Is Nvidia Still a Buy?

November 26, 1:44 pm

Nvidia (NVDA) has been one of the most talked-about stocks in recent years, thanks to its dominant position in the graphics processing unit (GPU) market and its critical role in fueling the artificial intelligence (AI) boom. However, recent stock performance has left some investors questioning: Is Nvidia still a buy?

Here’s a closer look at Nvidia's prospects through a blend of financial results and alternative data insights.

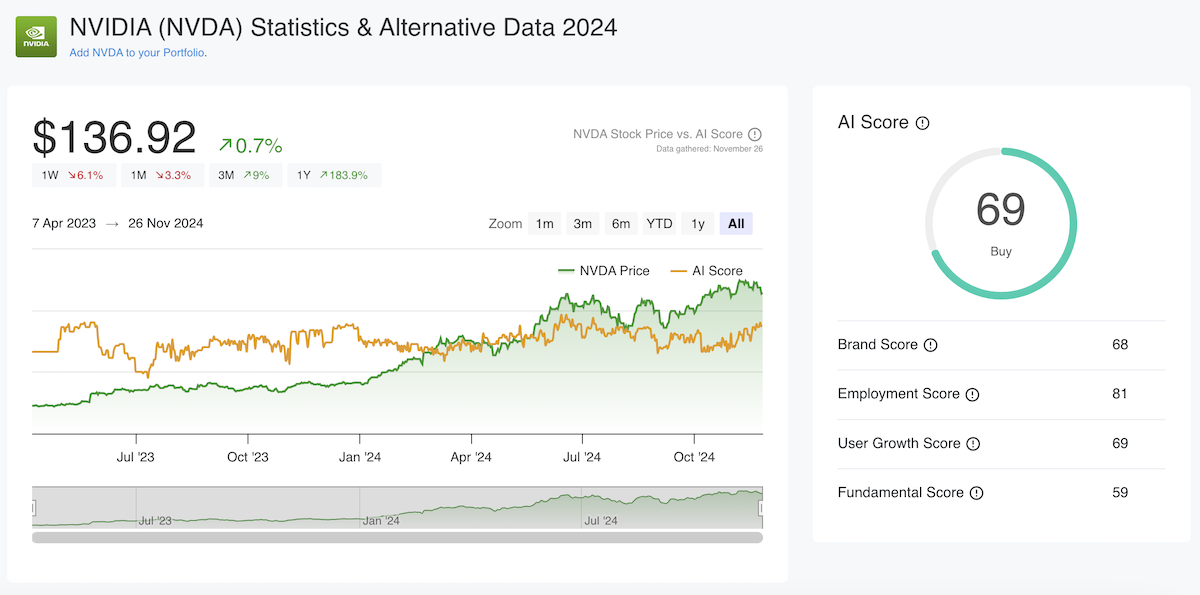

A Closer Look at Nvidia's Stock Performance

Currently trading at $136 per share, Nvidia's stock has dipped by 2.5% over the last month. This modest pullback has prompted mixed sentiment among retail investors which can be seen by analyzing Reddit mentions for Nvidia. Some are disappointed by the short-term performance, while others view this as an opportunity to "buy the dip" and ride the long-term growth story.

Insights from Alternative Data

Nvidia has posted nearly 2,000 open job positions - a 10% increase in just a few months. This hiring push signals robust growth and a commitment to expanding its market presence. Whether it’s exploring new markets or ramping up existing operations, this trend underscores Nvidia's confidence in its future.

Among the employees, there's a high level of confidence in the company's future, with 93% reporting a positive outlook. Strong employee sentiment often reflects a company's innovative culture and leadership, both of which are critical in maintaining competitive advantage in a fast-evolving tech landscape.

Financial Performance: Impressive Growth, Elevated Expectations

Nvidia’s fiscal third-quarter results once again exceeded Wall Street’s expectations. Revenue soared 94% year-over-year to $35 billion, handily beating management’s own projections of $32.5 billion. For the upcoming quarter, Nvidia expects revenue of $37.5 billion, which would represent 70% growth - a staggering feat for a company of its size.

While the results weren't the "blowout" some investors had hoped for, the numbers still affirm Nvidia’s dominant position in the AI-driven semiconductor market. The company’s growth is fueled by unprecedented demand for its GPUs, which are critical for training AI models and powering high-performance computing.

Add to that, Nvidia’s GPUs are unmatched in processing power, making them indispensable for industries adopting AI technologies. The surge in AI adoption across sectors has elevated Nvidia to a league of its own, giving it a significant edge over competitors like AMD (AMD) and Intel (INTC).

Valuation and Growth Potential

Despite its stellar growth, Nvidia’s valuation remains reasonable relative to its peers. With a strong balance sheet and immense cash flow, the company is well-positioned for future acquisitions, share buybacks, or investments. Analysts project that Nvidia could reach a $4 trillion market cap by 2025 if current growth trends continue.

Continued High AI Score

Our proprietary AI score for Nvidia currently stands at 69 (and even though it's been fluctuating a bit, it has remianed high since May of last year), signaling a strong buy. This rating reflects Nvidia’s:

- Sustained demand for GPUs

- Outstanding earnings growth

- Positive employee sentiment

- Hiring expansion and business outlook

These factors, amongst others, suggest that Nvidia is poised for long-term growth, making it one of the most attractive investments in the AI sector.

Conclusion: Should You Buy Nvidia?

For retail investors, Nvidia remains one of the best plays in the AI boom. Its dominant position in the GPU market, strong financial performance, and growth-oriented strategy make it a compelling investment opportunity. While the recent pullback in its stock price may deter some, it could be a golden opportunity for those with a long-term perspective.

Want to stay ahead of the curve? At AltIndex, we provide alternative data insights and AI-driven analysis on thousands of stocks. Discover how our tools can help you make more informed investment decisions today!

Disclaimer: The content provided in this article is for informational purposes only and should not be considered as financial advice. Investing in stocks involves risk, and past performance is not indicative of future results. Always conduct your own research or consult with a financial advisor before making investment decisions. AltIndex is not responsible for any losses incurred based on the information provided.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.