Data gathered: February 23

AI Stock Analysis - Dollar General (DG)

Analysis generated November 28, 2024. Powered by Chat GPT.

Dollar General Corporation is a well-known American chain of variety stores, known for offering a wide range of discounted household products, grocery items, and general merchandise. With thousands of locations spread across rural and urban areas, Dollar General serves millions of customers seeking value and convenience. The company's cost-efficient business model and extensive product selection have made it a key player in the retail industry.

Stock Alerts - Dollar General (DG)

|

Dollar General | February 21 Reddit mentions are up by 869% in the last 24h. |

|

Dollar General | February 14 App downloads are up by 12.6% in the last couple of days. |

|

Dollar General | February 13 Julie Johnson (member of U.S. congress) is buying shares |

|

Dollar General | February 12 Gil Cisneros (member of U.S. congress) is selling shares |

Alternative Data for Dollar General

About Dollar General

A leading American discount retailer, Dollar General operates over 17,000 stores in 46 states, selling branded and private-label products across a wide variety of categories.

| Price | $76.69 |

| Target Price | Sign up |

| Volume | 3,530,000 |

| Market Cap | $16.9B |

| Year Range | $68.44 - $130.45 |

| Dividend Yield | 3.08% |

| PE Ratio | 12.66 |

| Analyst Rating | 35% buy |

| Industry | Retail |

In the news

|

Elderly woman finds herself in a Dollar General with "nowhere to go" and unable to find the keys to her house, a 2013 Ford Taurus. Helpful local officer helps her search for her keys, finds her only creature comfort [Sad]February 22 - Fark.com |

Dollar General Celebrates North Little Rock, Arkansas Distribution Center Grand OpeningFebruary 21 - Finnhub |

|

Dollar General Corporation Celebrates North Little Rock, Arkansas Distribution Center Grand OpeningFebruary 21 - Finnhub |

|

|

Dollar General: Business Economics Worsen, But Low Valuation Limits Risk (Rating Upgrade)February 21 - SeekingAlpha |

|

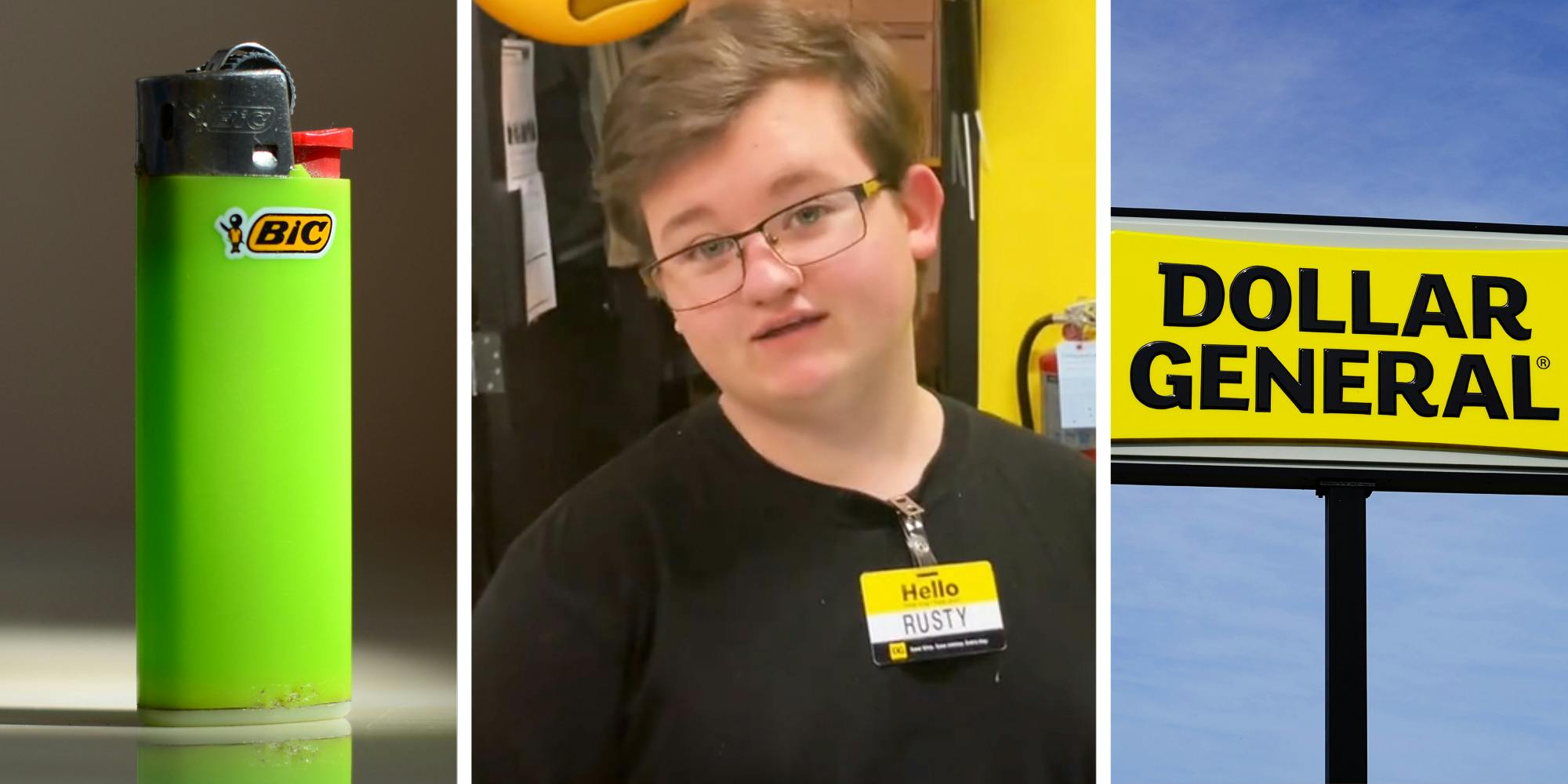

‘I need some answers’: Man tries to buy a Bic lighter at Dollar General. Then a worker steps inFebruary 20 - The Daily Dot |

|

New $5/$25 Dollar General Coupon | $9.95 for $25.20 in Schick, Scott, Snuggle & more | Just Use Your Phone! {02/22 ONLY}February 20 - Livingrichwithcoupons.com |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q4 '24 | 10.2B | 9.86B | 2.94B | 197M | 324M | 0.890 |

| Q3 '24 | 10.2B | 9.66B | 3.06B | 374M | 789M | 1.700 |

| Q2 '24 | 9.84B | 9.37B | 2.99B | 363M | 778M | 1.650 |

| Q1 '24 | 9.78B | 9.29B | 2.91B | 402M | 803M | 1.830 |

| Q4 '23 | 9.61B | 9.26B | 2.81B | 276M | 649M | 1.260 |

Insider Transactions View All

| CALBERT MICHAEL M filed to sell 40 shares at $75.3. January 3 '25 |

| CALBERT MICHAEL M filed to sell 1,752 shares at $75.3. January 3 '25 |

| CALBERT MICHAEL M filed to sell 1,001 shares at $75.3. January 3 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

CostcoCOST |

$1035.03 0% | 53 |

|

Dollar TreeDLTR |

$74.96 0% | 39 |

|

TargetTGT |

$124.27 0% | 32 |

|

Macy'sM |

$14.97 0% | 38 |

|

Best BuyBBY |

$89.78 0% | 35 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Julie Johnson |

Feb 13, 25 | Buy | $1K - $15K |

| Gil Cisneros |

Feb 12, 25 | Sell | $1K - $15K |

| Ro Khanna |

Oct 8, 24 | Sell | $1K - $15K |

Read more about Dollar General (DG) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, tiktok followers, twitter followers, twitter mentions, youtube subscribers, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of Dollar General?

The Market Cap of Dollar General is $16.9B.

What is Dollar General's PE Ratio?

As of today, Dollar General's PE (Price to Earnings) ratio is 12.66.

What is the current stock price of Dollar General?

Currently, the price of one share of Dollar General stock is $76.69.

How can I analyze the DG stock price chart for investment decisions?

The DG stock price chart above provides a comprehensive visual representation of Dollar General's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Dollar General shares. Our platform offers an up-to-date DG stock price chart, along with technical data analysis and alternative data insights.

Does DG offer dividends to its shareholders?

Yes, Dollar General (DG) offers dividends to its shareholders, with a dividend yield of 3.08%. This dividend yield represents Dollar General's commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering Dollar General in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

What are some of the similar stocks of Dollar General?

Some of the similar stocks of Dollar General are Costco, Dollar Tree, Target, Macy's, and Best Buy.

.