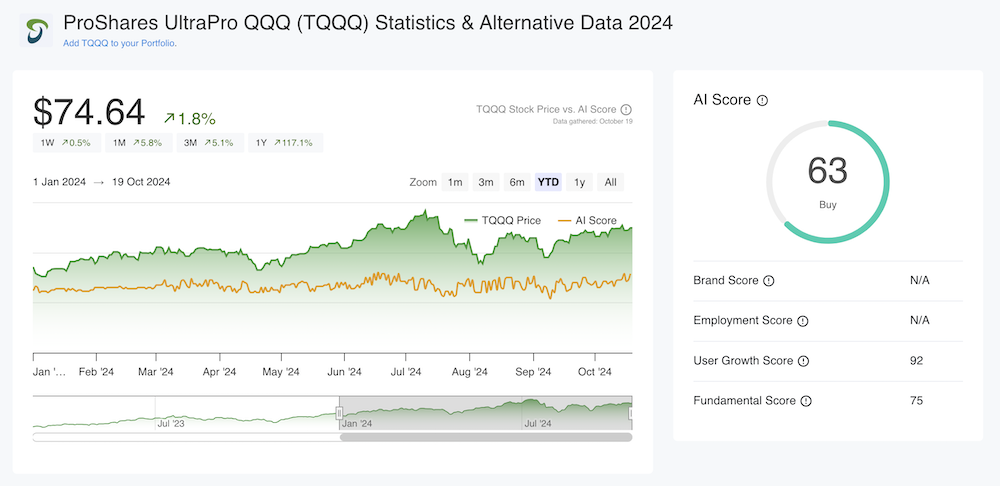

Investors seeking amplified exposure to the technology-driven NASDAQ-100 Index often turn to the ProShares UltraPro QQQ ETF (TQQQ). This leveraged exchange-traded fund aims to deliver three times the daily performance of its underlying index, making it a unique instrument for those with a strong conviction about the market's direction. Remarkably, TQQQ is currently trading at $74.64, up 110% in the last 12 months, showcasing its potential for significant gains.

At AltIndex, our advanced AI-driven analysis has currently assigned TQQQ an AI score of 63 out of 100. This score reflects a positive outlook, suggesting that TQQQ is currently a compelling option for investors. With this in mind and as one of the highest AI scores among ETFs on our platform, let's take a closer look at TQQQ and see if the ETF stands out as a potential buy.

What Makes TQQQ Special

TQQQ isn't your typical ETF. It uses financial derivatives and debt to triple the returns of the NASDAQ-100 Index on a daily basis. This leverage means that if the NASDAQ-100 gains 1% in a day, TQQQ aims to gain 3%. Conversely, if the index drops by 1%, TQQQ would aim to lose 3%. This magnification of returns—and losses—offers traders a powerful tool for capitalizing on short-term market movements.

The recent 110% surge over the past year underscores how potent this leverage can be in a bullish market, particularly within the technology sector that the NASDAQ-100 represents.

Top Holdings Driving Performance

While TQQQ achieves its goals through derivatives rather than holding stocks directly, its performance is intrinsically linked to the NASDAQ-100 Index. This index comprises 100 of the largest non-financial companies listed on the NASDAQ stock exchange. The recent spike in TQQQ's price is largely due to stellar performances by some of its top components:

Apple (AAPL): Up 36% year over year.

NVIDIA (NVDA): Soaring 233% year over year.

Microsoft (MSFT): Increasing 29% year over year.

These tech giants are at the forefront of innovation, driving significant growth and shaping the future of various industries. Their impressive stock performances have substantially contributed to TQQQ's triple-digit gains.

The Bull Case for Investing in TQQQ

Amplified Returns in Bull Markets: The recent 110% increase in TQQQ's price over the last 12 months exemplifies how it can significantly outperform traditional ETFs in a rising market due to its leveraged structure. Investors bullish on the tech sector might find this appealing.

Capitalizing on Short-Term Trends: For active traders, TQQQ offers the ability to maximize gains from short-term market movements without the need to use margin accounts or engage in complex derivative trading themselves.

Exposure to Leading Tech Companies: By mirroring the NASDAQ-100, investors indirectly gain exposure to some of the most influential tech companies driving global economic growth. The substantial year-over-year gains of companies like NVIDIA and Apple highlight the potential upside.

The Bear Case for Investing in TQQQ

High Risk and Volatility: Leverage is a double-edged sword. While it can amplify gains, it equally magnifies losses. TQQQ can experience significant volatility, making it unsuitable for risk-averse investors.

Not Ideal for Long-Term Holding: Due to daily rebalancing and the effects of compounding, holding TQQQ over extended periods can lead to returns that deviate significantly from three times the index's performance.

Complexity and Costs: Leveraged ETFs involve complex financial instruments and may carry higher fees and expenses compared to traditional ETFs, which can erode returns over time.

Conclusion

TQQQ offers a potent vehicle for traders seeking leveraged exposure to the NASDAQ-100 Index. Its ability to magnify daily returns makes it an attractive option for those confident in a bullish market trajectory, especially within the tech sector. The recent 110% surge in its price, fueled by significant gains in top tech stocks like NVIDIA and Apple, highlights the potential rewards.

Moreover, if the current AI frenzy continues and technological innovations persist, TQQQ could present even more compelling opportunities. As advancements in artificial intelligence and technology drive growth in leading companies, leveraged ETFs like TQQQ stand to benefit significantly from these upward trends.

However, the risks associated with leveraged investing cannot be overstated. It's crucial for investors to thoroughly understand these risks and consider their investment horizon and risk tolerance. TQQQ's impressive gains come with equally significant risks, and it's not suitable for everyone.

With an AI score of 63 from AltIndex, TQQQ emerges as one of the top-rated ETFs, signaling potential opportunities ahead. As always, investors should perform due diligence or consult financial advisors when considering such high-octane investment instruments.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.