Data gathered: October 27

Alternative Data for Airbnb

About Airbnb

Airbnb, Inc. is an American vacation rental online marketplace company based in San Francisco, California. Airbnb maintains and hosts a marketplace, accessible to consumers on its website or via an app.

| Price | $127.99 |

| Target Price | Sign up |

| Volume | 3,340,000 |

| Market Cap | $78.4B |

| Year Range | $105.69 - $160.6 |

| Dividend Yield | 0% |

| PE Ratio | 31.07 |

| Analyst Rating | 25% buy |

| Earnings Date | November 6 '25 |

| Industry | Travel & Leisure |

In the news

|

Angeloudis to protothema: “There is no Athens–Thessaloniki divide,” says Mayor — Calls for Airbnb restrictions in the city centreOctober 26 - Protothema.gr |

27-year-old birthday boy takes credit for bankrolling a 4-day vacation with friends, gets called out when his girlfriend exposes his lie to everyone: 'I did 90% of the planning, booked the Airbnb, coordinated rides, and paid the deposit'October 26 - Cheezburger.com |

|

|

The 7-Word Question Airbnb CEO Brian Chesky Says All Founders Should Ask ThemselvesOctober 26 - Biztoc.com |

|

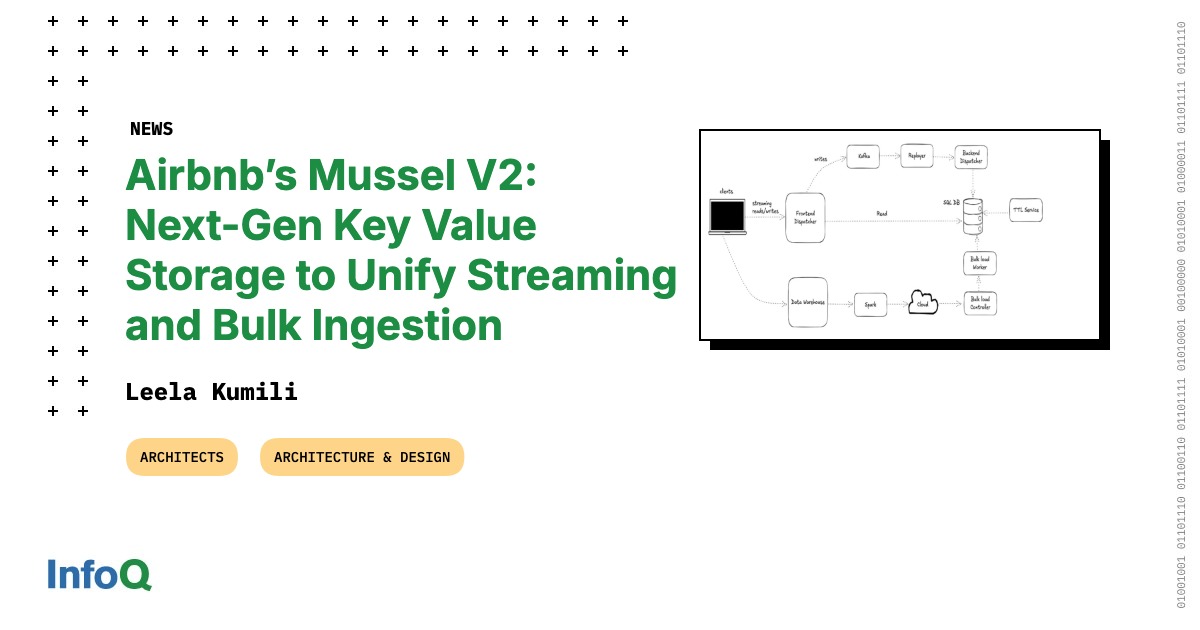

Airbnb’s Mussel V2: Next-Gen Key Value Storage to Unify Streaming and Bulk IngestionOctober 24 - InfoQ.com |

|

A profitable Airbnb host asks 3 questions before choosing a short-term rental property to invest inOctober 23 - Biztoc.com |

|

Airbnb transferred with Sector Weight at KeyBancOctober 22 - Thefly.com |

Financial performance View All

| Revenue | Cost of Revenue | Gross Profit | Net Income | ebitda | EPS | |

|---|---|---|---|---|---|---|

| Q2 '25 | 3.1B | 544M | 2.55B | 642M | 612M | 1.030 |

| Q1 '25 | 2.27B | 506M | 1.77B | 154M | 63M | 0.240 |

| Q4 '24 | 2.48B | 427M | 2.05B | 461M | 452M | 0.730 |

| Q3 '24 | 3.73B | 465M | 3.27B | 1.37B | 1.54B | 2.130 |

| Q2 '24 | 2.75B | 506M | 2.24B | 555M | 511M | 0.860 |

Insider Transactions View All

| BALOGH ARISTOTLE N filed to sell 197,206 shares at $124.3. October 20 '25 |

| Gebbia Joseph filed to sell 889,711 shares at $118.7. October 15 '25 |

| Gebbia Joseph filed to sell 704,015 shares at $119.4. October 15 '25 |

| BALOGH ARISTOTLE N filed to sell 197,806 shares at $120.5. October 14 '25 |

| BALOGH ARISTOTLE N filed to sell 198,406 shares at $122.5. October 6 '25 |

Similar companies

Congress Trading View All

| Politician | Filing Date | Type | Size |

|---|---|---|---|

| Rob Bresnahan |

Apr 29, 25 | Sell | $1K - $15K |

| Rob Bresnahan |

Mar 28, 25 | Buy | $1K - $15K |

| Gil Cisneros |

Feb 12, 25 | Sell | $1K - $15K |

Read more about Airbnb (ABNB) and their ai stock analysis, price prediction, earnings, congress trading, insider transactions, technical analysis, job posts, sentiment, webpage traffic, employee rating, google trends, patents, app downloads, 4chan mentions, facebook engagement, facebook followers, instagram followers, reddit mentions, stocktwits mentions, stocktwits subscribers, threads followers, tiktok followers, twitter followers, twitter mentions, x mentions, youtube subscribers, news mentions, customer reviews, lobbying cost, business outlook & linkedin employees.

What is the Market Cap of Airbnb?

The Market Cap of Airbnb is $78.4B.

What is Airbnb's PE Ratio?

As of today, Airbnb's PE (Price to Earnings) ratio is 31.07.

When does Airbnb report earnings?

Airbnb will report its next earnings on November 6 '25.

What is the current stock price of Airbnb?

Currently, the price of one share of Airbnb stock is $127.99.

How can I analyze the ABNB stock price chart for investment decisions?

The ABNB stock price chart above provides a comprehensive visual representation of Airbnb's stock performance over time. Investors can use this chart to identify patterns, trends, and potential support or resistance levels. By examining historical data and recent price movements, investors can make more informed decisions regarding buying, holding, or selling Airbnb shares. Our platform offers an up-to-date ABNB stock price chart, along with technical data analysis and alternative data insights.

Does ABNB offer dividends to its shareholders?

As of our latest update, Airbnb (ABNB) does not offer dividends to its shareholders. Investors interested in Airbnb should consider the potential for capital appreciation as the primary return on investment, rather than expecting dividend payouts.

What are some of the similar stocks of Airbnb?

Some of the similar stocks of Airbnb are TripAdvisor, Expedia, Royal Caribbean Cruises, Carnival Cruise Line, and Norwegian Cruise Line.

.