Data gathered: June 14

AI Stock Analysis - Domino's (DPZ)

Analysis generated October 9, 2024. Powered by Chat GPT.

Domino's Pizza, Inc., commonly referred to as Domino's, is an American multinational pizza restaurant chain founded in 1960. The company is known for its innovative approach to pizza delivery, continually leveraging technology to enhance customer experience and operational efficiency. Domino's operates a network of company-owned and franchised stores globally, making it one of the largest pizza chains in the world.

Stock Alerts - Domino's (DPZ)

|

Domino's | May 29 Facebook engagement is up by 65% in the last 24h. |

|

Domino's | May 19 App downloads are up by 16.6% in the last couple of days. |

|

Domino's | May 3 Insider Alert: BALLARD ANDY is selling shares |

|

Domino's | May 2 Reddit mentions are up by 525% in the last 24h. |

Download our app to get future alerts delivered in real-time.

Alternative Data for Domino's

About Domino's

Domino's Pizza Inc is a quick service pizza restaurant chain. It is engaged in retail sales of food, equipment and supplies to company-owned and franchised Domino's Pizza stores, and receipt of royalties and fees from Domino's Pizza franchisees.

| Price | $452.15 |

| Target Price | Sign up |

| Volume | 852,660 |

| Market Cap | $15.3B |

| Year Range | $400.69 - $497.52 |

| Dividend Yield | 1.53% |

| PE Ratio | 26.1 |

| Analyst Rating | 58% buy |

| Industry | Restaurants |

In the news

|

Redburn Atlantic Begins Coverage on Domino’s Pizza (NASDAQ:DPZ)June 11 - ETF Daily News |

|

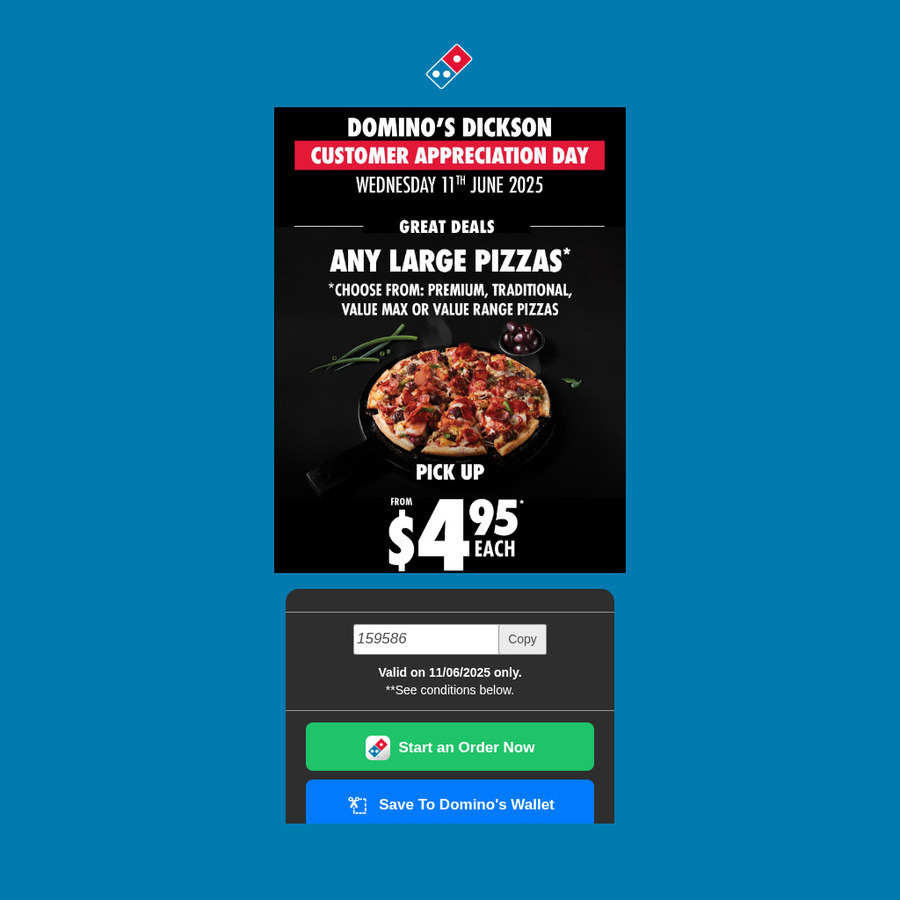

[ACT] Any Large Pizza $4.95 Pickup Only @ Domino's, DicksonJune 10 - Ozbargain.com.au |

|

Domino's Pizza, McDonald's rating surprise tied to persistent consumer issueJune 10 - Biztoc.com |

|

This Domino's Pizza Analyst Begins Coverage On A Bearish Note; Here Are Top 5 Initiations For TuesdayJune 10 - Biztoc.com |

|

Hennion & Walsh Asset Management Inc. Acquires New Position in Domino’s Pizza, Inc. (NASDAQ:DPZ)June 10 - ETF Daily News |

|

Merit Financial Group LLC Buys 747 Shares of Domino’s Pizza, Inc. (NASDAQ:DPZ)June 9 - ETF Daily News |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q1 '25 | 1.11B | 669M | 443M | 150M | 210M | 0.000 |

| Q4 '24 | 1.44B | 878M | 566M | 169M | 274M | 4.890 |

| Q3 '24 | 1.08B | 656M | 424M | 147M | 250M | 4.190 |

| Q2 '24 | 1.1B | 661M | 437M | 142M | 216M | 4.030 |

| Q1 '24 | 1.08B | 663M | 422M | 126M | 230M | 3.580 |

Insider Transactions View All

| BALLARD ANDY filed to sell 2,495 shares at $483.4. May 2 '25 |

| GOLDMAN JAMES A filed to sell 392 shares at $484.8. May 2 '25 |

| Sandeep Reddy filed to sell 8,756 shares at $462.2. April 4 '25 |

| HEADEN CYNTHIA A filed to sell 4,620 shares at $450. March 18 '25 |

| MORRIS KEVIN SCOTT filed to sell 793 shares at $437. March 14 '25 |

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

Denny'sDENN |

$4.13 0% | 39 |

|

McDonald'sMCD |

$301.91 0% | 32 |

|

ChipotleCMG |

$50.24 0% | 45 |

|

Wendy'sWEN |

$11.18 0% | 56 |

|

StarbucksSBUX |

$93.26 0% | 40 |

Read more about Domino's (DPZ) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, reddit subscribers, stocktwits mentions, stocktwits subscribers, threads followers, tiktok followers, twitter followers, twitter mentions, youtube subscribers, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of Domino's?

The Market Cap of Domino's is $15.3B.

What is Domino's' PE Ratio?

As of today, Domino's' PE (Price to Earnings) ratio is 26.1.

What is the current stock price of Domino's?

Currently, the price of one share of Domino's stock is $452.15.

How can I analyze the DPZ stock price chart for investment decisions?

The DPZ stock price chart above provides a comprehensive visual representation of Domino's' stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Domino's shares. Our platform offers an up-to-date DPZ stock price chart, along with technical data analysis and alternative data insights.

Does DPZ offer dividends to its shareholders?

Yes, Domino's (DPZ) offers dividends to its shareholders, with a dividend yield of 1.53%. This dividend yield represents Domino's' commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering Domino's in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

What are some of the similar stocks of Domino's?

Some of the similar stocks of Domino's are Denny's, McDonald's, Chipotle, Wendy's, and Starbucks.

.