Data gathered: October 25

AI Stock Analysis - ASML (ASML)

Analysis generated August 14, 2025. Powered by Chat GPT.

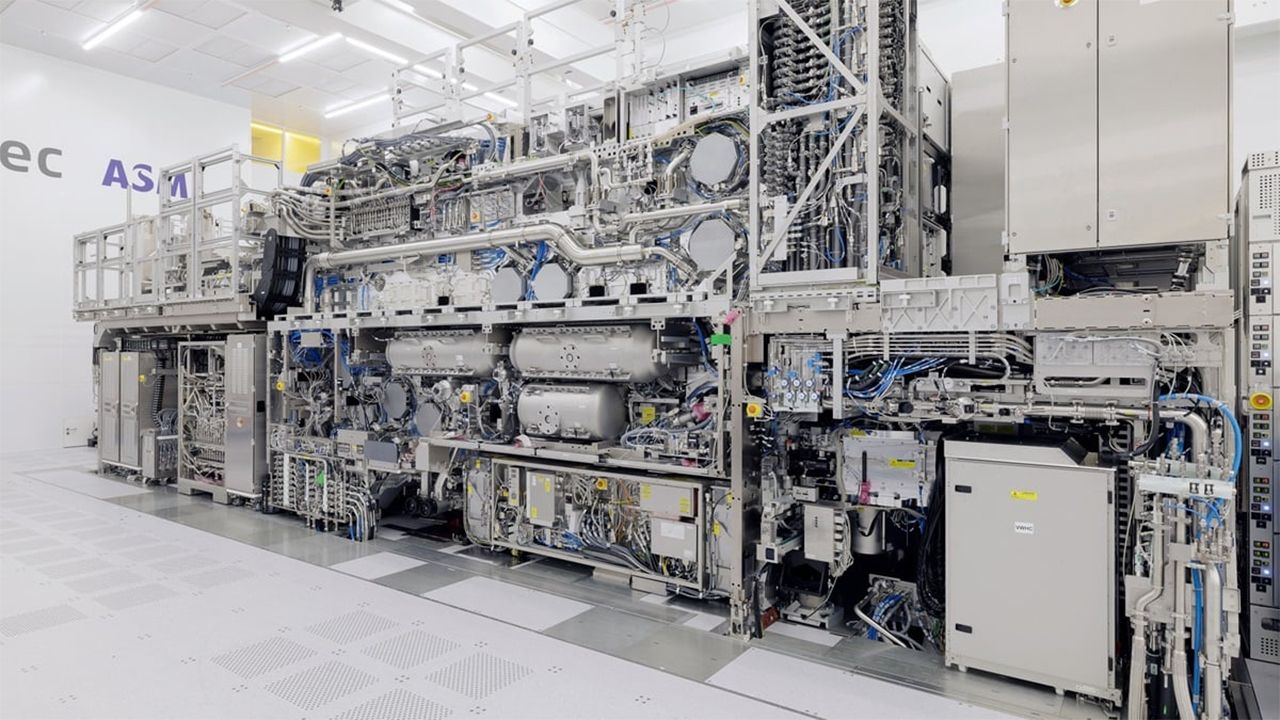

ASML Holding NV (ASML) is a Dutch multinational company engaged in the development, production, and distribution of photolithography systems used in the semiconductor industry. ASML's technology is integral to the manufacturing of integrated circuits (IC), which power a multitude of electronic devices. With a dominant position in the market and cutting-edge EUV lithography, ASML is a critical player in the semiconductor supply chain.

Stock Alerts - ASML (ASML)

|

ASML | October 24 Lisa McClain (member of U.S. congress) is buying shares |

|

ASML | October 24 Reddit mentions are up by 141% in the last 24h. |

|

ASML | October 17 Sentiment is down by 9.9% in the last couple of days. |

|

ASML | October 16 Reddit mentions are up by 179% in the last 24h. |

Download our app to get future alerts delivered in real-time.

Alternative Data for ASML

About ASML

ASML Holding N.V. is a holding company. The Company is a manufacturer of chip-making equipment. The Company is engaged in the development, production, marketing, selling and servicing of semiconductor equipment systems, consisting of lithography systems.

| Price | $1033.10 |

| Target Price | Sign up |

| Volume | 1,030,000 |

| Market Cap | $402B |

| Year Range | $590.57 - $1043.3 |

| Dividend Yield | 0.71% |

| PE Ratio | 37.17 |

| Analyst Rating | 100% buy |

| Industry | Semiconductor |

In the news

|

TSMC And ASML: The Deep Value Engine Of The AI RevolutionOctober 25 - Biztoc.com |

|

ASML's Earnings & How to Follow Earnings SeasonOctober 23 - Biztoc.com |

|

EU considers punitive DUV machine export ban following China's latest round of rare earth export controls — ban would impact ASML’s biggest growth marketOctober 23 - Tom's Hardware UK |

|

ASML’s 50% Rally: More Than Just AI Hype?October 23 - Forbes |

|

Here's How Much You Would Have Made Owning ASML Holding Stock In The Last 15 YearsOctober 22 - Biztoc.com |

Chinese Technicians Boldly Tried to Reverse Engineer ASML’s DUV Machines; Only to Break Them & Call the Dutch Firm For HelpOctober 22 - Freerepublic.com |

|

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q3 '25 | 7.52B | 3.64B | 3.88B | 2.12B | 2.74B | 5.490 |

| Q2 '25 | 7.69B | 3.65B | 4.04B | 2.68B | 3.65B | 5.900 |

| Q1 '25 | 7.74B | 3.56B | 4.18B | 2.36B | 2.98B | 6.000 |

| Q4 '24 | 9.26B | 4.47B | 4.79B | 2.69B | 3.78B | 6.840 |

| Q3 '24 | 7.47B | 3.67B | 3.79B | 2.08B | 2.68B | 5.280 |

Insider Transactions View All

No recorded Insider transactions.

Similar companies

| Company | Price | AI Score | |

|---|---|---|---|

|

AMDAMD |

$252.92 0% | 43 |

|

IntelINTC |

$38.28 0% | 44 |

|

Microchip TechnologyMCHP |

$63.17 0% | 49 |

|

NVIDIANVDA |

$186.26 0% | 66 |

|

Texas InstrumentsTXN |

$169.13 0% | 55 |

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Lisa McClain |

Oct 22, 25 | Buy | $1K - $15K |

| Michael McCaul |

Oct 13, 25 | Sell | $15K - $50K |

| Michael McCaul |

Oct 13, 25 | Sell | $1K - $15K |

Read more about ASML (ASML) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, twitter followers, twitter mentions, x mentions, youtube subscribers, news mentions, customer reviews, business outlook & linkedin employees.

What is the Market Cap of ASML?

The Market Cap of ASML is $402B.

What is ASML's PE Ratio?

As of today, ASML's PE (Price to Earnings) ratio is 37.17.

What is the current stock price of ASML?

Currently, the price of one share of ASML stock is $1033.10.

How can I analyze the ASML stock price chart for investment decisions?

The ASML stock price chart above provides a comprehensive visual representation of ASML's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling ASML shares. Our platform offers an up-to-date ASML stock price chart, along with technical data analysis and alternative data insights.

Does ASML offer dividends to its shareholders?

Yes, ASML (ASML) offers dividends to its shareholders, with a dividend yield of 0.71%. This dividend yield represents ASML's commitment to providing value to its shareholders through both potential capital appreciation and steady income. Investors considering ASML in their portfolio should factor in this dividend policy alongside the company's growth prospects and market position.

What are some of the similar stocks of ASML?

Some of the similar stocks of ASML are AMD, Intel, Microchip Technology, NVIDIA, and Texas Instruments.

.