Data gathered: October 4

Alternative Data for Rollins

| Alternative Data | Value | 3m Change | Trend | Benchmark |

|---|---|---|---|---|

| Job Posts | 508 | Sign up | Sign up | Sign up |

| Sentiment | 100 | Sign up | Sign up | Sign up |

| Webpage traffic | 51,000 | Sign up | Sign up | Sign up |

| Employee Rating | 66 | Sign up | Sign up | Sign up |

| Google Trends | N/A | Sign up | Sign up | Sign up |

| Patents | N/A | Sign up | Sign up | Sign up |

| 4chan Mentions | N/A | Sign up | Sign up | Sign up |

| Facebook Engagement | 2 | Sign up | Sign up | Sign up |

| Facebook Followers | 1,738 | Sign up | Sign up | Sign up |

| Reddit Mentions | N/A | Sign up | Sign up | Sign up |

| Stocktwits Mentions | 7 | Sign up | Sign up | Sign up |

| Stocktwits Subscribers | 946 | Sign up | Sign up | Sign up |

| Twitter Followers | 13 | Sign up | Sign up | Sign up |

| Twitter Mentions | N/A | Sign up | Sign up | Sign up |

| X Mentions | 7 | Sign up | Sign up | Sign up |

| News Mentions | 4 | Sign up | Sign up | Sign up |

| Customer reviews | N/A | Sign up | Sign up | Sign up |

| Business Outlook | 67 | Sign up | Sign up | Sign up |

| Linkedin Employees | 1,597 | Sign up | Sign up | Sign up |

About Rollins

Rollins, Inc. engages in the provision of pest and termite control services through its wholly-owned subsidiaries to both residential and commercial customers in North America, Australia, and Europe.

| Price | $58.71 |

| Target Price | Sign up |

| Volume | 1,140,000 |

| Market Cap | $28.5B |

| Year Range | $47.94 - $58.74 |

| Dividend Yield | 1.11% |

| PE Ratio | 58.13 |

| Analyst Rating | 67% buy |

| Industry | Industrial Products |

In the news

|

Truist Financial Corp Raises Stock Position in Rollins, Inc. $ROLOctober 4 - ETF Daily News |

|

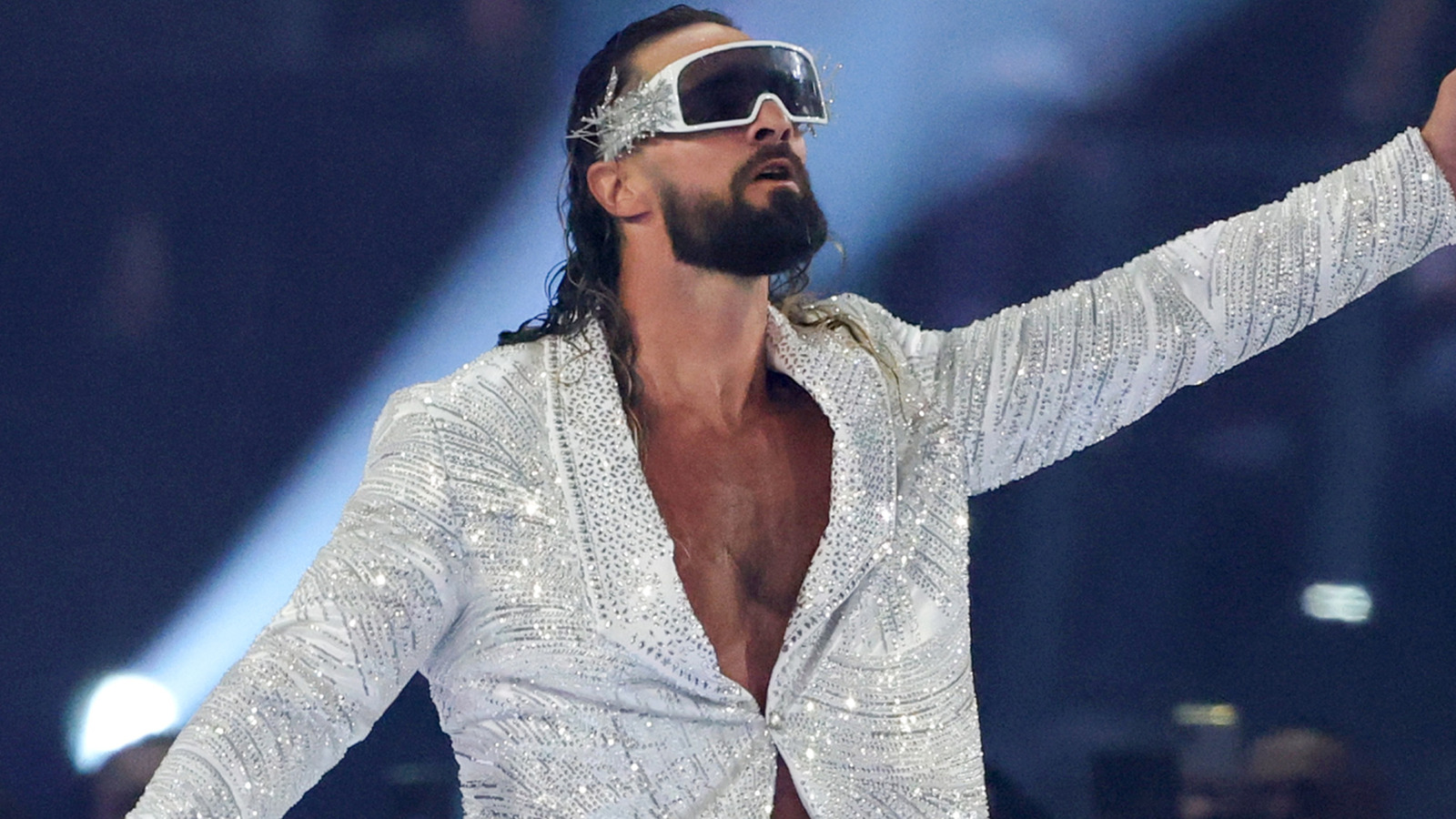

Rollins creates more animosity with Cody, OrtonOctober 3 - ESPN |

|

WWE SmackDown Results & Highlights (10/3/25): Seth Rollins aids The Vision to victory over Cody Rhodes & Randy Orton, NXT stars appear and moreOctober 3 - The Times of India |

|

Bully Ray Details What Seth Rollins Is Missing, As Compared To Other Top WWE StarsOctober 2 - Wrestling Inc. |

|

How Ken Griffey Jr., Jimmy Rollins helped Yankees' Jazz Chisholm feel better through a video gameOctober 2 - Sporting News |

|

V Square Quantitative Management LLC Reduces Stock Holdings in Rollins, Inc. $ROLOctober 2 - ETF Daily News |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q2 '25 | 1000M | 494M | 506M | 141M | 230M | 0.300 |

| Q1 '25 | 823M | 429M | 393M | 105M | 173M | 0.220 |

| Q4 '24 | 832M | 436M | 396M | 106M | 181M | 0.230 |

| Q3 '24 | 916M | 450M | 467M | 137M | 220M | 0.290 |

| Q2 '24 | 892M | 438M | 454M | 129M | 211M | 0.270 |

Insider Transactions View All

| Tesh Thomas D filed to sell 37,080 shares at $57.1. August 22 '25 |

| Wilson John F filed to sell 632,727 shares at $58. July 25 '25 |

| Gahlhoff Jerry Jr. filed to sell 332,895 shares at $57. June 11 '25 |

| Wilson John F filed to sell 662,727 shares at $56.8. May 30 '25 |

| Tesh Thomas D filed to sell 38,028 shares at $56.5. May 13 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

HoneywellHON |

$209.05 0% | 42 |

|

General ElectricGE |

$297 0% | 51 |

|

3M CompanyMMM |

$158.66 0% | 40 |

|

Emerson ElectricEMR |

$134.76 0% | 44 |

|

Zebra TechnologiesZBRA |

$305.01 0% | 52 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Richard W. Allen |

Jan 17, 25 | Buy | $15K - $50K |

| Rohit Khanna Democrat |

Nov 8, 23 | Buy | $1K - $15K |

Read more about Rollins (ROL) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, facebook engagement, facebook followers, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, x mentions, news mentions, customer reviews, business outlook & linkedin employees.

What is the Market Cap of Rollins?

The Market Cap of Rollins is $28.5B.

What is Rollins' PE Ratio?

As of today, Rollins' PE (Price to Earnings) ratio is 58.13.

What is the current stock price of Rollins?

Currently, the price of one share of Rollins stock is $58.71.

How can I analyze the ROL stock price chart for investment decisions?

The ROL stock price chart above provides a comprehensive visual representation of Rollins' stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Rollins shares. Our platform offers an up-to-date ROL stock price chart, along with technical data analysis and alternative data insights.

Does ROL offer dividends to its shareholders?

Yes, Rollins (ROL) offers dividends to its shareholders, with a dividend yield of 1.11%. This dividend yield represents Rollins' commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering Rollins in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

What are some of the similar stocks of Rollins?

Some of the similar stocks of Rollins are Honeywell, General Electric, 3M Company, Emerson Electric, and Zebra Technologies.

.