Three stock picks for 2024

January 1, 4:53 am

As we bid adieu to 2023, our focus shifts to the investment landscape of 2024. This year, we're stepping away from the usual suspects - the so-called 'magnificent seven' - to spotlight smaller companies that embody the quintessence of high risk and reward. Our analysis, a blend of fundamental, technical, and alternative methods, draws upon comprehensive data from AltIndex.

Let's jump in.

Cloudflare

As we venture into 2024, Cloudflare stands out as a company at the forefront of two converging technological revolutions: generative AI and data security. In a digital era increasingly reliant on AI and machine learning, Cloudflare's role becomes ever more pivotal.

Pioneering in AI and Data Protection

AI Integration: The rise of generative AI and automation, especially in sectors heavy on natural language processing, opens up vast opportunities. Cloudflare's capacity to integrate these technologies into their services is not just an asset; it's a necessity for modern businesses. Their potential role in sectors like education, office support, and software development could be transformative.

Data Security as a Priority: In the current digital age, data is king. The increasing value of data has elevated the importance of robust security measures. Cloudflare, with its extensive array of security services like DDoS protection, web application firewalls, and secure access services, is well-equipped to meet these growing demands. Their expertise in safeguarding data is crucial as businesses increasingly seek to protect their most valuable digital assets.

Technological Advancements and Market Position

Edge Computing Investments: Cloudflare's investment in edge computing is particularly noteworthy. By decentralizing data storage and computation, bringing these services closer to where they are needed, Cloudflare is setting itself up to be an indispensable player in fields requiring real-time processing and low-latency responses. This technology is vital for applications such as autonomous vehicles or IoT devices, where immediacy and speed are critical.

Market Presence and Growth: The growing market presence of Cloudflare is evident in the increasing web traffic to its site, a surge of over 50% year over year. This uptick is not just a number; it reflects the growing dependence of businesses on Cloudflare's services.

Financial Health and Future Prospects

Revenue Growth: Cloudflare's financial health, as indicated by its Q3 revenue report showing a 336 million USD revenue, a 8.8% increase from the previous quarter, signals a robust demand for its services. This growth is part of a sustained trend, with a notable 32% revenue increase year over year. Such consistent financial growth is a strong indicator of the company's stability and potential for future expansion.

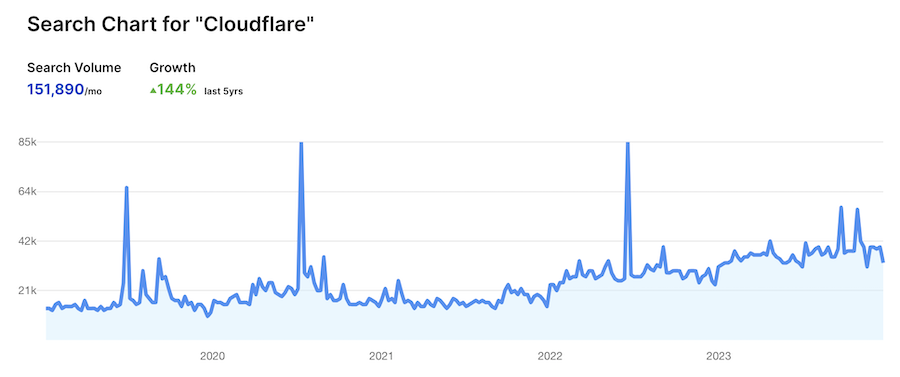

Market Trends and Predictions: The increasing searches and positive sentiment towards Cloudflare on various platforms, including financial forums and social media, point to a heightened interest and confidence in the company. This trend is likely to catalyze further growth and market penetration.

Conclusion

As we look into 2024, Cloudflare emerges as a company uniquely positioned at the intersection of AI, data security, and edge computing. Its robust financial growth, combined with technological advancements, positions it favorably in the market. For investors with an appetite for high risk and reward, Cloudflare represents a compelling opportunity, albeit one that requires careful consideration of the evolving tech landscape.

Root Insurance

Root Insurance emerges in 2024 as a distinctive player in the insurance sector, blending technology with innovative insurance models. Its performance and strategic direction suggest a company poised for growth in a transforming industry.

Embedded Insurance: A Game-Changer

Pioneering Embedded Insurance: Root Insurance is at the forefront of embedded insurance – a cutting-edge concept where insurance products are seamlessly integrated into the buying process of other services or products. This model is particularly resonant in today's market, where consumers seek convenience and simplicity. Root's partnership with Carvana exemplifies this strategy, presenting insurance as a natural extension of the car buying experience.

Market Trend Alignment: The shift towards embedded insurance is more than a fleeting trend; it's the future of insurance distribution. Root Insurance's commitment to this approach positions it well to capitalize on this emerging market movement.

Facing Challenges Head-On

Addressing Net Losses: Despite facing net losses, Root Insurance has demonstrated resilience and adaptability. For instance, their Q3 2023 earnings report showed significant gains in new writings, with a remarkable 54% increase in revenue quarter over quarter. This is indicative of a growing demand for their innovative insurance offerings.

Technological Edge in Pricing and Underwriting: Root’s advancements in pricing and underwriting, powered by data science and telematics, set it apart in the industry. These improvements are crucial in refining their business model and addressing industry-specific challenges.

Strategic Moves and Performance Metrics

Focus on New Business Over Renewals: The company's current emphasis on new business, as evidenced by a decrease in renewal premiums, might indicate a strategic prioritization. While this approach has its risks, Root's leadership appears confident in their long-term strategy.

Mobile App Usage as a Growth Indicator: The remarkable increase in mobile app downloads – over 200% year over year – is a vital indicator of Root's growing consumer base. This contrasts sharply with the stagnation in app downloads of competitors like Progressive, Allstate, and Lemonade, underscoring Root’s unique appeal and market penetration.

Conclusion

In summary, Root Insurance in 2024 stands as a testament to innovative thinking in the insurance industry. Its focus on embedded insurance, coupled with a strong technological foundation in telematics-based pricing and underwriting, positions it favorably in an evolving market. While challenges exist, Root's strategic direction, underscored by its impressive performance in new business acquisition and mobile app engagement, points to a company with potential for considerable growth. For investors seeking opportunities in the insurance sector, Root Insurance offers a compelling blend of innovation, technology, and market adaptability.

Crispr Therapeutics

Crispr Therapeutics enters 2024 as a beacon of hope and innovation in the biotechnology sector. After a period of volatility, the company is regaining attention for its groundbreaking advancements in gene editing.

Breakthroughs in Gene Editing

Clinical Approvals and Milestones: A significant milestone for Crispr Therapeutics was the UK's clinical approval of its gene-editing tool for treating sickle cell anemia and beta-thalassemia. These approvals, followed by green lights from the FDA and European Medicines Agency, mark a pivotal moment in genetic medicine. These disorders, caused by a single genetic error, can now be treated more effectively, showcasing the transformative potential of Crispr's technology.

CRISPR-Cas9: A Revolution in Biotechnology: The discovery and application of CRISPR-Cas9, a technology that allows precise editing of the genetic code, has revolutionized biotechnology. This tool, which started as a bacterial defense mechanism, is now a beacon of hope for curing genetic diseases. The newly approved gene editor, Casgevy, exemplifies this potential, correcting genetic defects in stem cells and giving rise to healthy blood cells.

Market Response and Future Potential

Stock Market Dynamics: The stock market's reaction to Crispr Therapeutics has been a rollercoaster, with highs and lows reflecting the volatile nature of biotech investments. The stock, which once peaked at $165, experienced a downturn but has been steadying around $50. The recent clinical approvals and growing social media buzz, especially on platforms like Reddit and Twitter, indicate renewed interest and potential for a market rebound.

The Promise of CRISPR Technology: The technology's ability to edit genes with high precision opens up endless possibilities in medicine. While its initial focus is on blood disorders, the scope for expanding into other genetic diseases is immense. This technological promise, coupled with Crispr's recent successes, paints a hopeful picture for its future.

Challenges and Considerations

Market Volatility and Risks: Investing in biotechnology, especially in a company like Crispr, involves significant risks. The sector is known for its volatility, driven by regulatory approvals, clinical trial results, and technological advancements.

Ethical and Regulatory Hurdles: As with any groundbreaking technology in medicine, Crispr faces ethical and regulatory challenges. Navigating these complexities will be crucial for the company’s sustained growth and acceptance in the medical community.

Conclusion

Crispr, in 2024, stands at the cusp of revolutionizing genetic medicine. Its recent clinical approvals and the transformative potential of CRISPR-Cas9 technology position it as a key player in the biotech industry. While the stock has seen its share of fluctuations, the company's technological promise and recent achievements indicate a bright future. Investors interested in biotech and cutting-edge medical technology should closely monitor Crispr, keeping in mind the sector's inherent risks and volatility.

An extra asset to consider, Bitcoin

As we move into 2024, Bitcoin stands at a pivotal juncture, influenced by major developments that could significantly impact its value and perception.

The Impact of a Spot Bitcoin ETF

Prospects of a Spot ETF: The potential approval of a spot Bitcoin exchange-traded fund (ETF) in the U.S. is a monumental event. Unlike existing Bitcoin ETFs based on financial derivatives, a spot ETF would be backed directly by Bitcoin, offering a more straightforward and potentially less volatile investment option. This development, expected as early as January or by the end of the first quarter, could attract substantial new investment into Bitcoin.

Market Implications: The approval of a spot Bitcoin ETF could lead to a surge in Bitcoin's value. Estimates suggest that as much as $25 billion could flow into Bitcoin, with a significant portion directed towards these new ETFs. This influx of capital could drive a substantial increase in Bitcoin's price, making it a noteworthy event for potential investors.

The Bitcoin Halving: A Cyclical Catalyst

The Halving Phenomenon: The Bitcoin halving, scheduled for April 2024, is another critical event. This process, which halves the reward for mining Bitcoin, has historically led to significant price surges. The halving reduces the rate at which new bitcoins are generated, creating a supply shock that has, in the past, led to substantial price increases.

Historical Performance and Speculation: The average return of Bitcoin in halving years is approximately 98.21%, a figure derived from the returns in 2012, 2016, and 2020. While these events have been followed by price increases, it's essential to approach this pattern with caution, as past performance is not always indicative of future results.

Current Trends and Indicators

Growing Adoption and Interest: The number of addresses holding Bitcoin is on an upward trend, suggesting growing adoption and interest. This increase, coupled with heightened discussions on stock forums, Reddit, and Twitter, points to a growing hype around Bitcoin.

Year-Over-Year Growth: Bitcoin's impressive 150% growth year over year further strengthens its case as an investment worth considering. However, it's important to note that Bitcoin, like all cryptocurrencies, is subject to high volatility and market dynamics that can rapidly change.

Conclusion

Bitcoin in 2024 presents a mix of transformative events and speculative elements. The potential approval of a spot Bitcoin ETF and the upcoming halving are significant events that could greatly influence its value. While historical patterns and current trends suggest a bullish outlook, investors should approach Bitcoin with an understanding of its volatility and unique market dynamics. As with any investment, diversification and risk management are key.

Navigating 2024's Investment Landscape with Insight and Caution

As we conclude our exploration of these four diverse investment opportunities for 2024, it's essential to reflect on the unique aspects that each brings to the table. Cloudflare's role in AI and data security, Root Insurance's innovative approach to embedded insurance, Crispr's groundbreaking advances in genetic editing, and Bitcoin's potential transformation through major regulatory and cyclical events, all present intriguing possibilities for the discerning investor.

The insights provided in this article draw heavily on alternative data sources, such as web traffic trends, social media buzz, app download metrics, and user engagement. This type of data offers a fresh perspective, adding a layer of depth to traditional financial analysis methods. It's a testament to how modern investment research goes beyond mere numbers, integrating diverse data streams to glean a more holistic view of potential investment opportunities.

However, it's imperative to remember that the investment world is inherently unpredictable, and what shines today may not necessarily do so tomorrow. The information presented here is based on current data and trends, which are subject to change. Moreover, while alternative data can provide valuable insights, it should be part of a broader, well-rounded investment strategy.

It's also crucial to emphasize that this article does not constitute financial advice. Investing, especially in areas with higher volatility and risk, such as small-cap stocks and cryptocurrencies, requires careful consideration of your financial situation, investment goals, and risk tolerance. Consultation with a financial professional is always recommended before making any investment decisions.

In conclusion, as we step into 2024, let's approach the investment landscape with a blend of enthusiasm and prudence. By staying informed, diversifying our portfolios, and being mindful of the ever-changing dynamics of the market, we can navigate these opportunities wisely. Remember, investing is not just about capitalizing on the right opportunities but also about managing risks and adapting to new information as it emerges.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.