No Signs of Stopping: NVDA Hits New Record High

October 15, 4:33 am

Listen to article here.

Nvidia (NVDA) has been on an extraordinary trajectory, capturing the market's attention with its meteoric rise in stock value. From overtaking Microsoft (MSFT) to become the world's second-most valuable company to its shares soaring by over 187% year-to-date, Nvidia's performance is nothing short of remarkable. This surge begs the questions: what's fueling this rally, and for how long can it last?

A Closer Look at the Stock's Performance

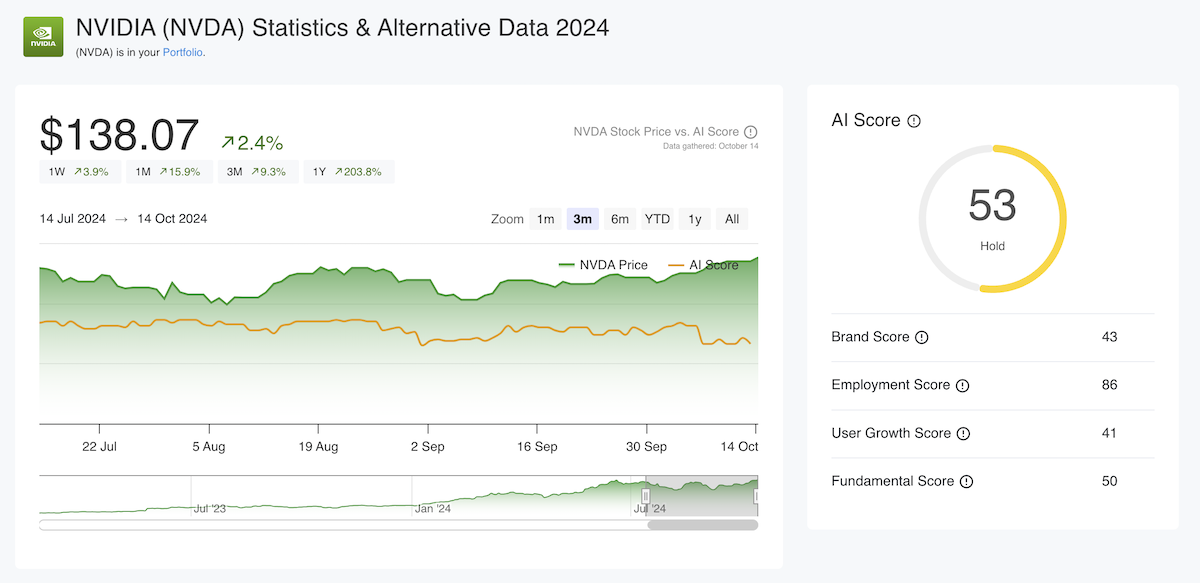

Nvidia's stock has been a standout in the tech sector, demonstrating impressive gains across various timeframes. Closing at over $138 on Monday, up from below $135 last Friday, the stock has climbed more than 18% over the past month and nearly 61% in the last six months. This consistent upward momentum highlights strong investor confidence and suggests that Nvidia is capitalizing effectively on current market trends.

The Driving Forces Behind Nvidia's Success

Dominance in the AI Hardware Market

At the heart of Nvidia's success is its leadership in the artificial intelligence (AI) hardware sector. The company holds a commanding 67% share of the AI accelerator market among the four largest U.S. hyperscalers—Amazon, Microsoft, Alphabet (Google), and Meta Platforms. Nvidia's advanced graphics processing units (GPUs) are essential for training complex AI models, making them indispensable to tech giants investing heavily in AI.

Surging Demand for AI Technologies

The global market for AI chips and processors is experiencing a multibillion-dollar investment boom. Competitor Advanced Micro Devices (AMD) recently projected that the AI accelerator market could reach $500 billion within three years, a significant increase from previous estimates. This explosive growth in AI infrastructure spending directly benefits Nvidia, as it supplies the critical hardware needed to power these technologies.

Analyst Endorsements and Bullish Outlooks

Top Wall Street analysts have reaffirmed their bullish stance on Nvidia, further fueling investor enthusiasm. Citigroup's Atif Malik reiterated a "buy" rating with a $150 price target, citing Nvidia's substantial market share and expected sales growth. Goldman Sachs' Toshiya Hari also raised the price target to $150, highlighting the company's advantage in handling increasingly complex AI workloads. Such endorsements contribute to a positive market sentiment and can influence stock performance.

Alternative Data Insights from AltIndex

Beyond traditional financial metrics, alternative data provides unique perspectives on Nvidia's prospects.

Political Investments Indicate Confidence

Notably, multiple U.S. politicians, including Nancy Pelosi and Marjorie Taylor Greene, have recently purchased shares in Nvidia. Such high-profile investments may signal insider confidence in the company's future growth and underscore the critical role of AI technology in the economy.

Workforce Expansion Reflects Organizational Health

Nvidia has been expanding its workforce significantly, indicating robust organizational health and growth potential. According to LinkedIn data, the company increased its number of employees by 31% in the last 12 months. This expansion suggests that Nvidia is scaling effectively to meet rising demand and is attracting top talent to drive innovation.

Analyst Consensus Supports Growth Prospects

Our data at AltIndex shows that 93% of analysts have a "buy" rating for Nvidia, reflecting a strong consensus on the company's growth prospects. This widespread confidence among industry experts can be a powerful indicator of a stock's potential trajectory.

AI Score and Web Traffic

While Nvidia has maintained a high AI score on AltIndex, there was a recent slight dip due to decreased web traffic. However, this minor fluctuation doesn't overshadow the company's overall strong fundamentals and growth potential.

Nvidia Stock Price & AI Score

How High Can Nvidia's Stock Go?

Predicting exact stock prices is always challenging, but several factors suggest that Nvidia's upward momentum could continue. The company's upcoming product launches, such as the Blackwell platform, promise to enhance performance and drive sales. With a significant share in a rapidly expanding market and continuous innovation, Nvidia is well-positioned to capitalize on the increasing investments in AI technologies.

Analysts anticipate significant revenue growth, driven by increased capital spending from U.S. cloud providers. As AI becomes more integral across various industries, the sustained demand for Nvidia's GPUs is likely to persist, potentially propelling the stock even higher.

What Should Investors Consider?

While Nvidia's prospects appear bright, investors should approach with a balanced perspective.

Opportunities

Strategic Positioning: Nvidia's leadership in AI hardware places it at the forefront of a high-growth industry.

Market Demand: The surging need for AI technologies across sectors provides a strong market for Nvidia's products.

Analyst Support: Widespread bullish analyst ratings can boost investor confidence and influence stock performance.

Risks

Market Competition: Competitors like AMD are also making strides in AI technologies, which could impact Nvidia's market share.

Valuation Concerns: The rapid appreciation of the stock raises questions about potential overvaluation.

Regulatory Factors: Changes in trade policies and technology regulations could affect Nvidia's operations and profitability.

Conclusion

Nvidia's extraordinary stock performance is a testament to its strategic leadership in the burgeoning AI industry. The company's competitive advantages, coupled with strong market demand and positive analyst sentiment, suggest that its upward trajectory may continue. However, as with any investment, it's crucial to weigh potential risks and conduct thorough due diligence. Nvidia represents a compelling opportunity for investors interested in the forefront of technological innovation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.