A Year in Review: How Did Our Picked Growth Stocks Perform?

December 27, 4:44 am

At the start of 2024, we published an article titled Three stock picks for 2024 which focused on 3 growth stocks based on emerging trends and insights gleaned from alternative data. Our focus was on companies and assets poised to disrupt their industries: Cloudflare, Root Insurance, and Crispr Therapeutics. We also mentioned Bitcoin as a growth investment. Each pick was rooted in a thesis supported by analysis of market sentiment, technological advancements, and alternative performance metrics. Here’s how they fared over the year.

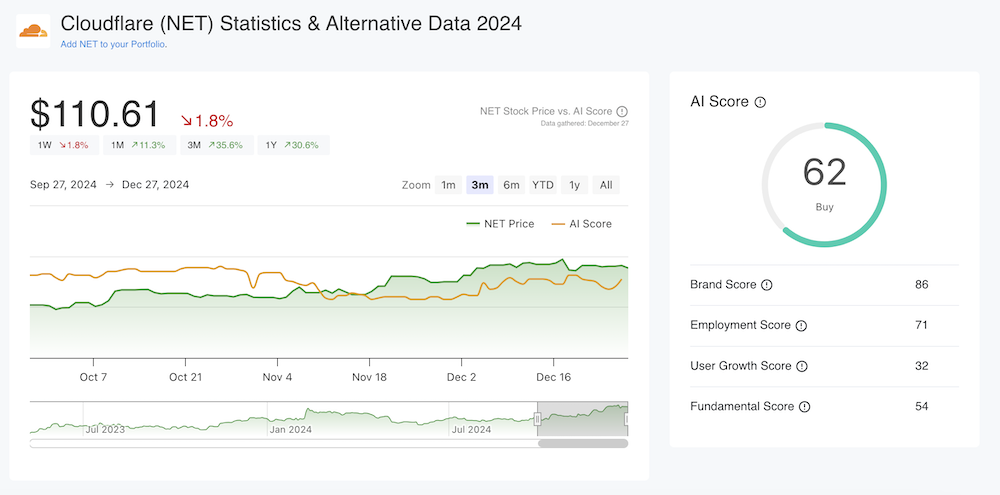

Cloudflare: Steady Growth in Line with Expectations

Cloudflare (NET) delivered what we anticipated, with the stock rising 31.6% over the year and outperforming the broader market. This steady climb highlights the company’s ability to capitalize on its strong position in AI-driven solutions and data security services.

Cloudflare proved to be a reliable choice in 2024 and we believe that the stock has more room to grow in 2025.

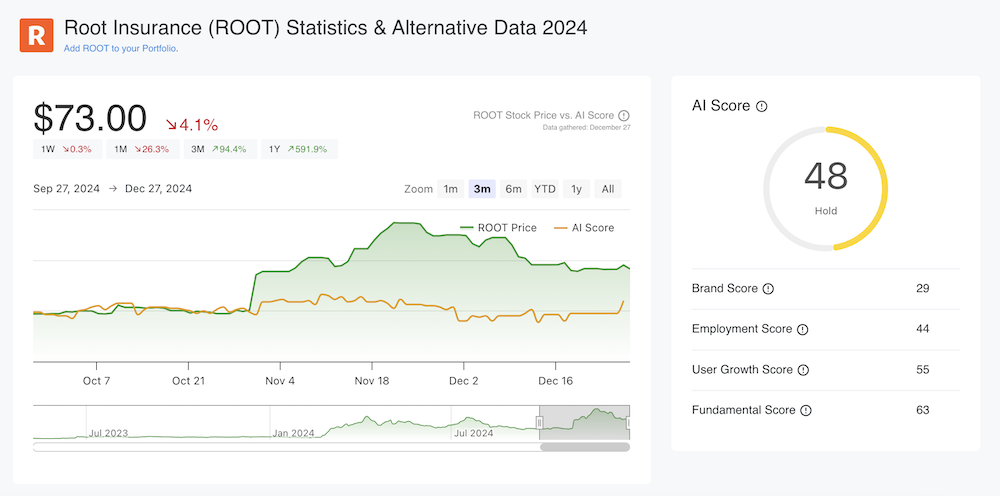

Root Insurance: A Surprise Superstar

Root Insurance (ROOT) exceeded even our most optimistic expectations, skyrocketing over 600% since our article. The stock hit an all-time high of $109.4 mid-year and, despite some pullback, remains one of the year’s top performers. Root’s ability to innovate within the insurance space made it a standout growth story.

Root Insurance Price & AI Score

The stock has been very volatile in the last couple of months, and with that, our AI score has taking a step back and the stock is currently a hold.

Crispr Therapeutics: A Disappointment

While Crispr Therapeutics (CRSP) initially showed promise with a 40% jump in March, the stock’s trajectory faltered in the second half of the year. It ended 2024 down 36%, weighed down by regulatory setbacks and biotech sector volatility. Our analysis pointed to a growing interest in the company's Gene Editing products, but by the end of the year it looks like the company underperformed and haven't been able to deliver on this interest.

The stock, because of it's low AI score, has been downgraded a sell.

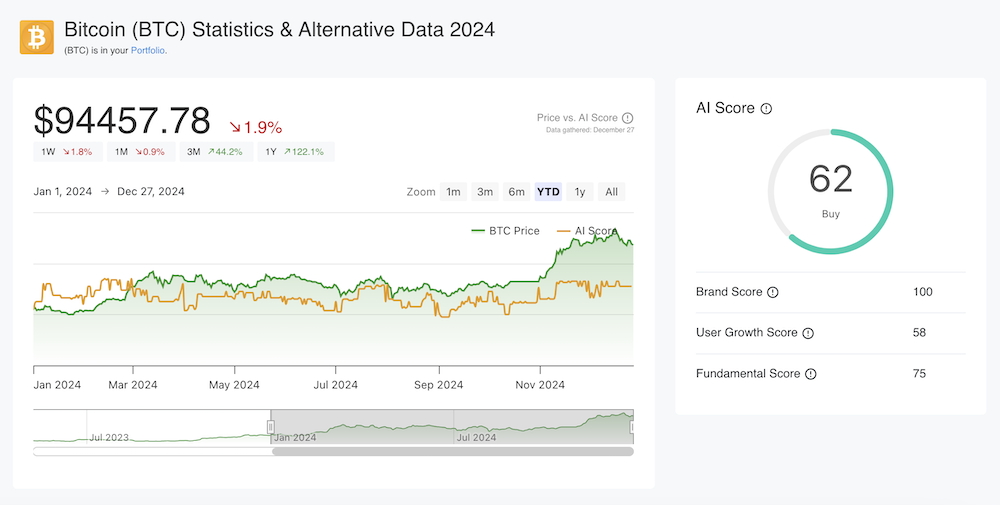

Bitcoin: A Stellar Year for the Crypto Giant

Bitcoin (BTC) has been the standout performer, boasting a 120% gain since our article. The approval of a spot Bitcoin ETF, April’s halving event, and increasing public interest propelled Bitcoin to new all-time highs. For investors, Bitcoin underscored its status as a high-reward opportunity in the digital asset space.

Currently sitting at $94,457 per Bitcoin, our AI score points to more upside for the crypto currency.

The Role of Alternative Data in Achieving a 176% Return

Our four picks for 2024 - Cloudflare, Root Insurance, Crispr Therapeutics, and Bitcoin - delivered an average return of 176%. This remarkable performance underscores the power of data-driven investment strategies. While some stocks, like Crispr, faced challenges, the overall portfolio demonstrated strong results with Root Insurance and Bitcoin proving to be very solid investments for the year.

The success of the stock picks reaffirms the value of alternative data in identifying promising investments. By analyzing web traffic, app downloads, social media buzz, and market sentiment, we provided insights that went beyond traditional metrics. Alternative data continues to be a cornerstone of our investment approach, helping us analyze company performance, anticipate trends and identify outliers.

Looking Ahead: Growth Stock Ideas for 2025

As we prepare to unveil our 2025 growth stock ideas, we invite investors to join us in harnessing the power of alternative data. Stay tuned for our next set of recommendations, and don’t miss the opportunity to discover high-potential investments and ideas.

Sign up to receive updates on our latest stock picks and insights.

Get More Insights

Sign up and get access to a personalized dashboard, deeper insights, AI stock picks, stock alerts, weekly newsletter and much more.