Data gathered: October 25

AI Stock Analysis - Intuitive Surgical (ISRG)

Analysis generated October 10, 2025. Powered by Chat GPT.

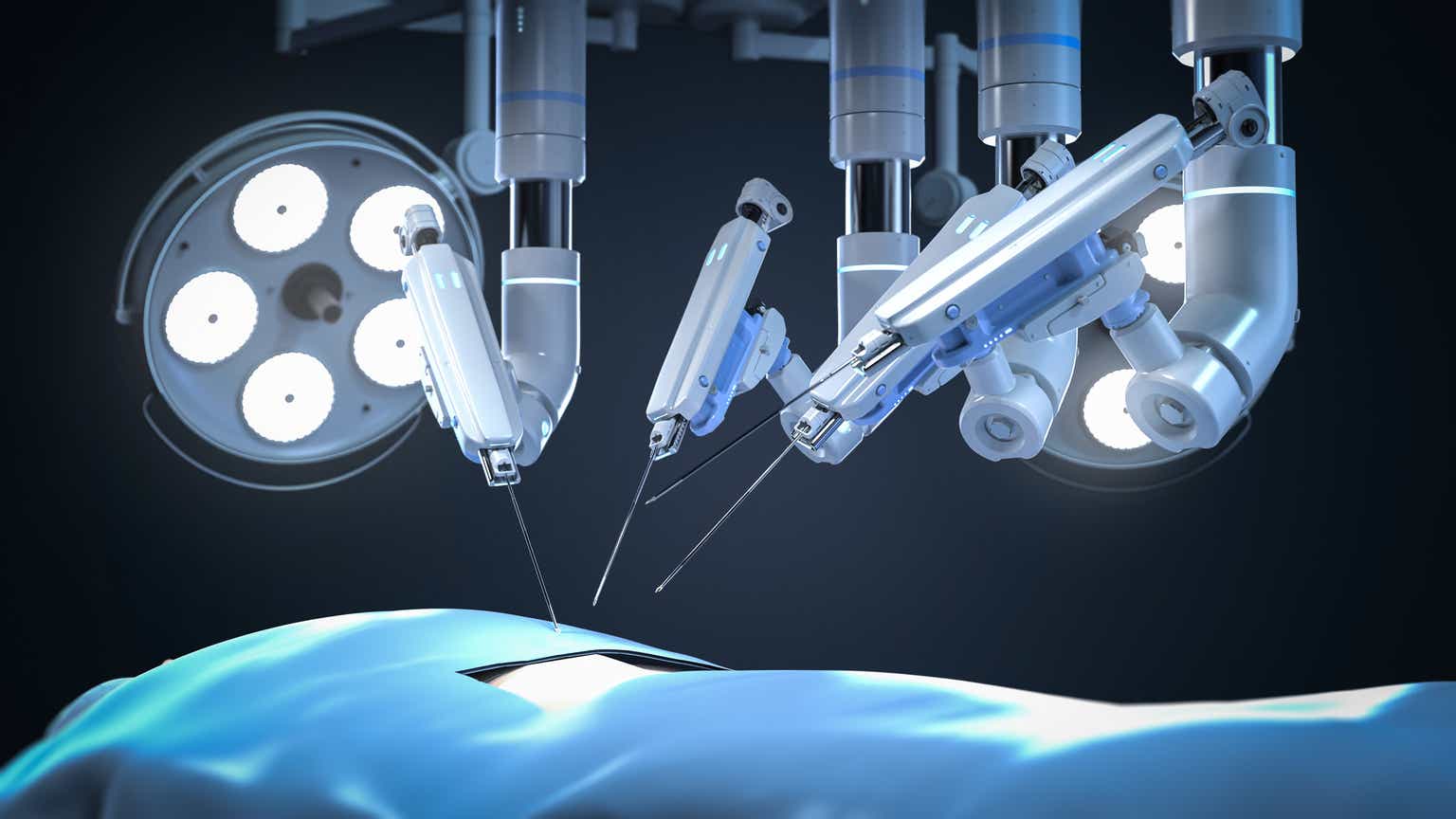

Intuitive Surgical, Inc. is a global technology leader in minimally invasive care and the pioneer of robotic-assisted surgery. Known for its innovative Da Vinci Surgical Systems, the company has transformed the field of surgery by developing products that enable surgeons to perform complex procedures with minimal invasiveness, which in turn enhances patient outcomes. With a technological edge and a strong market position, Intuitive Surgical remains a cornerstone in the robotics-assisted surgery industry. The company continues to push the innovation envelope, aiming to expand the capabilities and reach of its surgical systems.

Stock Alerts - Intuitive Surgical (ISRG)

|

Intuitive Surgical | October 22 Price is up by 17.3% in the last 24h. |

|

Intuitive Surgical | October 16 Josh Gottheimer (member of U.S. congress) is selling shares |

|

Intuitive Surgical | September 5 Insider Alert: Ladd Amy L is selling shares |

|

Intuitive Surgical | September 3 Insider Alert: GUTHART GARY S is selling shares |

Download our app to get future alerts delivered in real-time.

Alternative Data for Intuitive Surgical

| Alternative Data | Value | 3m Change | Trend | Benchmark |

|---|---|---|---|---|

| Job Posts | 449 | Sign up | Sign up | Sign up |

| Sentiment | 82 | Sign up | Sign up | Sign up |

| Webpage traffic | 8,000 | Sign up | Sign up | Sign up |

| Employee Rating | 84 | Sign up | Sign up | Sign up |

| Google Trends | N/A | Sign up | Sign up | Sign up |

| Patents | 1,812 | Sign up | Sign up | Sign up |

| 4chan Mentions | N/A | Sign up | Sign up | Sign up |

| Facebook Engagement | 96 | Sign up | Sign up | Sign up |

| Facebook Followers | 7,575 | Sign up | Sign up | Sign up |

| Reddit Mentions | 1 | Sign up | Sign up | Sign up |

| Stocktwits Mentions | 475 | Sign up | Sign up | Sign up |

| Stocktwits Subscribers | 19,705 | Sign up | Sign up | Sign up |

| Twitter Followers | 16,656 | Sign up | Sign up | Sign up |

| Twitter Mentions | 713 | Sign up | Sign up | Sign up |

| X Mentions | 59 | Sign up | Sign up | Sign up |

| News Mentions | N/A | Sign up | Sign up | Sign up |

| Customer reviews | N/A | Sign up | Sign up | Sign up |

| ESG | N/A | Sign up | Sign up | Sign up |

| Lobbying Cost | $50,000 | Sign up | Sign up | Sign up |

| Business Outlook | 88 | Sign up | Sign up | Sign up |

| Linkedin Employees | 11,980 | Sign up | Sign up | Sign up |

About Intuitive Surgical

Intuitive Surgical Inc designs, manufactures, markets da Vinci Surgical Systems, and related instruments. The da Vinci surgery, combines the benefits of minimally invasive surgery for patients with the ease of use, precision and dexterity of open surgery.

| Price | $546.51 |

| Target Price | Sign up |

| Volume | 2,690,000 |

| Market Cap | $195B |

| Year Range | $429.59 - $608.48 |

| Dividend Yield | 0% |

| PE Ratio | 73.02 |

| Analyst Rating | 76% buy |

| Industry | Medical Devices |

In the news

|

Why Intuitive Surgical Stock Zoomed 23% Higher This WeekOctober 24 - Biztoc.com |

|

Intuitive Surgical Is A Buy Despite Post-Earnings SurgeOctober 22 - SeekingAlpha |

|

Why Intuitive Surgical (ISRG) Is Up 21.0% After Record da Vinci 5 Growth and Strong Q3 ResultsOctober 22 - Yahoo |

|

Market Wrap- Top Stocks: Tesla, Intuitive SurgicalOctober 22 - Yahoo |

|

Intuitive Surgical, Inc. 2025 Q3 - Results - Earnings Call PresentationOctober 22 - SeekingAlpha |

|

Intuitive Surgical (ISRG) Earnings Beat Reinforces Bullish Narratives, But Valuation Stays ExpensiveOctober 22 - Yahoo |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q3 '25 | 2.51B | 843M | 1.66B | 704M | 1.02B | 2.400 |

| Q2 '25 | 2.44B | 819M | 1.62B | 658M | 987M | 2.190 |

| Q1 '25 | 2.25B | 796M | 1.46B | 698M | 719M | 1.810 |

| Q4 '24 | 2.41B | 771M | 1.64B | 686M | 860M | 2.210 |

| Q3 '24 | 2.04B | 664M | 1.37B | 565M | 694M | 1.840 |

Insider Transactions View All

| Ladd Amy L filed to sell 739 shares at $440.7. September 4 '25 |

| Ladd Amy L filed to sell 1,074 shares at $470.1. September 4 '25 |

| GUTHART GARY S filed to sell 19,827 shares at $472.5. September 2 '25 |

| GUTHART GARY S filed to sell 18,520 shares at $495.2. July 29 '25 |

| GUTHART GARY S filed to sell 13,187 shares at $498.6. July 29 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

Boston ScientificBSX |

$101.11 0% | 66 |

|

Edwards LifesciencesEW |

$76.1 0% | 59 |

|

MedtronicMDT |

$93.67 0% | 61 |

|

StrykerSYK |

$381.79 0% | 77 |

|

Becton Dickinson and CoBDX |

$185.83 0% | 65 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Josh Gottheimer |

Oct 16, 25 | Sell | $1K - $15K |

| Lisa McClain |

Aug 13, 25 | Buy | $1K - $15K |

| Lisa McClain |

Aug 13, 25 | Buy | $1K - $15K |

Read more about Intuitive Surgical (ISRG) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, facebook engagement, facebook followers, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, x mentions, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of Intuitive Surgical?

The Market Cap of Intuitive Surgical is $195B.

What is Intuitive Surgical's PE Ratio?

As of today, Intuitive Surgical's PE (Price to Earnings) ratio is 73.02.

What is the current stock price of Intuitive Surgical?

Currently, the price of one share of Intuitive Surgical stock is $546.51.

How can I analyze the ISRG stock price chart for investment decisions?

The ISRG stock price chart above provides a comprehensive visual representation of Intuitive Surgical's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Intuitive Surgical shares. Our platform offers an up-to-date ISRG stock price chart, along with technical data analysis and alternative data insights.

Does ISRG offer dividends to its shareholders?

As of our latest update, Intuitive Surgical (ISRG) does not offer dividends to its shareholders. Investors interested in Intuitive Surgical should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of Intuitive Surgical?

Some of the similar stocks of Intuitive Surgical are Boston Scientific, Edwards Lifesciences, Medtronic, Stryker, and Becton Dickinson and Co.

.